Though rising interest rates have significantly sapped the appeal of stocks versus cash, and in particular slammed the brakes on tech-stock multiples, it’s important to not completely lose exposure to growth stocks amid the current recession. In my view, there remains a great opportunity for investors to cherry-pick strong businesses that are now trading at multi-year valuation lows.

Workday (NASDAQ:WDAY), in my view, is an excellent stock in this regard. This cloud juggernaut, the undisputed leader in HCM and finance ERP systems, is all but shrugging off the current macro situation. It is keeping up its solid growth rates, while also taking advantage of the current environment to slim down its workforce and re-hone in on profitability.

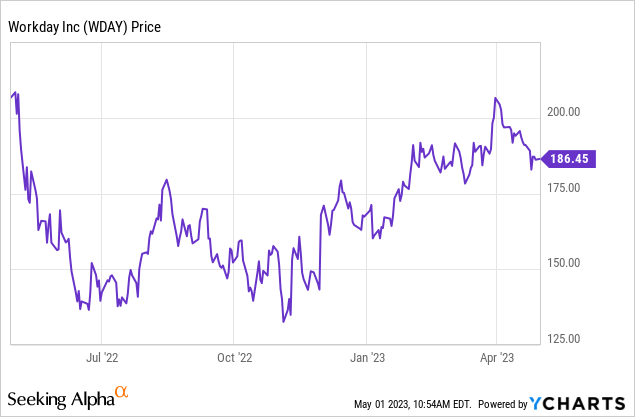

Up only ~10% year to date, Workday remains down ~35% from its 2021 pandemic-era highs. This is one of few tech stocks I’m comfortable buying and completely forgetting about for years.

Bull case remains robust; Workday plows ahead with minimal macro impact

By no means is Workday as buzzy or as exciting as it was in the past. But this is a company that continues to quietly hit its targets, deliver impressive top and bottom line growth, while continuing to dominate its two areas of HR and finance software. I remain bullish on Workday. And considering the stock is now down roughly ~10% since peaking above $200 in March, I’d use the dip as an opportunity to buy.

As a reminder for investors who are newer to this stock, here is my full long-term bull case for Workday:

- Category leadership in two very large markets in enterprise software. For investors who don’t have the history, Workday was born out of ex-Oracle employees who eventually turned Workday into a premier cloud software solution for HR. The company has now extended that dominance into financial/ERP software, and together between these two markets Workday now sits on a massive $125+ billion market opportunity.

- Cloud-based, recurring revenue software. Workday has always been one of the “original” large-cap software companies, alongside Salesforce.com. Its revenue base is almost purely driving from subscriptions, giving Workday a powerful recurring revenue stream from which to grow.

- Ample resources and cash. Workday has more than $6 billion of cash on its balance sheet, giving it plenty of financial firepower to pursue both organic and inorganic growth.

- Growth/profitability balance. Workday is a “Rule of 40” software stock, which is a goal many fellow enterprise software companies strive to achieve and fail to do. With ~20% revenue growth on top of 20%+ pro forma operating margins, Workday has achieved a level of growth/profitability balance that should give investors some comfort in a choppy stock market.

Valuation remains modest

From a valuation perspective: at current share prices near $186, Workday trades at a market cap of $48.19 billion. After we net off the $6.12 billion of cash and $2.98 billion of debt on Workday’s most recent balance sheet, the company’s resulting enterprise value is $45.05 billion.

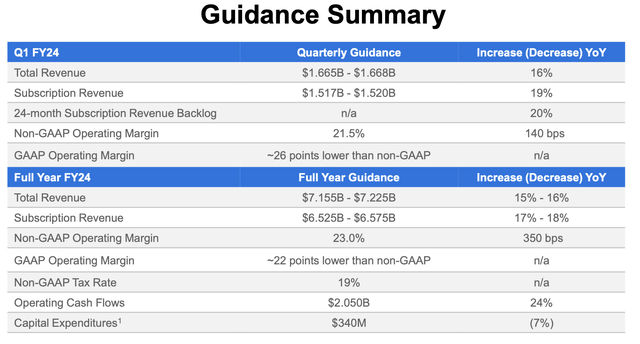

For the current fiscal year FY24 (the year for Workday ending in January 2024), the company has guided to $7.155-$7.225 billion in revenue, representing 15-16% y/y growth (with 17-18% y/y subscription revenue growth underpinning that):

Workday FY24 outlook (Workday Q4 earnings deck)

This puts Workday’s valuation at just 6.2x EV/FY24 revenue – which I’d consider to be quite reasonable for a “Rule of 40” contender, and especially as Workday plans to boost pro forma operating margins by 350bps this year.

