Health is the greatest possession. Contentment is the greatest treasure. Confidence is the greatest friend.”― Lao Tzu.

Today, we put Certara, Inc. (NASDAQ:CERT) in the spotlight for the first time since our initial article on this company just over a year ago. This tech solution provider primarily services various parts of the biotech, biopharma, and healthcare developmental space.

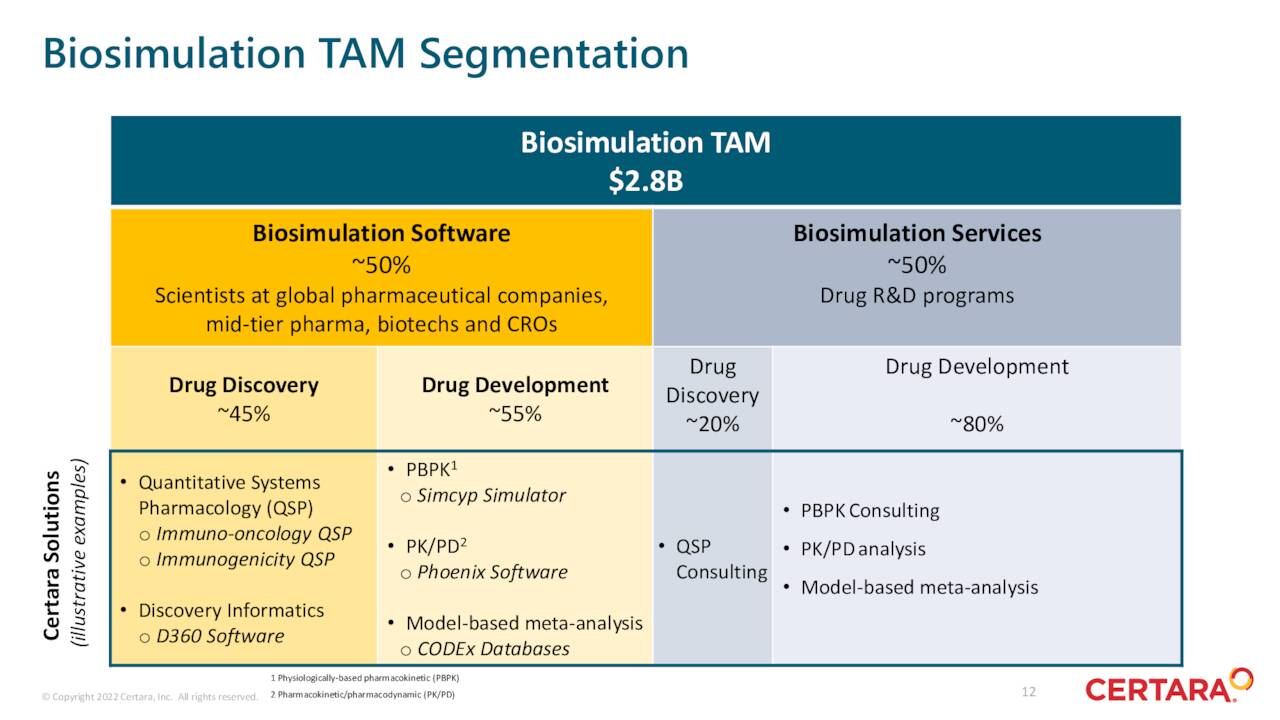

June 2022 Company Presentation

