The news for Social Security always looks like a horizon crowded with storm clouds. In the most recent Social Security trustees report, the social insurance trust fund may have to cut benefits by 2034.

Of course, Congress can act sooner to bolster the trust fund, which is still fully funded, so the bad news is not a done deal. Tell your Congressional representative and senators to get working on a fair fiscal solution.

In the interim, it makes sense to plan some Social Security maximization. I found some great advice in Mark Miller’s superb recent book “Retirement Reboot,” which he summarized in a recent talk and in his excellent newsletter “Retirement Revised.”

“Married couples should have a coordinated claiming strategy for Social Security,” Miller writes. “Couples have a range of options. Should one or the other spouse start benefits early, should both delay, or should both file early?”

* Most often, couples will benefit if the higher-benefit spouse delays filing to earn delayed credits. An oft-cited Census Bureau statistic is that women earn 82 cents for every dollar earned by men. But some estimates have found a larger gap—49 cents on the dollar in 2015 when the broadest possible definition of workers is used. If your household’s income history reflects that kind of gender gap, a sensible approach might call for the wife to file earlier to start the flow of benefits into the household, offsetting living expenses.

* Another reason for her not to delay too long: those higher-earning men tend to die at earlier ages. At that point, the lower earner steps up to 100 percent of the deceased spouse’s benefit—and any increased benefit gained from her own delay vanishes at that point.

* The man’s benefit becomes an extended joint-life benefit for his survivor. A coordinated delay strategy increases the odds that lifetime benefits will be greater, because one of the two are very likely to beat their break- even age.

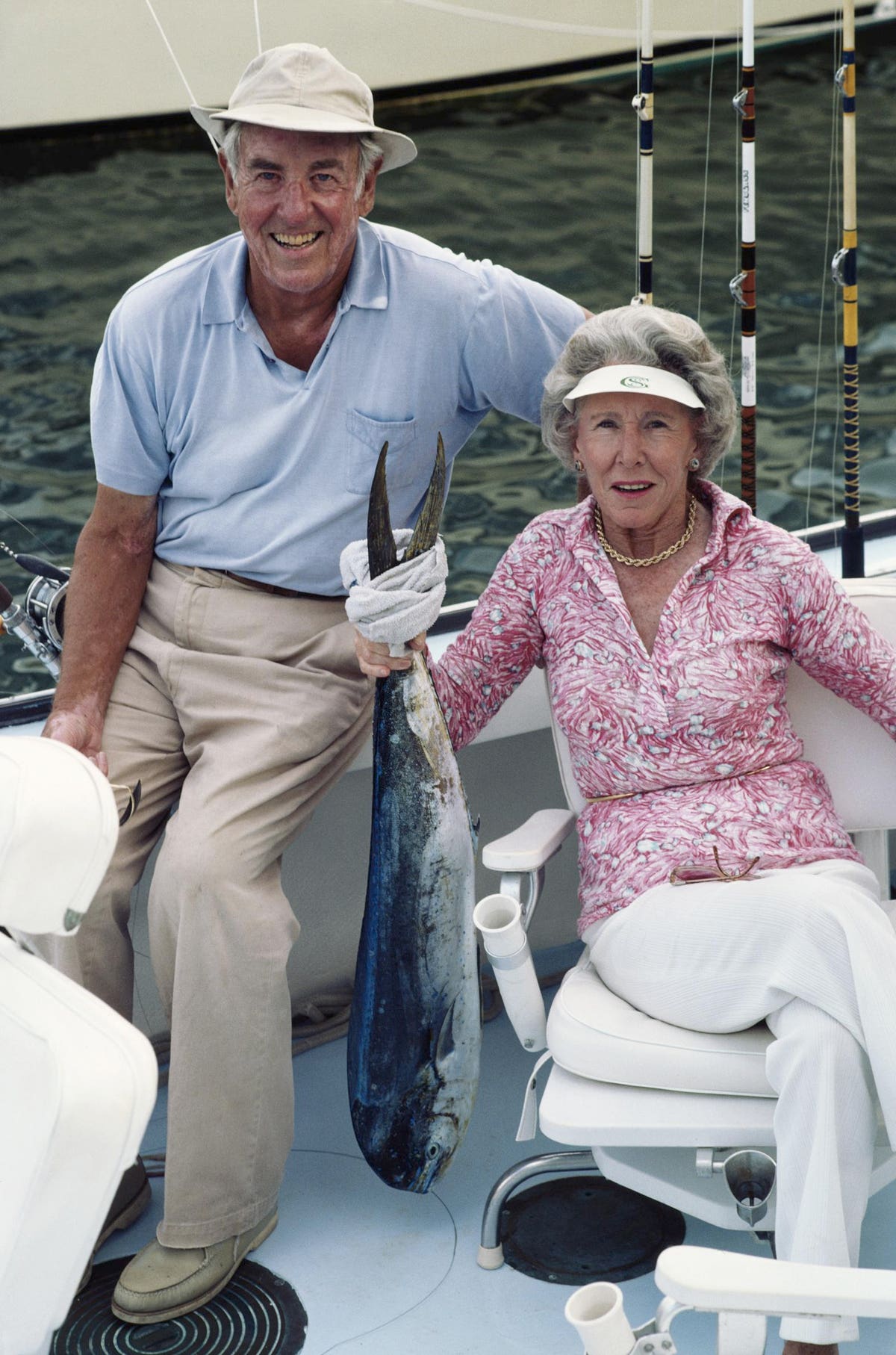

In summary, talk with your spouse and do the math. If you need professional help, consult a fee-only certified financial planner. My wife and I just had the couples Social Security planning conversation and it infused us with hope.

Read the full article here