I have been bullish on Skyworks Solutions, Inc. (NASDAQ:SWKS) for a few years and have owned the stock since the start of the pandemic. When I published my investment thesis for the company, Skyworks stock was trading around $74 but soon took off during the market recovery that followed the Covid crash. I invested in the company around $75 but added to my position at much higher prices too as I was – and I am – convinced of the long-term growth opportunities available for the company. After revisiting the company, my long-term conviction of Skyworks remains stronger than ever, but I believe SWKS stock will offer meager returns in the foreseeable future.

The 5G Smartphone Upgrade Cycle Has More Legs

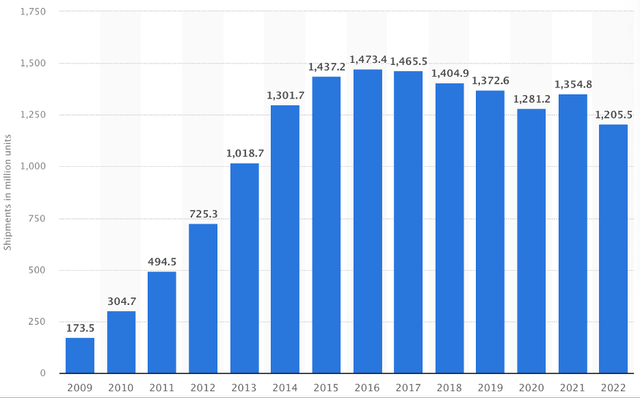

Global smartphone shipments reached a high in 2016 and declined steadily through 2020. In 2021, smartphone shipments came back to life and registered nearly 6% growth, aided by the growing popularity of 5G-enabled smartphones. Unfortunately, 2022 proved to be another disappointing year for smartphone manufacturers, with global smartphone shipments suffering the largest-ever decline in a single quarter during the Holiday Quarter (18.3% YoY). For the full year, shipments declined by more than 11%.

Exhibit 1: Global smartphone shipments

Statista

A notable weakness in demand for new devices, high inventory levels, and rising fears of a global recession in 2023 were among the main reasons behind this massive decline in smartphone shipments last year. Skyworks, as a chipmaker that derives the majority of its revenue from mobile products, suffered as a result of this broad weakness in the smartphone market. The net income of the company declined by close to 15% on the back of 7% revenue growth in fiscal 2022 ended in September, and the company reported a 12% revenue decline for the first quarter of fiscal 2023.

The smartphone upgrade cycle that was triggered by the rollout of 5G technology may have come across a few roadblocks today, but the long-term picture still looks promising. Western countries and China dominated the first phase of the upgrade cycle, but as we move on deeper into the cycle, emerging nations are slowly beginning to take over. According to GSM Association, 5G networks will be launched in 30 new countries this year, pushing the number of consumer 5G connections to more than 1.5 billion from around 1 billion at the end of the last year. In a potentially transformative development, many populous countries such as India and Brazil are expected to launch 5G networks this year. In India alone, the number of 5G users is expected to surpass 145 million by 2025. Commenting on how emerging markets are coming to the spotlight in the second phase of the 5G rollout, GSMA Intelligence Head Peter Jarich said:

Until now, 5G adoption has been driven by relatively mature markets and consumer use cases like enhanced mobile broadband, but that’s changing. We’re now entering a second wave for 5G that will see the technology engage a diverse set of new markets and audiences. The extension to new use cases and markets will challenge the mobile ecosystem to prove that 5G truly is flexible enough to meet these diverse demands in a way that’s both inclusive and innovative.

With new 5G networks covering populous regions coming to life in the next 3 years, the demand for 5G-enabled smartphones will see a notable uptick. Not to forget, many of these regions are benefiting from the rise of a middle-class society that is well-positioned to direct their discretionary spending to adopt the latest technological developments. This expected uptick in demand will create a strong platform for specialized mobile RF manufacturers to grow, and Skyworks is one such chipmaker with deep ties in the smartphone manufacturing industry with the likes of Apple Inc. (AAPL) and a few major Android device makers.

