Today at the Lab, we decided to recap Novartis’ latest and subsequent development (NYSE:NVS, OTCPK: NVSEF). As a reminder, on the 15th of September 2023, at the Extraordinary General Meeting, the company’s shareholders approved the Sandoz spin-off. Our internal team views this business separation positively, given that the companies have limited synergies. In addition, this spin-off will likely extrapolate more value embedded in the Novartis Innovative Medicine division and simultaneously create a global leader in Generics and Biosimilars. Yesterday was Sandoz’s D-day, and the company was listed with an IPO for a market value of $11.2 billion.

Looking at the press release details, Novartis completed “the Spin-off through a dividend-in-kind distribution to holders of Novartis shares and American Depositary Receipts (ADRs), with each holder receiving one Sandoz share for every five Novartis shares or one Sandoz ADR for every five Novartis ADRs, held at the close of business on October 3, 2023.” The new listing was placed with the SIX Swiss Exchange under the ticker ‘SDZ,’ but there is already an ADR in the US (with an over-the-counter market). Here at the Lab, we are not new to commenting on this type of operation, as a reminder, last year, we reported Eurapi’s spin-off from Sanofi. This deal made Sanofi a more agile company and extrapolated the actual value of the company’s drug portfolio.

The New Novartis

In line with Sanofi, Novartis has now completed its business transformation to become a leader in innovative medicines. Indeed, the company is well-positioned for sustained top & bottom line growth thanks to four areas: Oncology, Neuroscience, Immunology, and Cardiovascular, Renal & Metabolic. Despite the spin-off, Novartis reaffirmed its 2023 outlook which was already raised in Q2 with the following: top-line sales forecasted to grow high single digits and EBIT to increase by low double digits to mid-teens. We can say that Novartis’s strategic plan unveiled in 2022 is almost completed. In addition, to support shareholders’ remuneration, the company confirmed its growing dividend per share policy, with no re-basing after the spin-off and its ongoing buyback, which is equal to $15 billion.

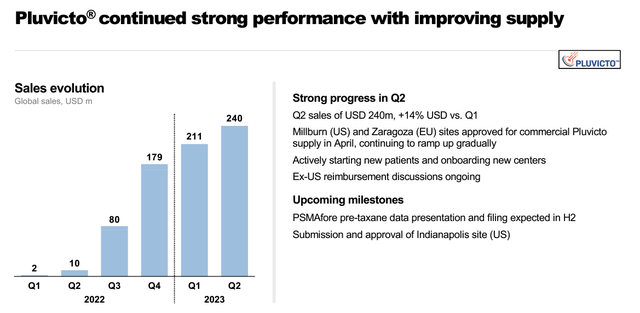

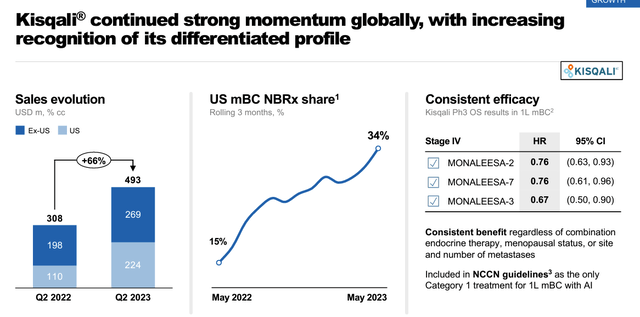

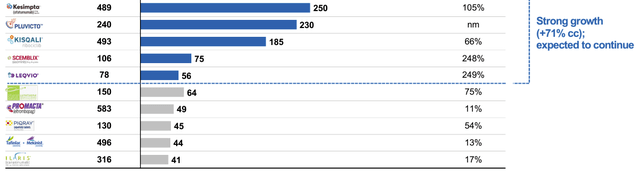

In our estimates, Novartis ex-Sandoz might experience a margin uplift. In Q2, we reported the following: “What we liked was the restructuring process, which started to be evident in H1 and reflected the company’s margin improvements”. Here at the Lab, despite LOEs on Entresto/Promacta, we anticipated a 2.5% CAGR revenue growth combined with a 3.7% core operating profit growth until 2028. How? Our internal team sees upside sales from Pluvicto (pre-chemo – Fig 1), Kisgali (adjuvant – Fig 2), Iptacopan (kidney disease with a readout planned in Q4 2023), and Scemblix (1L use with a submission and readout in 2024). In addition, Novartis has two existing technology platforms and three following platforms to increase internal R&D capabilities and add production capacity scale. At the moment, Novartis has a rich pipeline with approximately 150 projects in clinical development with a lower generics competition.

Pluvicto sales development

Fig 1

Kisgali sales development

Fig 2

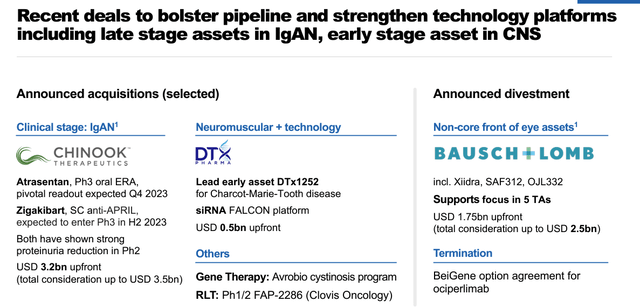

For the above reason, in a stand-alone model, excluding Sandoz, we anticipate a top-line sales CAGR of 3% until 2027 (Fig 3). In addition, despite the buyback, Novartis is actively looking for M&A. Recently, Novartis reached an agreement to acquire biopharmaceutical company Chinook Therapeutics for a total consideration of approximately $3.5 billion. With this acquisition, Novartis primarily intends to strengthen its pipeline in the field of kidney diseases (Fig 4).

Novartis sales

Fig 3

Chinook Therapeutics transaction

Fig 4

Conclusion and Valuation

Although our internal team has a positive view of recent the company’s progress and potential positive catalyst thanks to a rich pipeline, we retain our preference for Roche, Lonza, and Grifols. Post Q2 results, we raised our visible period forecast which is in line with the company’s latest guidance; however, looking at the valuation, we reaffirmed our CHF 90 target price with a 2024 price earning of 14.5x (in line with our EU pharma peers). Our neutral rating is then confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here