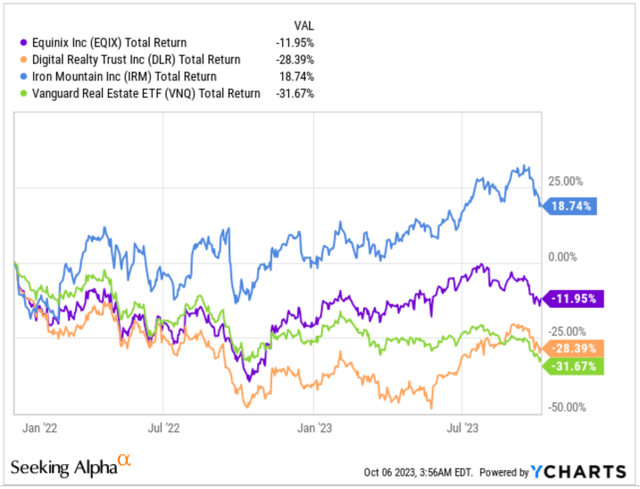

Iron Mountain Incorporated (NYSE:IRM) is a REIT focused on data storage. This comes in two segments – data centers, similar to those run by Digital Realty Trust (DLR) or Equinix (EQIX) and paper storage facilities. I consider paper storage facilities an inferior product, which will gradually cease to exist as more and more companies choose to store their data online. That’s why I would expect IRM to trade at a discount relative to DLR or EQIX. Interestingly, though, the stock has performed much better than other data center REITs and has even outperformed the broader REIT index (VNQ).

YCharts

I’m puzzled by this, which is why I wanted to investigate the company in more detail to see what’s happening under the hood.

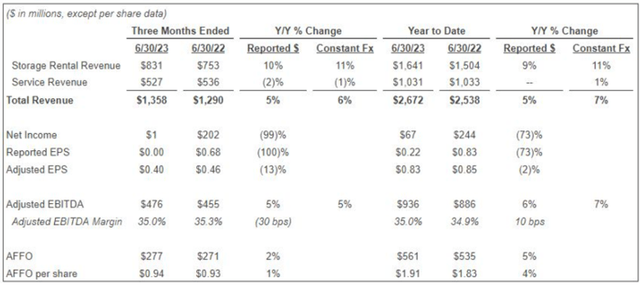

Q2 earnings

I want to start by reviewing their Q2 earnings. The company reports revenues in two segments. First, the storage rental segment which represents rent paid for paper storage facilities and second, the service revenue which represents fees from renting data server space. As you can see, storage rental revenues account for about 65% of all revenues and have seen a solid 9% YoY growth over the first six months of the year. Service revenue, on the other hand, has seen no growth.

Beyond revenues, I want to look at AFFO, instead of the usual FFO. The reason is that data centers are a capital-intensive business with relatively high maintenance CAPEX. AFFO captures the effect of this CAPEX which is why I consider it to be a superior metric for data center REITs. For the first half of 2023, AFFO per share has reached $1.91, up 4% YoY.

IRM

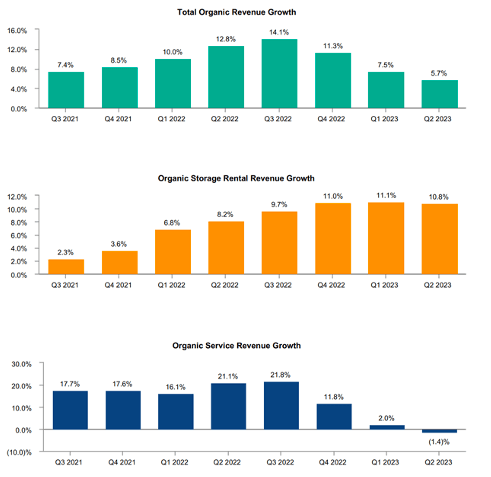

That’s not bad on an average basis, but if we break it down into individual quarters, we’ll see that while EPS growth was as high as 7% YoY during Q1 2023, it slowed quite a bit in Q2 to just 1% YoY. The reason for this is service revenue growth (in blue below) which has decreased drastically from 20%+ prior to Q4 2022 to negative 1.4% by the most recent quarter. Consequently, total organic revenue growth has reached the lowest levels since 2021. Regardless, the stock trades near its all-time high.

IRM

As far as guidance, management thinks that they can reach AFFO per share of $3.95 which would be up 4% YoY. But getting there assumes reacceleration of organic revenue growth from current levels. While the goal is not completely unrealistic, the company is a little bit behind in delivering on the target. It’s been interesting to see if they were able to catch up in Q3.

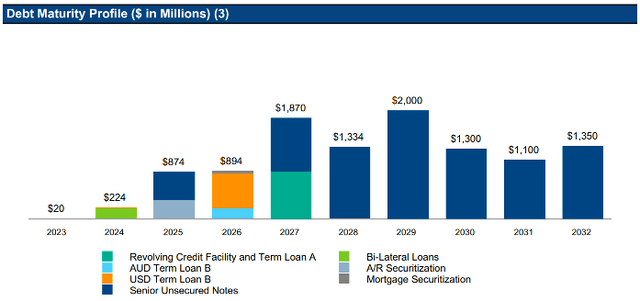

Financial position

One of the reasons, AFFO has been under pressure is the fact that there is nearly $1 billion outstanding on the credit line at a nearly 7% interest rate. And frankly, there’s little that IRM can do about that. Given their low rating of BB-, refinancing the credit facility is unlikely to decrease the rate materially. Moreover, their total cost of capital, excluding the credit line, is already quite high at 5.5% and their leverage of 6x EBITDA isn’t great either.

IRM

So far, we have decelerated growth and a poor balance sheet neither of which can justify the stock outperformance. It must be that investors are seeing something that I’m not, but it certainly doesn’t have to do with dividends either, because the stock has a relatively average yield of 4.5% and has barely grown their dividends over the past 5 years with a growth CAGR of just above 1%. Moreover, the payout ratio is relatively high at 85%.

Valuation

Despite all of this, the stock trades at 15x AFFO which is above its long-term average of 12x FFO. With everything we’ve seen, I would expect the opposite.

In terms of expected return, I cannot justify the premium to the historical average, especially when growth is slowing and the REIT is heavily leveraged with a high cost of debt. A simple re-rating to 12x AFFO would result in 20% of downside, which is very unlikely to get offset by a sub-5% dividend and sub-5% AFFO growth at best. As a result, I rate IRM a SELL here.

FastGraphs

I think the stock is especially unattractive at a time like today, when many other REITs are trading at significant discounts.

Read the full article here