Park Hotels & Resorts Inc. (PK) is undoubtedly one of the biggest brand names in the world. However, despite its big name, the real estate investment trust (“REIT”) often experiences significant drawdowns due to the cyclical nature of its properties.

In today’s analysis, we enter a discussion about Park Hotels & Resorts to determine whether the REIT’s current price presents a lucrative entry point.

Without further delay, let’s get stuck into the main analysis.

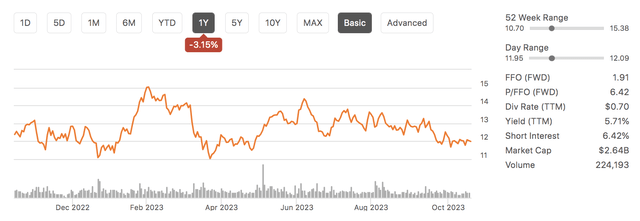

Seeking Alpha

Fundamental Analysis

The Portfolio

Park Hotels & Resorts participates in the hospitality business, primarily as a property owner, meaning it is ultra-sensitive to cyclical economic swings.

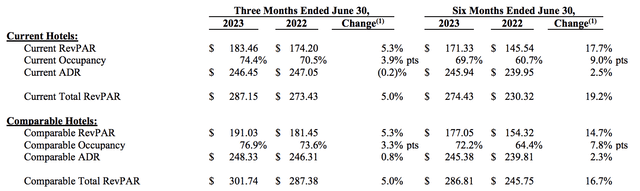

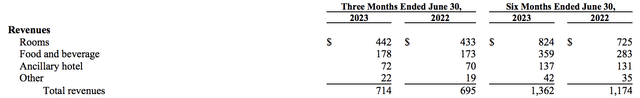

However, despite the systemic turbulence embedded in today’s real estate market, the REIT is delivering solid results. For example, Park Hotels & Resorts’ second-quarter financial results showed its revenue per available room is growing sharply with a 5.3% year-over-year increase. Moreover, occupancy has risen by 3.9% in the same period, illustrating increasing demand from its consumer base.

Q2 Earnings (Park Hotels & Resorts)

Park Hotels & Resorts’ current occupancy rate is more or less in line with the 20-year industry average.

It is generally accepted that higher productivity/higher-end hotels experience less cyclical behavior than lower-end hotels or motels, phasing out some risk for the REIT’s volatility risk. Nevertheless, we do not see occupancy climbing much higher than its current level; 65% would be pushing it.

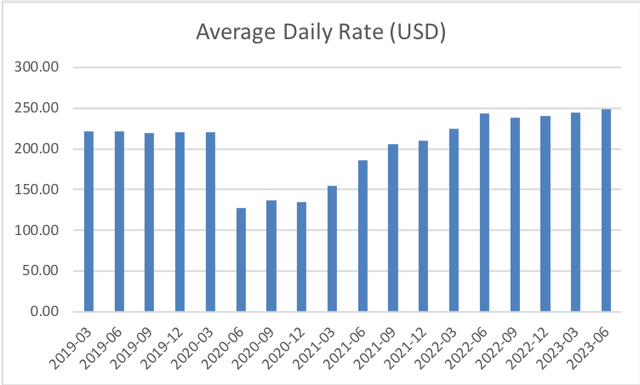

Fortunately for Park Hotels & Resorts, its strong luxury brand allows it to charge high prices. Although it is tapering, inflation remains resilient. Moreover, people are still on a post-pandemic reopening buzz, presenting Park Resorts and Hotels with the scope to charge sustainable prices.

Data from GuruFocus (Author’s Work)

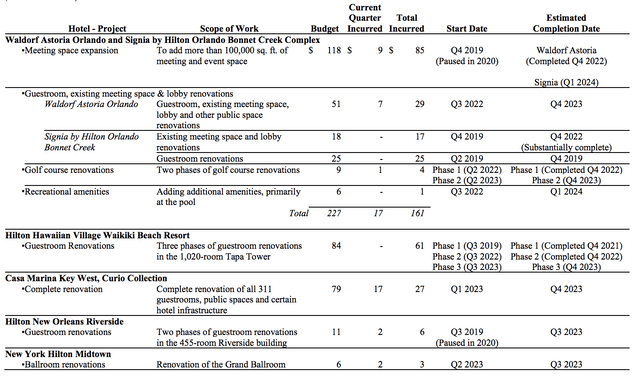

Furthermore, the REIT’s CapEx roadmap provides further latitude for price hikes. As visible in the diagram below, various renovations and add-ons are occurring, which could all add value.

The firm plans a full-year spend of $340 to $365 million. We think external acquisitions will commence when debt is more freely available, but value can be added via internal investments until then.

Development Pipeline (Park Hotels & Resorts)

Lastly, a mention of other revenues.

In our opinion, Food, Beverage, and Ancillary revenues are contingent on occupancy, which, as previously mentioned, is scaling. Sure, a hint of elasticity may come into play as consumer sentiment in the U.S. is weakening. Nevertheless, consider that sustainable occupancy and higher-income customer targeting might actually stimulate demand.

