Despite the large number of announced layoffs these past few months, the unemployment rate moved down to 3.4%. That’s tied for the lowest level since 1953. Of course, the politicians will take heaps of credit, but the fact is that it fell, not because of job growth, but because people left the labor force; really not a good sign for economic growth.

The Fed’s Fixation on Employment

The unemployment rate is a lagging indicator, meaning that changes show up several months after the economy has shifted gears. Nevertheless, it is at the top of this Fed’s list. In the recent press conference, after the Fed announced its +25 basis point rate hike, Powell said one reason they raised was the “strong” labor market.

The headline payroll number was +253K. Markets had penned in +185K, so a substantial beat. What wasn’t mentioned in the media was the downward -146K revisions to February and March data. So, on net, the actual growth from the old March number was +104K, -81K lower than what the market forecast was. In past blogs we’ve talked about the Birth/Death model “add-on.” This is the number that is just added (not counted anywhere) because BLS doesn’t survey small businesses. That number for April was +176K. So, the actual counted number was +77K (=253-176). Adjusting for the -146 downward revisions for February and March, the net number turns out to be -72K. So, no – not a strong employment number by any means.

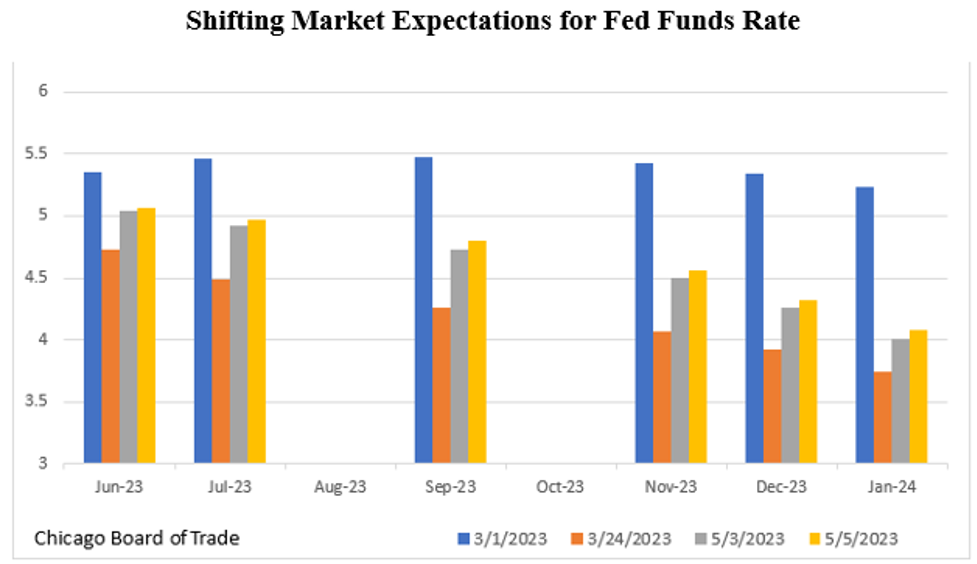

The chart above shows rapidly shifting market expectations for the Federal Funds Rate. Note the fall in the expected rate in March (orange bars), and its rise in early May after the Fed meeting (gray). Note the up move in rates on Friday (May 5) (gold) after the release of the payroll report vs. the Wednesday (May 3) (gray) levels.

Other employment indicators:

- In the Household Survey, non-agricultural and salaried employment fell -96K in April.

- The workweek (for nonsupervisory employees) shrank again in April (-0.3%) and has been flat or down in 13 of the past 14 months (down to 33.8 hours/week vs. 34.1 a year ago).

- Temp-Help Agency employment fell -23K in April and is down -139K over the past six months. The labor market can’t be very strong when the head hunters are cutting their own heads!

- The latest JOLTS (Job Opening and Labor Turnover Survey), a favorite of Fed Chair Powell, showed job openings contracted -384K in March (down three months in a row), hiring fell (-1K in March, -117K in February), quits were down (-129K and down in three of the last four months), and layoffs were up (+248K).

- In the S&P 500 quarterly reports, for the first time since mid-2021, the mentions of “job cuts” were higher than those of “labor shortages” (see chart).

So much for the so-called strength in the labor market.

Banking Fallout

Our view is that it is way too early to assess the damage from the chaos in the banking system. As late as Thursday (May 4), the financial markets have continued to put pressure on regional banks, as seen from the chart of their stock prices. There is likely to be more fallout there. In addition, credit conditions have massively tightened and this takes time to have an economic impact.

Whenever the Fed embarks upon a credit tightening cycle, especially a rapid one, the initial impact occurs in the financial sector, i.e., something breaks! We saw this in the 1980s (Lincoln Savings and the S&L debacle) and again in 2008 (Lehman Brothers and 25 bank failures). In today’s world, the three banks that have failed so far had assets, in the aggregate, greater than those 25 failures 18 years ago (see chart).

This particular Fed is obsessed with inflation and is focusing only on the Year/Year CPI which is a backward-looking indicator. It says zero about what the future looks like. (On the other hand, markets see the 10-Year TIPS breakeven at a mere +2.2%.) The Fed made this same overtightening mistake in 2008. Then, CPI inflation was +5.6% Y/Y (vs. +5.0% today). A year later, it was -2.0%! We see a similar scenario playing out over the next 12 months.

