Thesis

Match Group, Inc. (NASDAQ:MTCH) holds a dominant position in the online dating industry, holding a large share of the global dating user base across its various brands. Tinder, in particular, stands out as the largest and most profitable dating app worldwide, while Hinge is rapidly expanding its presence globally. MTCH demonstrates an appealing financial profile, and I anticipate that improved performance in Tinder will drive sustainable double-digit revenue growth, operating income margins exceeding 35%, and mid-teens percentage growth in earnings per share. Given the recent decline in the company’s stock price, I find the current valuation compelling and assign a buy rating to the stock.

Q2 Review and Outlook

MTCH reported better-than-expected results with a 2% increase in revenue and an 8% rise in EBITDA compared to what was anticipated by the market. The management also revised its revenue guidance for the fiscal year 2023, expecting growth between 6% and 7%, and foreseeing an improvement in EBITDA margins year-over-year by at least 50 basis points.

Looking beyond the financials, there are several positive indicators. US Tinder daily active users (DAUs) experienced a 10-point growth acceleration in the second quarter of 2023, thanks to a new marketing campaign. Additionally, there was a significant increase in female subscribers in the UK following the introduction of weekly subscription options, with a conversion rate increase of over 40%.

Tinder witnessed a faster growth in subscription revenue throughout the quarter. Hinge, another dating app under MTCH, achieved a 35% year-over-year revenue growth, driven by stronger performance in English-speaking and Continental European markets. It also introduced its weekly subscription packages. Hinge’s app downloads grew by nearly 50% in the second quarter, a leading indicator for revenue growth, particularly in Italy, Spain, and the Netherlands, where it became one of the top 5 most downloaded dating apps. Furthermore, MTCH has unified its Evergreen & Emerging brands division and has started consolidating its Evergreen businesses onto a single tech platform. This move is expected to streamline operations and improve efficiency in the future.

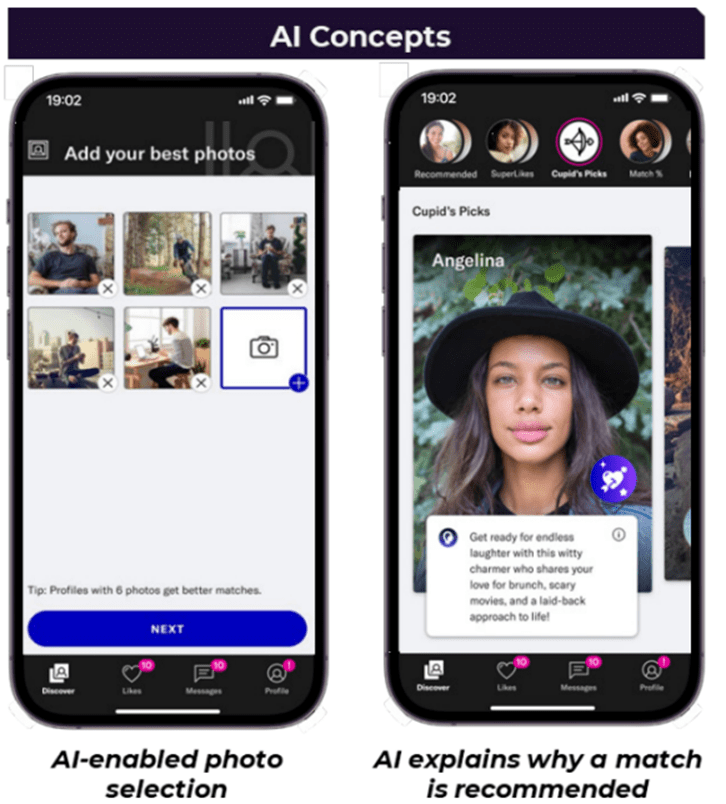

Utilizing AI in onboarding new users

Match’s increased use of artificial intelligence could reduce the friction of onboarding new users. Tinder’s AI photo selector, which has undergone testing recently, can browse a user’s album and select the best pictures for a profile. This may lead to user growth and quicker client spending. The technology can also better match people across the company’s platforms, and, in the case of Azar pair people in real-time video. Additional usages could include the generation and selection of prompts and the creation of profile images. However, curating profiles with AI might result in less authentic ones, a risk that Match will have to balance vs. the benefits.

Company Presentation

Financial Outlook

Match Group’s efforts to rejuvenate Tinder are expected to significantly boost the platform’s revenue. I believe Match’s Tinder revenue is likely to experience high-single to low-double-digit growth in the next 2-3 years as the company embarks on revitalizing the platform. Following a disappointing 2022, during which Tinder’s revenue dropped from over 20% growth to high-single digits, the company initiated various measures in 2023, including improved pricing strategies and the introduction of weekly subscriptions, to drive revenue growth by more than 10% in the current fiscal year. It’s worth noting that much of Tinder’s expansion is anticipated to be driven by the revenue generated per paying user rather than an increase in the number of new users.

The growth of Tinder has the potential to be the primary factor in widening Match’s margin over the medium term as operating efficiency improves. I believe the majority of Tinder’s expansion will be driven by an increase in revenue per paying user rather than acquiring new users. This means that a larger portion of revenue may directly contribute to the company’s operating income.