Park Hotels & Resorts

Capital Structure

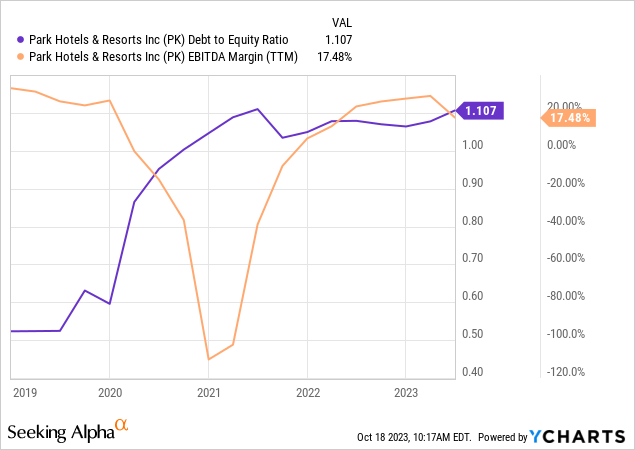

Park Hotels & Resorts runs on a debt-to-equity ratio of 1.107 and an EBITDA margin of 17.48%. In tandem, one could say that the REIT is slightly overloaded with debt if its moderate profit margin is considered.

However, the net impact ultimately depends on the cost of debt.

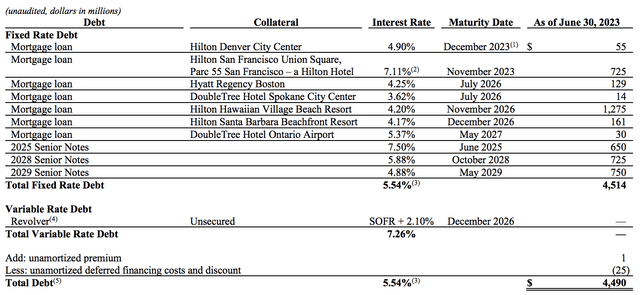

The REIT has a weighted average cost of debt of 5.54%. Apart from a revolving loan, Park’s debt is fixed and holds medium-term durations.

We believe the REIT’s cost of debt is slightly higher than what most investors would typically be happy with. However, it will have the opportunity to refinance at lower interest rates when a U.S. rate pivot eventually occurs, especially as it possesses a good credit rating for a hospitality REIT (Last Rated B+ by S&P Global).

Park Hotels & Resorts

Furthermore, the REIT is set to stop payments on a $725 million non-recourse loan scheduled to mature in November 2023. Park Hotels & Resorts views parts of San Francisco as strategic exits given its underwhelming post-covid recovery. As such, the abandonment of the liability provides much to cheer about as it frees up capital for strategic ventures.

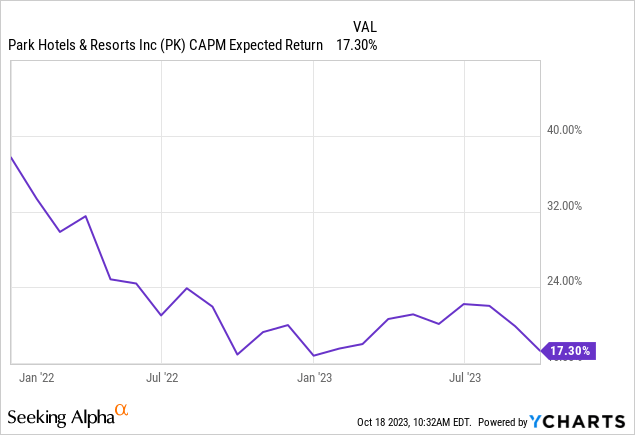

Park Hotels & Resorts’ required rate of return risk premium echoes the risk embedded within its capital structure during the earlier stages of the pandemic re-openings. However, its CAPM has evidently curtailed since then, implying lower overall risk, which we believe is largely due to better coverage of its credit obligations.

Valuation

I used the P/E expansion approach to value the REIT, whereby I adjusted the formula to incorporate the REIT’s funds from operations instead of its price-to-earnings.

According to my findings, the REIT is significantly undervalued, as it possesses a price target of $22.04. Sure, this valuation approach is slightly oversimplified and does not guarantee value realization. However, it is a helpful indicator applied by many across the investment industry.

| Variable | Value |

| FFO Estimated For Dec 2023 | 1.91 |

| Sector Media Forward P/FFO | 11.54 |

| Price Target | $22.04 |

Source: Data from Seeking Alpha

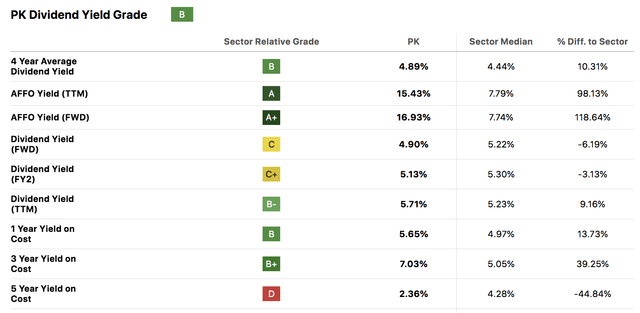

Dividends

At first glance, Park Hotels & Resorts’ dividend profile seems rather solid. Although cyclicality may come into play, factors such as lower future interest rates, a continuing post-pandemic industry recovery, and minimum payout obligations dictate sustainability.

Further, it is worth considering that the REIT provides diversified returns as it operates in a non-traditional sub-sector.

Seeking Alpha

Final Word

Our findings reflect that Park Hotels & Resorts is gaining momentum and that it is undervalued.

Specifically, the REIT’s properties are experiencing solid escalation relative to their peers while occupancy is above industry standard. Moreover, other revenue from food, beverages, and ancillary offerings sales might correlate with rising occupancy to support broad-based earnings.

Risks for Park Hotels & Resorts Inc. such as an expensive debt profile and cyclical dividends must not be overlooked. However, our general feeling is that this REIT is undervalued.

Consensus: Buy Rating Assigned.

Read the full article here