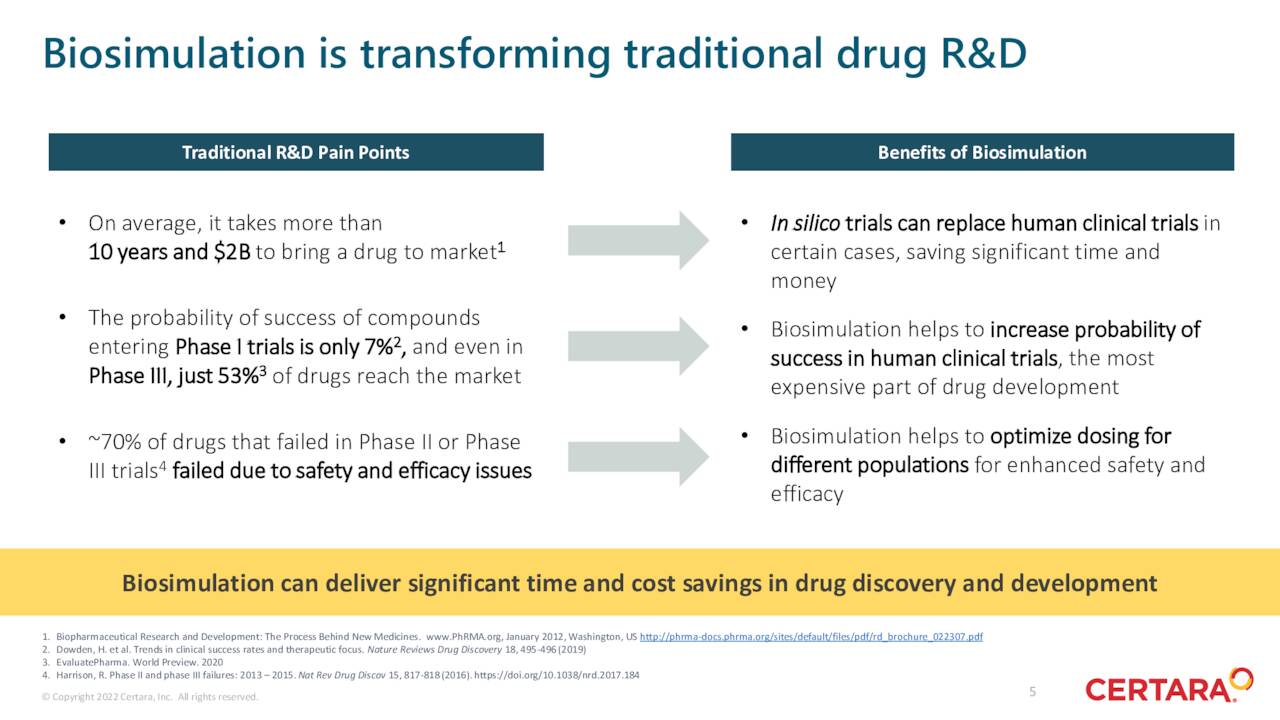

The company provides a software platform in the emerging area of biosimulation which has a significant potential market, can cut development costs, and should see solid growth over time. With the stock selling near 52-week lows, it seemed a good time to take an updated look at Certara. An analysis follows below.

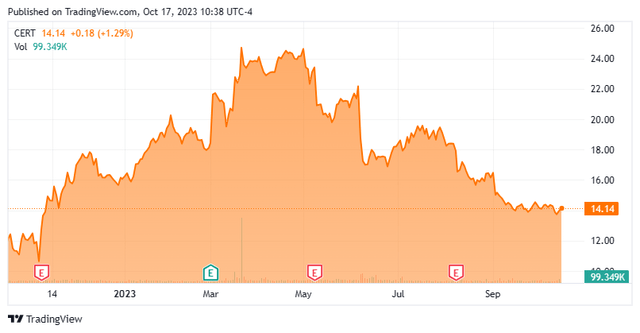

Seeking Alpha

Company Overview:

