Thesis

The Healthcare sector has returned to the forefront of investors’ attention after the Covid-19 pandemic, as the sector tends to maintain defensive characteristics that can prove beneficial during economic downturns, while also offering some respectable growth options. Boston Scientific Corporation (NYSE:BSX) is an established medical device manufacturer, with a strong global presence across many different medical specialties, yet has been following a growth path over the past years.

Over the past decade, BSX has seen its stock price growing by 577%, as sales have doubled. Despite its profitable business model and expected growth trajectory, the stock price run-up appears to have some analysts concerned over the company’s valuation.

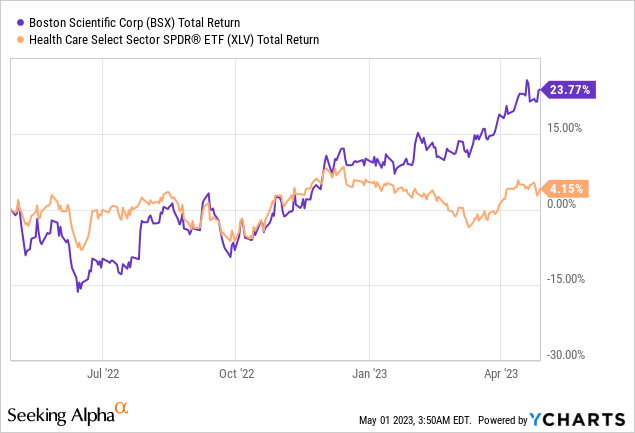

Recent Performance

Even though the healthcare sector has performed decently over the past year, despite broader turbulence in the markets, BSX has seen far better performance, especially over the past 6 months. The stock has returned +23.77% compared to the sector’s +4.15%. Currently, BSX trades at $52.12 ($75B market cap), very close to 52-week highs and pays no dividend.

Business Units

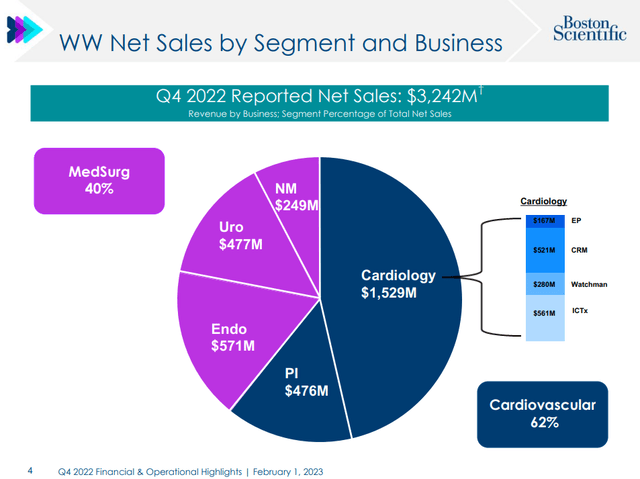

Boston Scientific is U.S. based developer, manufacturer and marketer of medical devices for a number of different medical specialties. The company’s core business activities are organized into two major reportable segments: MedSurg and Cardiovascular.

The MedSurg segment includes BSX’s Endoscopy device business, Urology and Neuromodulation. The Cardiovascular segment, on the other hand, includes interventional cardiology solutions, the WATCHMAN Left Atrial Appendage Closure devices, Cardiac Rhythm Management solutions, Electrophysiology (less-invasive) devices, as well as peripheral intervention solutions. Over the next years, maintaining and expanding its global presence remains a top priority for the business.

Sales Diversification

For Q4 2022, the Cardiovascular segment accounted for the majority of revenue (62%). Overall BSX’s sales are well-diversified across many different medical specialties, allowing the company to establish a strong presence across the healthcare device market.

For the entire 2022, Endoscopy sales were up by 3.7% YoY over the on a global scale, Neuromodulation revenue increased by a slight 0.9%, while Urology net global sales recorded the largest increases (+12.0% YoY).

Q4 2022 Presentation

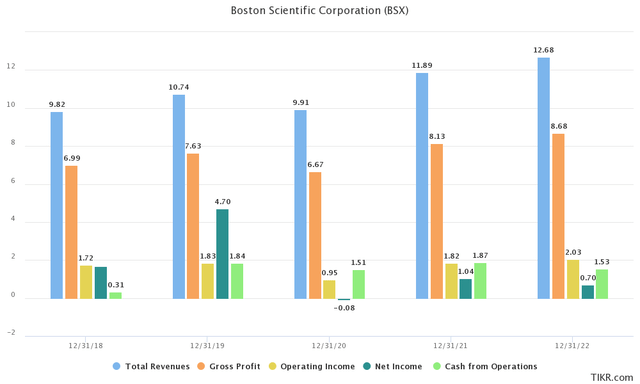

Growth Trajectory

With the exception of a disruptive 2020, due to the spread of the Covid-19 pandemic, Boston Scientific has managed to maintain a steady growth trajectory, with sales growing from $9.82B in 2018 to $12.68B in 2022 (7.1% CAGR). Over the past decade, revenue has grown at a respectable 6.2% CAGR.

