Procter & Gamble’s (NYSE:PG) stock is up ~2% in a down market after reporting better-than-expected Q1 FY24 earnings earlier today. I covered the stock in June and anticipated that the company’s growth and margins would continue benefiting from pricing increases. In addition, I expected the company’s volume to improve as the inventory destocking at retailers nears completion and management focuses on improved marketing strategy by leveraging digital tools and technology to target desired customers more effectively outside of the declining linear TV medium. Further, the company’s productivity initiatives along with easing inflationary headwinds were expected to help margins.

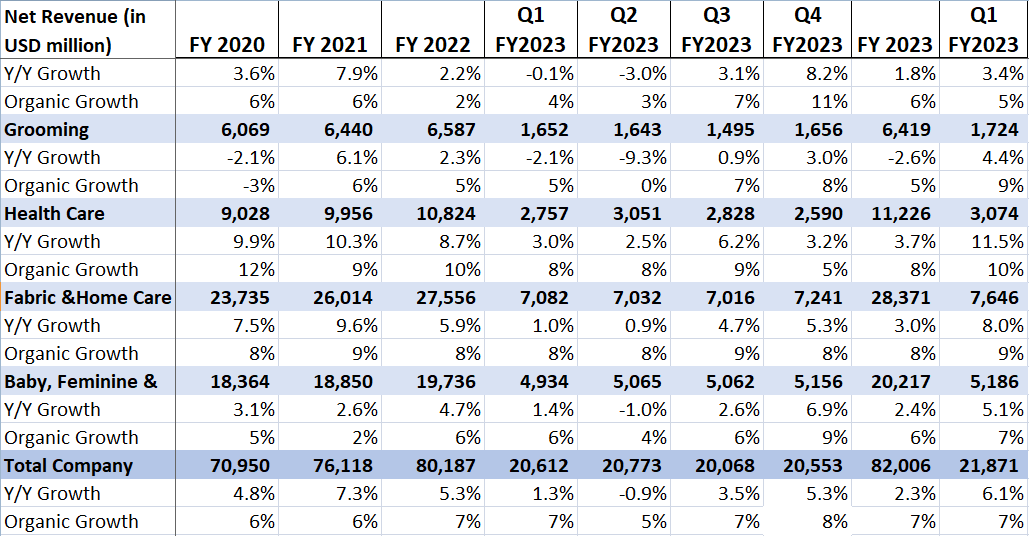

The company’s Q1 FY24 results reflected these trends. The company reported organic sales of 7% Y/Y, with pricing adding 7 percentage points and mix contributing 1 percentage point. While volume was down 1% Y/Y, it was because of still tough conditions in the Chinese market while markets outside of Greater China posted volume growth in aggregate. The shipment volume in the U.S. grew 3% Y/Y and the company returned to volume growth in Europe. Mexico, Brazil, and India continued to deliver solid volume growth as well.

P&G’s Historical Revenue Growth (Company Data, GS Analytics Research)

The company continues to gain market share and its global aggregate volume share was up 40 bps Y/Y with 32 of its top 50 categories holding or growing share. In the U.S. value share was up 50 bps Y/Y with 7 out of the top 10 categories holding or gaining share.

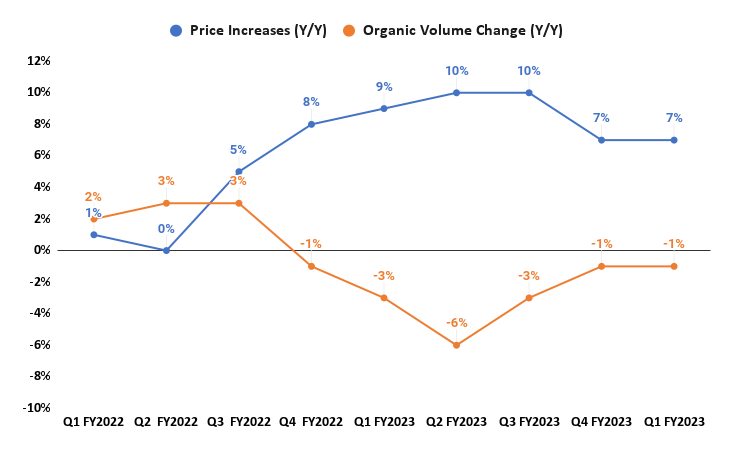

Looking forward, the company has good growth prospects. I expect volume to return to Y/Y growth in Q2 FY24 based on easing comps alone. If we look at the company’s volume decline, Q2 FY23 was a bottom with a ~6% Y/Y decline. This was 3 percentage points lower than Q1 FY23’s ~3% Y/Y decline. So, the volume comparisons are getting easier in Q2 FY24 and the company should return to low single-digit volume growth based on easing comparisons alone. Now, add to this the benefit from the retail inventory destocking headwind easing (as the inventory at retailers is in good shape after the past several quarters of destocking) and the company’s continued focus on improving its advertising strategy and retail execution which is helping it gain market share, and we can easily make a case for volume growth resuming. Further, if there is any improvement in Chinese sales as the reopening continues to gain momentum, it can further add meaningfully to the volume growth given China is the largest market for the company outside the U.S.

P&G’s Price increases and Organic Volume growth (Year-over-Year) (Company Data, GS Analytics Research)

The company’s execution on the pricing front is also impressive. The company saw a 7% Y/Y increase in pricing last quarter, over and above the strong 9% Y/Y pricing increase in Q1 last year.