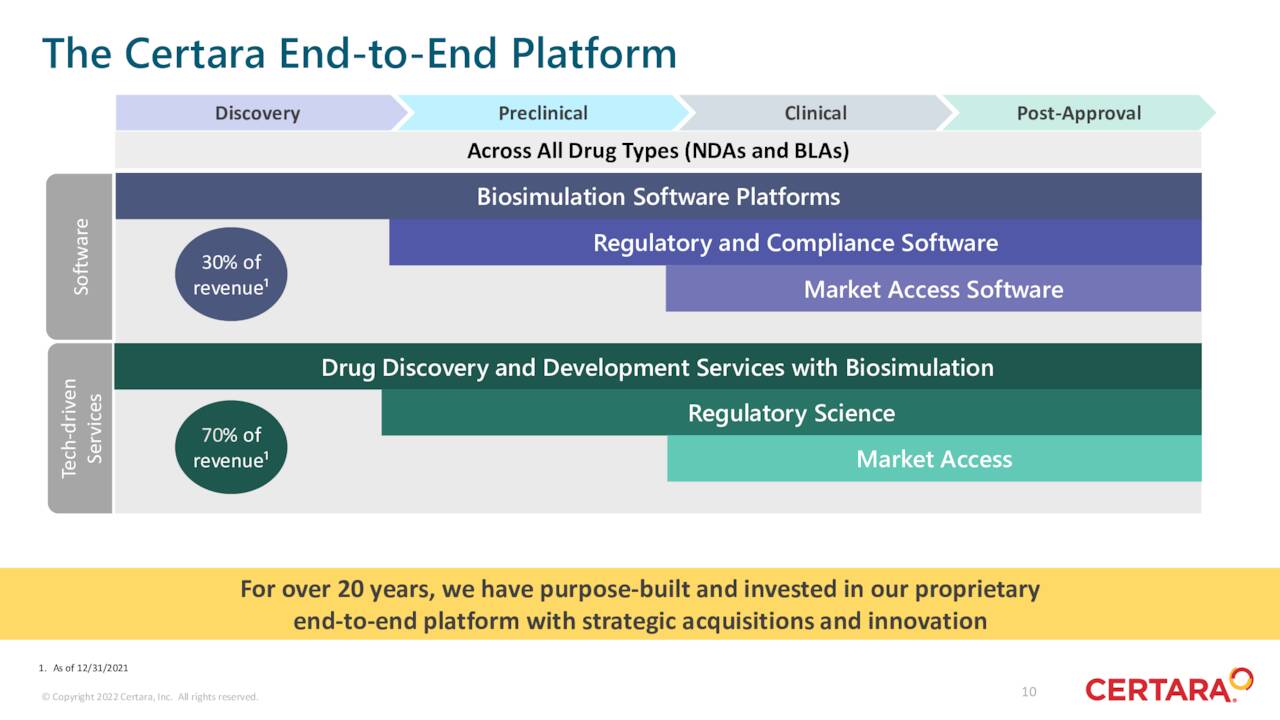

June 2022 Company Presentation

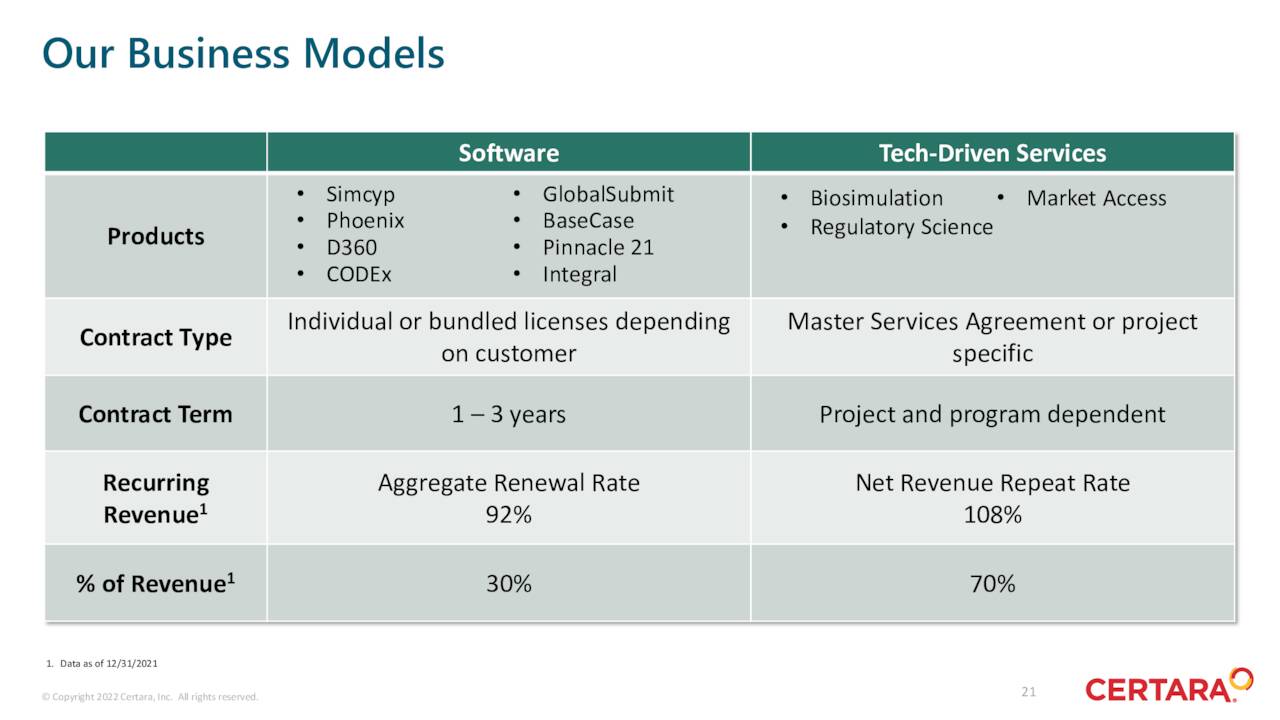

Certara, Inc. is headquartered in Princeton, NJ. The company provides software products and technology-enabled services to customers for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access. The stock currently trades at just over $14.00 a share and sports an approximate $2.25 billion market capitalization.

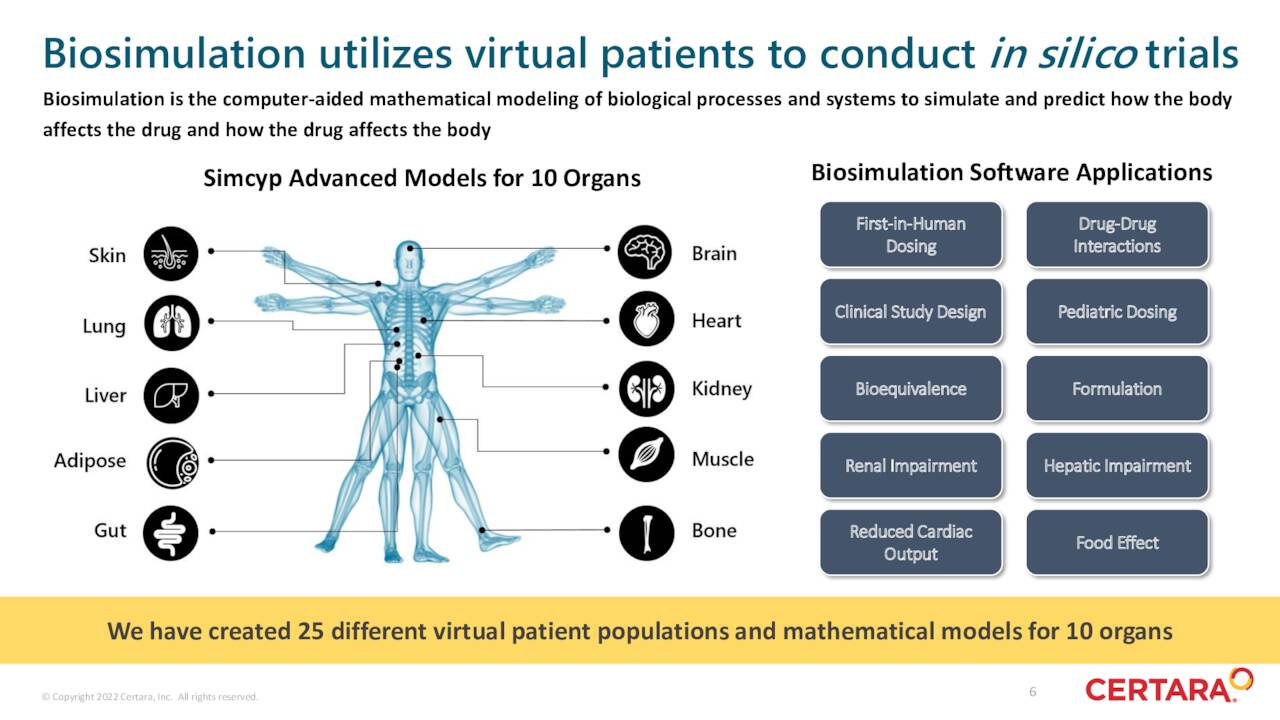

June 2022 Company Presentation

Certara provides biosimulation software and other related services that enable biotech and biopharma firms to conduct virtual trials to help predict how drugs might behave in patients. These products can help cut development and also provide additional benefits.

June 2022 Company Presentation

The company also continues to expand its AI capabilities and acquired artificial intelligence company Vyasa Analytics early this year to help it on that front.