In my view, Workday should be able to flex up to a minimum of 7.5x EV/FY24 revenue by the end of this year, representing a year-end price target of $220 and ~19% upside from current-levels.

Growth remains solid, while the company quietly builds margins

Relative to other enterprise software companies, I’d argue Workday has been among the least impacted by the current macro situation. Many companies have reported severe deceleration in the fourth calendar quarter of the year, owing to elongating deal cycles. Workday’s advantage here is likely partially owing to the fact that it’s already an established subscription business, where new deals aren’t a major factor in contribution to growth.

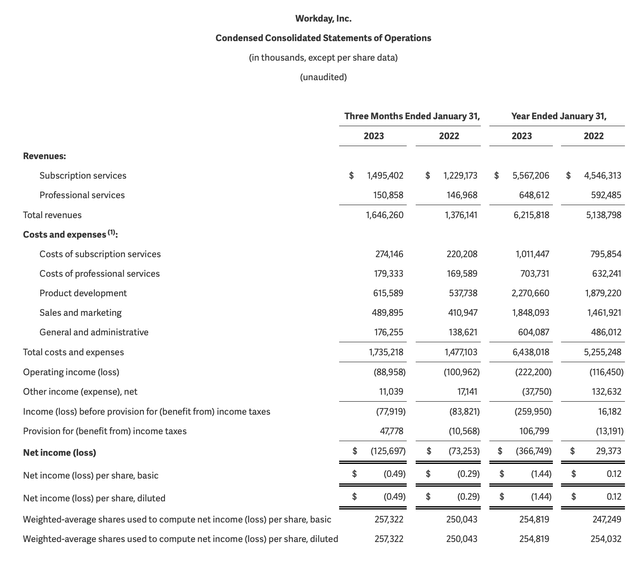

In Q4, Workday’s most recent (January) quarter, Workday grew total revenue at 20% y/y to $1.65 billion, beating Wall Street’s expectations of $1.63 billion:

Workday Q4 results (Workday Q4 earnings deck)

Per co-CEO Carl Eschenbach’s prepared remarks on the Q4 earnings call:

Despite a macro environment that remains uncertain and that no one is immune from, we drove strong close rates in Q4 and built a healthy pipeline for the year ahead. Our team was prepared to respond to the extra scrutiny we knew would come with deals in this environment. And because of that, we are heading into our new fiscal year in a position of strength. I can tell you the excitement for the year is all around us as we are coming to you live from our annual sales kickoff conference in Las Vegas.”

Eschenbach tacked onto these thoughts during the Q&A portion of the call, indicating that further growth levers in FY23 include adding quota-carrying sales reps, pushing more deals through reseller partners, as well as international expansion, as international currently only contributes to 25% of Workday’s overall revenue. With these factors in place, Eschenbach indicated confidence that Workday can return to 20%+ subscription growth in the near future (22% y/y growth in Q4 is expected to decelerate to 19% y/y in Q1, though Workday usually does have a tendency to guide conservatively).

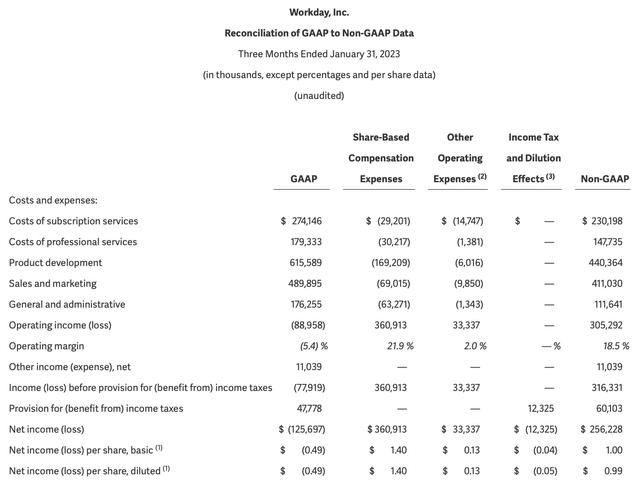

Workday also continued to make small strides in profitability. Note that the company did eliminate approximately 3% of its workforce to drive efficiency. These moves, plus the more favorable subscription revenue mix, helped drive pro forma operating margins in the fourth quarter to 18.5%, a 130bps y/y improvement (to be followed by a 350bps jump in FY24, per the company’s latest guidance);

Workday profitability (Workday Q4 earnings deck)

Key takeaways

In my view, Workday remains a great “set it and forget it” investment. Looking longer term, the company has plenty of upside catalysts including partner-driven/international growth as well as tailwinds to profitability from headcount shrinkage. Stay long here.

Read the full article here