Now, the pricing comparison is slightly tough in Q2 FY24 as the Y/Y pricing increase was 10% in Q2 FY23 versus 9% in Q1 FY23. However, this 1 percentage point difficult pricing comp should be more than offset by 3 percentage point easier volume comps in Q2 FY24. So, I believe the organic volume growth can further accelerate from the 7% Y/Y growth we saw in Q1 FY24. Management has maintained its 4% to 5% Y/Y organic sales growth guidance despite beating the consensus revenue estimates. In their guidance, they are anticipating 3 to 4 percentage point lower pricing benefits in Q2 FY24 and Q3 FY24 but my math on pricing comps indicates that they are being conservative here. So, there is a potential for further positive surprises in terms of topline growth.

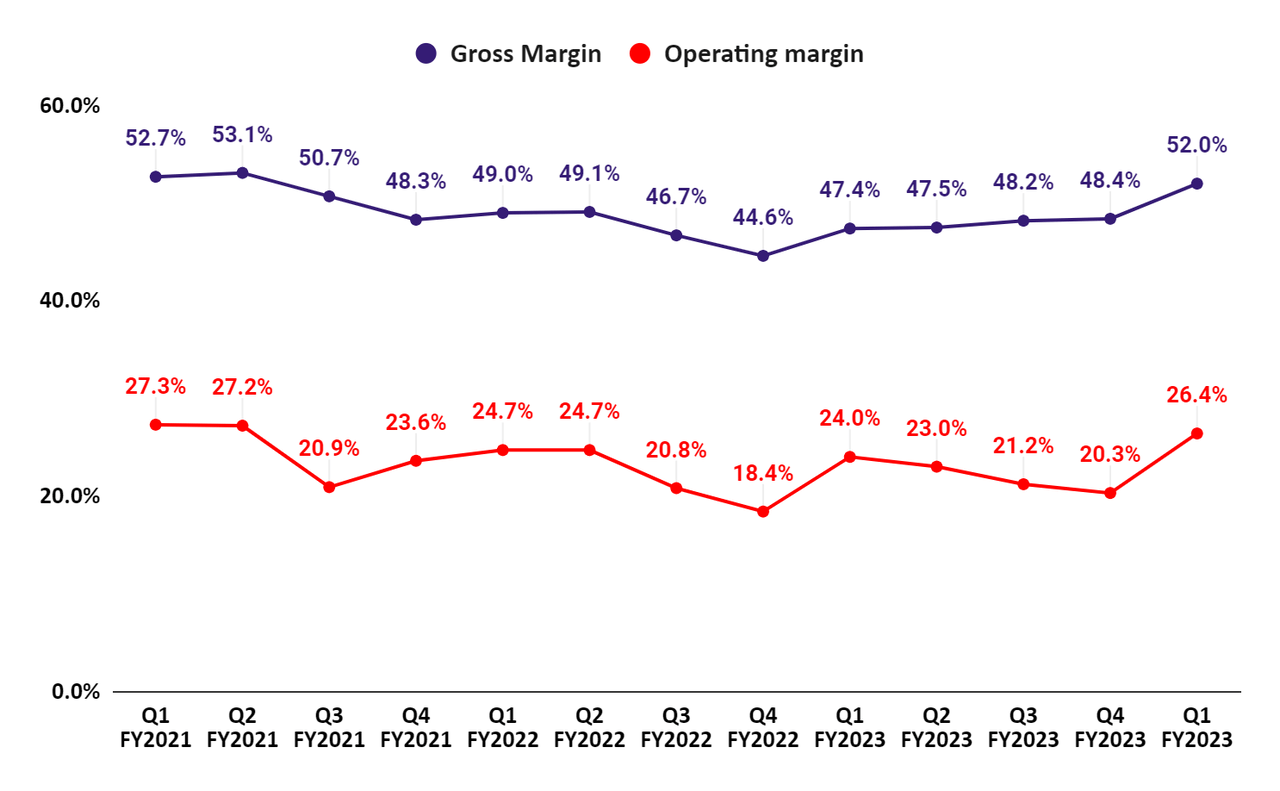

The company’s margin performance has been equally impressive and it posted a solid Y/Y growth as well as a sequential increase in both adjusted gross as well as operating margins.

P&G’s Gross margin and Operating Margin (Company Data, GS Analytics Research)

One interesting thing to note is that despite a ~$600 million incremental headwind from adverse FX movement compared to what P&G guided at the beginning of this fiscal year, the company maintained its EPS growth guidance. This indicates that the company is doing a much better job in terms of price increases and productivity initiatives compared to expectations and I anticipate this strong execution to continue.

While management’s FY24 guidance calls for a 6% to 9% Y/Y EPS increase, if we adjust for a 7 percentage point FX headwind on earnings, the core EPS growth should be in the range of low to mid-teens. Also, as discussed before, I believe management’s revenue growth assumptions are likely conservative. So, there is a potential for the company to post even better core earnings growth than the low to mid-teens growth that the guidance implies.

The company is trading at 22.91x FY24 consensus EPS estimates of $6.38 which is a discount to its historical 5-year forward P/E of 24.26x. It also has a healthy 2.57% forward dividend yield. Further, there is also a potential for upward revisions in the consensus estimates. Given the company’s good growth prospects and lower than historical valuations, I continue to have a buy rating on the stock.

Read the full article here