The RF Content In Devices Will Continue To Rise

To offer the latest technological advancements on their devices, smartphone manufacturers need to boost their spending on radio frequency components used in these devices. Skyworks and other chipmakers will benefit from these content investments. As investors, the easy way to think about this relationship is that the more complex devices become, the higher the number of RF components that need to be used in these devices to perform complex tasks. As a silver lining for Skyworks, IoT devices are increasingly becoming more complex.

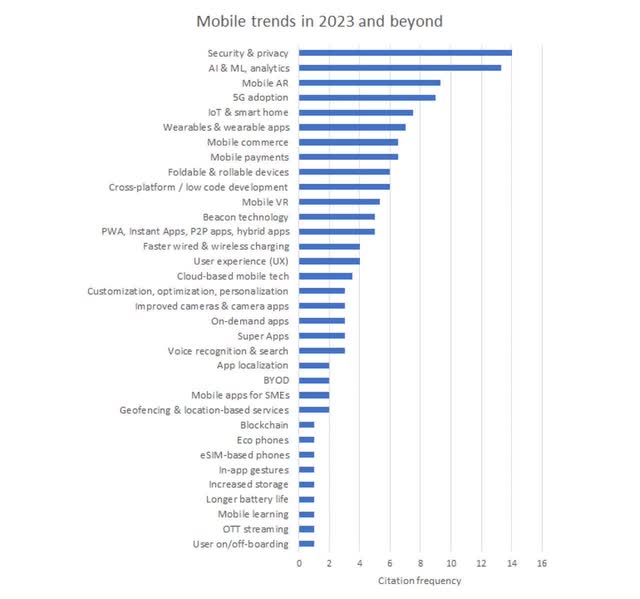

If we look at smartphones, below are the top trends to watch in this space in 2023 and beyond.

Exhibit 2: Top mobile trends in 2023

ZDNET

The advanced privacy features offered by smartphone manufacturers, AI and ML compatibility, and the use of Artificial Reality are all complex tasks that require advanced RF components. In the long run, IoT device manufacturers can be expected to increase their spending meaningfully to keep up with these trends, which is good news for Skyworks.

The Business Diversification Will Take Time

We are arguably at the beginning of the 5G-induced innovation cycle. Skyworks, through recent acquisitions and strategic investments, has positioned itself to benefit at every stage of this innovation cycle by gaining exposure to different industries such as the automobile sector and the healthcare sector. However, it would take a couple of years at least for these strategic decisions to payoff, meaning the company’s fortunes will remain closely tied to the smartphone industry for now. With the smartphone upgrade cycle currently facing barriers, it is reasonable to expect Skyworks to go through a rough patch in 2023 until the long-term favorable trends start kicking in to help the company make the most of its recent investments.

The Missing Earnings Catalyst

At Beat Billions, we believe stock prices can be predicted by observing and analyzing earnings estimate revisions, earnings surprises, and the sensitivity of stock prices to these events. Skyworks stock has historically shown a strong positive relationship with these earnings events, and today, earnings estimate revisions are trending in the wrong direction. Although Skyworks is well-positioned to benefit from several technological developments in the coming years, I believe SWKS will trade rangebound at best in the foreseeable future. For this reason, I am not planning to double down on Skyworks today. I will keep a close eye on upcoming earnings revisions to assess whether a reversal of fortunes is likely.

Takeaway

Skyworks Solutions, in my opinion, is still one of the best chip stocks to own despite the company’s dependence on a few major customers. As I have stated in my previous articles, I believe the company’s technological superiority makes it difficult for a competitor to eat into its market share, and its major customers are unlikely to replace Skyworks as such a decision might disrupt the product development process, at least for now. I will continue to remain invested in SWKS with a bullish long-term view, but I will wait for a more positive earnings momentum to add to my position.

Read the full article here