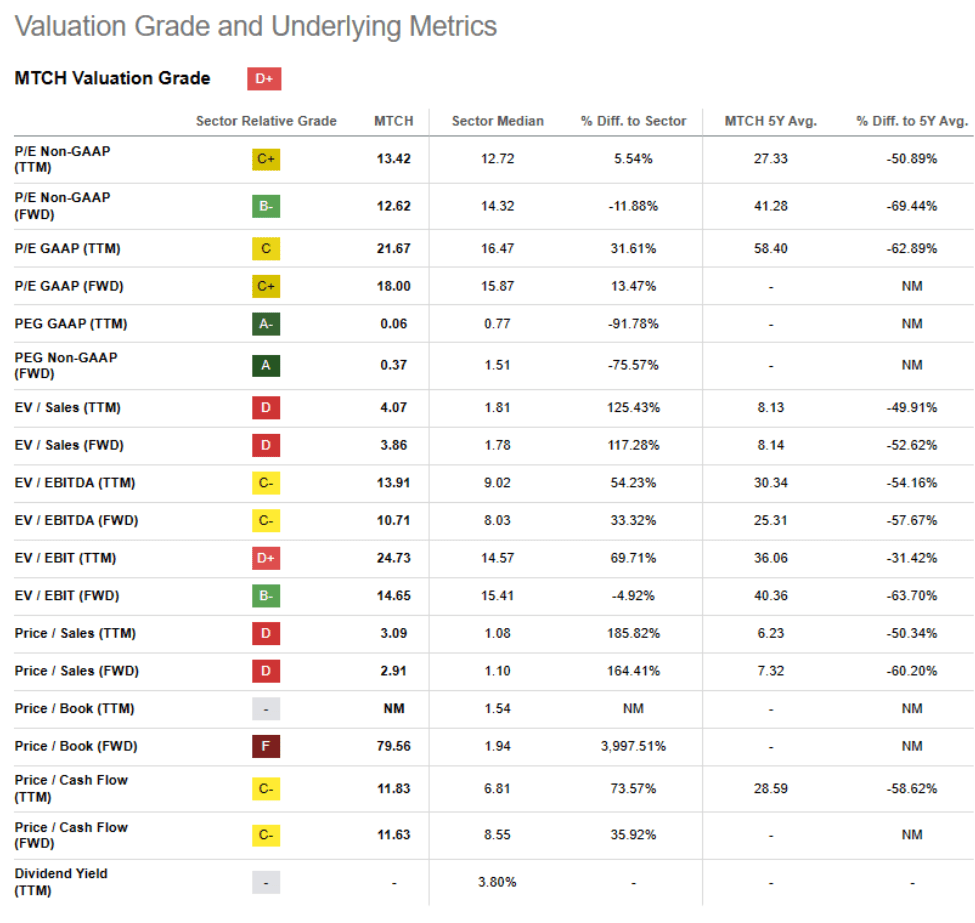

Valuation

Match Group is expected to experience a boost in its revenue growth over the next 18 months, even though economic conditions are challenging. I believe this growth will mainly be driven by emerging brands like Hinge and an increased use of artificial intelligence. The company’s global expansion efforts, including acquisitions like Hyperconnect in Asia and Hinge’s international expansion, will help diversify its sources of revenue across different regions, opening up a larger market opportunity. This could potentially result in a return to double-digit growth in 2024. Moreover, Match Group is in a strong position to maintain a steady cash flow, even in the face of ongoing economic challenges. This is thanks to its wide range of dating apps, both in the domestic and international markets. The company’s financial stability is evident with a robust balance sheet holding almost $600 million in cash, and the company’s expected free cash flow will reach $800 million in 2023. The leverage is also close to the company’s target of 3x, which could lead to benefits for shareholders and potential credit rating improvements in the medium term. I believe the company is positioned to perform well over the near and medium term which is why I believe the current forward PE multiple of 12.6x, at a discount to sector median is an attractive opportunity for long-term investors to gain exposure to the company.

Seeking Alpha

Investment Risks

There are several risks surrounding the company. The possibility that sustained growth for Tinder doesn’t materialize, and the efforts to revamp it under new management prove ineffective poses a major risk. The likelihood that Match Group’s profit margins may not see improvement and could even contract, particularly if its fastest-growing brand, Hinge, operates with narrower margins compared to Tinder poses a downside risk.

Moreover, I believe that two major challenges hindering the acquisition of new users are concerns regarding user authenticity and safety issues that can be addressed through technological advancements. Match Group has been actively addressing the issue of user authenticity by introducing innovative features, such as live video chats for matches, which can be used before in-person meetings. Voice prompts also serve a similar purpose in ensuring that individuals accurately represent themselves as presented in their app profiles, thereby enhancing trust and security in the online dating experience.

Conclusion

As the provider of online dating services on a global scale, Match Group is well-positioned to capture a larger portion of the rapidly growing online dating market. I regard MTCH as a top-tier operator and manager of a strategically valuable portfolio of dating assets designed to cater to a wide range of user needs and life stages. I believe that the online dating industry is fundamentally strong and well-aligned with trends related to mobile connectivity and changing demographics. Given the recent decline in the company’s stock price, I find the current valuation compelling and recommend a buy rating for the stock.

Read the full article here