Operating income has increased from $1.72B in 2018 to $2.03B in 2022, while Net income has shown greater variability, yet recording a 52% 5-year CAGR. Cash flow production from the company’s operating activities has been much more stable over the past few years, leveling above $1.5B annually.

Tikr.com

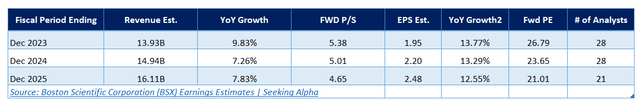

Analysts expect sales growth to continue in high-single digits, with revenue expected to reach $16.11B in 2025. EPS growth is forecasted at higher rates, between 12% – 14% for the next couple of years. Compared to most of its competitors in the industry BSX is exhibiting superior growth attributes.

SeekingAlpha

Q1 2023 Results, Guidance & Profitability

For the first quarter of 2023, BSX reported solid financial results, showing increasing sales by 15% YoY, exceeding previous guidance. Management attributes the accelerated sales increases to strong demand, coupled with the company’s differentiated product portfolio. EPS also exceeded the high end of the guidance range ($0.47 vs $0.42 – $0.44 guidance). Operating margins came in line with expectations. Management guided for 7% – 9% growth and EPS between $1.90 to $1.96. Electrophysiology sales remain the company’s best-performing segment.

In terms of profitability, the company maintains very wide gross margins of 70.4%, expected to stabilize (even increase a bit) for 2023. For Q1 2023, Boston Scientific also recorded a 25.5% adjusted operated margin, while management guided for margin expansion (a goal of 26.5% adj. operating margin for 2023). On a GAAP basis, BSX maintains a 16.3% operating margin.

For the entire 2023 fiscal year management also looks to generate over $2.3B of free cash flow marking a new record for the business. As of March 31, 2023, BSX had cash on hand of $570 million. Management also expects to marginally increase the number of shares outstanding (approximately 24 million new shares upon the conversion of preferred stock).

Valuation Raises Concerns

Boston Scientific’s valuation raises concerns regarding the stock’s ability to generate strong returns, even if the company continues to grow revenues at a relatively high pace. At a 26.8x FWD P/E (non-GAAP) and a 49x P/Cash Flow, someone could easily argue that they would significantly overpay to own the stock at the current price.

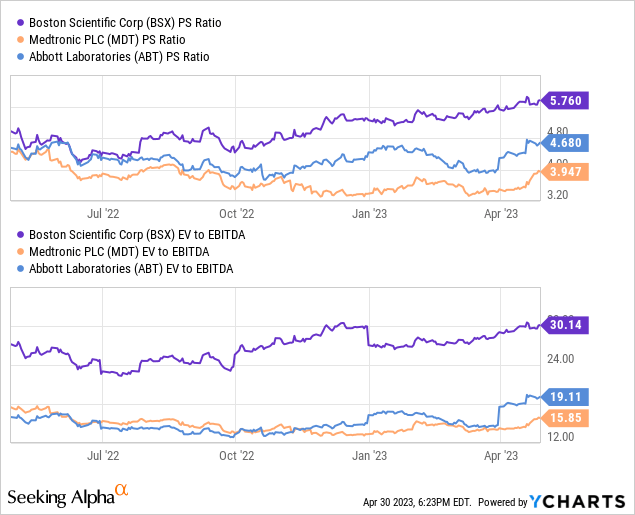

Boston Scientific appears especially expensive when we consider the valuation multiples other healthcare technology companies are trading at. Medtronic (MDT) and Abbott Laboratories (ABT), two of the largest players within the industry trade at a 3.95x P/S and 4.6x P/S respectively (compared to BSX’s 5.76x P/S). While all three companies are somewhat overvalued BSX multiples have substantially expanded over the competition over the past year.

BSX’s EV/EBITDA multiple stands almost 50% higher compared to MDT and ABT, while it is also important to note that the company also trades at the high end of its own historical multiples over the past few years.

Final Thoughts

Among other healthcare technology companies Boston Scientific stands out for its growth record and potential, as well a proven, yet expanding innovative product range. However, based on the stock’s current valuation metrics, its risk-return profile over the mid-term appears mildly unfavorable. At these price levels I would rate BSX as a Hold.

Read the full article here