The Recession (it’s already begun!)

Despite what you hear on TV from the sell-side pundits, it appears that the Recession has already begun. Our educated guess is that the National Bureau of Economic Research (NBER), when they get around to dating this Recession, will say it started either in Q1 or in the current quarter (Q2). Th following is a list of the indicators screaming the “R” word. As you will see as you read on, the evidence is overwhelming.

- The Conference Board’s Leading Economic Indicators (LEI) peaked in December 2021 and have been negative in every succeeding month, i.e., 15 months in a row. Note in the chart its close relationship to GDP. LEI has a 100% track record in signaling Recession when it shows this many negative months in a row.

- LEI leads Recessions by 14 months on average. This would indicate that March or April will be the Recession start date. Remember, Q1 GDP was quite weak with most of the strength for the quarter occurring in January and then significant deterioration by March. The handoff to Q2 was quite weak, especially in consumer spending on durable goods, and on cyclical services. In addition, there was significant deterioration in the housing market, in other construction, and in inventory investment. In fact, inventories are in the process of being liquidated (a big negative for GDP).

- Retail sales fell -1.0% in March after a -0.2% fall in February. Department stores were off -2.5% (-3.7% February). Clothing -1.7% (-2.0% February), Autos -1.6% (-1.3% February and down in four of the last five months), Building Materials -2.1%, and even Groceries -0.1% (and down in three of the last four months).

- After unprecedented stimulus during the pandemic, the U.S. consumer went on a massive service sector spending spree (having been deprived during the pandemic lockdowns). That has now faded. March retail sales data shows spending on services (restaurants, hotels, air travel, movies, sports, entertainment, and theme parks) fell -0.6% in real terms on top of February’s -2.2%. Such spending has fallen in four of the last five months.

- The transportation company, J.B. Hunt said in their quarterly report that the U.S is in a “freight recession.” Truck cargo volume is down -13% Y/Y. April’s railway car loadings fell -3.4% from March, and activity at the Ports of LA and Long Beach are off -25% Y/Y and -30% Y/Y respectively. In addition, shipping rates have fallen dramatically.

- All the Manufacturing Surveys are showing weakness. The latest Richmond Fed Survey (April) was -10, and the Philly Fed’s latest was -22.8. The ISM Manufacturing Survey was 47.1 in April, having contracted now for six months in a row (i.e., <50). The Chicago equivalent has contracted for the past eight months.

- Home prices are falling. The latest Cash-Shiller 20 City Index rose 0% M/M (March), and was up +0.4% on a Y/Y basis. This was +21.2% Y/Y in April 2022.

Inflation

The Fed is also glued to the backward-looking Y/Y rate of inflation instead of concentrating on current and forward looking data. On a Y/Y basis, CPI inflation peaked in June 2022 at 9.1%. Last month, that measure was 5.0% and the M/M growth was just +0.1%. The PCE Index (Personal Consumption Expenditures) also rose +0.1% in March (a +1.2% annual rate), and the core (ex-food and ex-energy) rose +0.3%. Excluding energy and rent (another Powell favorite), that index rose +0.2% in March. But instead of looking at the nearby monthly data to see the trend, this Fed appears to just be looking at the Y/Y numbers!

The Fed’s fear of a 1970s style wage-price spiral is also way overblown. The ECI (Employment Cost Index) rose +1.2% Q/Q (+4.7% annual rate). It has shown such +1% gains for seven quarters in a row; so, no acceleration here.

On top of all this, commodity prices have plummeted. Oil is the world’s most important commodity, and its price is now hovering around $70/bbl., down from $122/bbl. last June. And this in the face of the OPEC+ production cuts. That says something about demand!

CPI Bias

We have commented in past blogs about the bias in the CPI due to the way in which the Bureau of Labor Statistics (BLS) calculates shelter costs (rents). Those costs comprise more than 30% of the CPI, so the fact that the data are lagged six months or more seriously biases the results.

March’s CPI was +0.1% M/M even with the lagged shelter costs (30% of the index) at +0.6% (the current private sector shelter indexes are negative, e.g., Redfin

RDFN

Researchers at Penn State developed an alternative measure which substitutes a current rent index for shelter costs used by the BLS. Note the reality (red line) vs. the actual CPI (blue line). You can tell from this chart where the CPI is headed.

Final Thoughts

In the face of overwhelming evidence of the onset of a Recession, with inflation falling rapidly, and in the face of significant stress and breakage in the banking system, this Fed chose to raise rates yet again at its May 2-3 meeting! Looks like overkill to us.

The icing on the deflation cake is the negative Y/Y growth in the money supply, a first in the history of this series going back to the 1950s. (Strange that this isn’t discussed in the media.)

Note from the chart the rapid growth in M2 in 2021 and 2022. Any doubt about the origins of the current inflation? The recent negative growth in this series along with the stress in the financial system caused by the rapid rise in rates all but guarantees that we are at the beginning of a significant period of outright deflation. Buy bonds!

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here