Second Quarter Results:

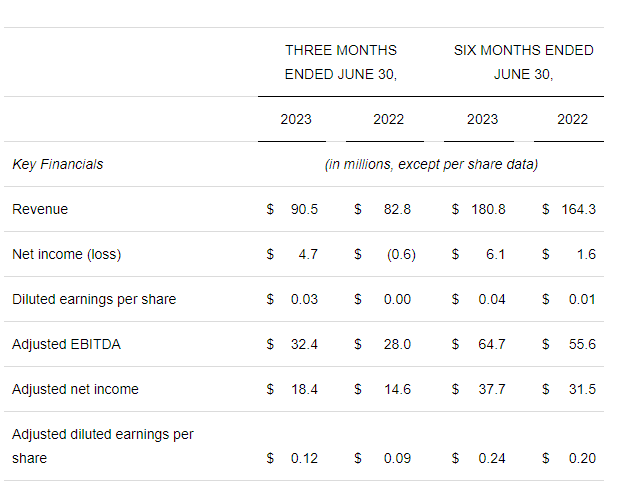

Certara posted its second-quarter numbers on August 9th. The company had non-GAAP earnings of 12 cents a share as revenues increased just over nine percent on a year-over-year basis to just under $90.5 million. Both top and bottom-line numbers came in just shy of expectations. Management stated “cautious spending among smaller biotech customers, as well as a slow recovery in our regulatory business” curtailed revenue growth on the margins.

June 2022 Company Presentation

Certara did have a net income of $4.7 million for the quarter compared to a net loss of $600,000 in the same period a year. Adjusted EBITDA grew to $32.4 million from $28 million in Q2 2022 as well. Notably, software revenues grew 17% on a year-over-year basis to $33.7 million while sales from services only saw five percent growth to $56.7 million. Ratable and subscription revenue made up 57% of that total. The company is currently in the process of combining its services groups to gain additional synergies across that 700-person part of the organization.

Seeking Alpha

Management also stated that it now expects FY2023 revenue to be between $345 million and $360 million and non-GAAP EPS to come in between 44 to 48 cents a share.

Analyst Commentary & Balance Sheet:

The analyst community is pessimistic overall about Certara’s near-term prospects. Since second quarter numbers were posted, three analyst firms including Morgan Stanley and Barclays have reiterated Hold/Neutral ratings on the stock. Both William Blair and Jefferies also downgraded the shares to a Hold as well. Jefferies noted that “We continue to believe in the shift to biosimulation. It’s just not happening as quickly as we had envisioned” behind their downgrade on August 22nd in which they also slashed their price target to $17.00 a share from $24.50 previously.

Price targets offered by this group range from $16 to $21 per share. Meanwhile, Credit Suisse ($21 price target, down from $27 previously), Bank of America ($24 price target, down from $21 previously), and Behrenberg Bank ($19 price target) maintained their Buy ratings on the shares.

Approximately six percent of the stock’s outstanding float is currently held short. One corporate insider bought nearly $80,000 worth of stock late in August. Other insiders have sold approximately $1.9 million worth of shares collectively so far in 2023. The company ended the second quarter with just over $245 million worth of cash and marketable securities on its balance sheet, against approximately $290 million of long-term debt. Interest expense increased to $5.7 million in the second quarter from $3.9 million in the same period a year ago due to a higher rate on Certara’s floating rate term loan.

Verdict:

Certara, Inc. made 46 cents a share of profit in FY2022 on just over $335 million in revenue. The current analyst firm consensus has the company making 45 cents a share in earnings on just under $353 million in sales in FY2023 followed by 48 cents a share in FY2024 on a seven percent rise in revenues.

The company is delivering steady, but hardly impressive sales growth. However, growth is not living up to expectations as biosimulation continues to gain slow traction. Profit growth looks like it will be a bit over flattish from FY2022 to FY2024.

With Certara, Inc. shares trading a bit north of 30 times earnings and nearly 6.5 times forward sales, there is nothing compelling about the stock’s current valuation given Certara’s projected medium-term growth prospects. Therefore, the only investment recommendation I can give around CERT at these trading levels is to avoid it.

Objection, evasion, joyous distrust, and love of irony are signs of health; everything absolute belongs to pathology.”― Friedrich Nietzsche.

Read the full article here