Investment Thesis

Intel (INTC) has its fair share of naysayers, such as AMD (AMD) bulls, many of whom perhaps predicted all kinds of doom-and-gloom in the wake of its process slips in the last several years. And indeed, those who look at Intel’s recent sinking ship financials may finally be tempted to pat themselves on the back, seeing how Intel has been on a path towards irrelevancy for the last year. Indeed, some comments are already predicting Intel is headed towards bankruptcy.

However, nothing could be further from the truth. Behind the scenes, Intel has been diligently working on its comeback for several years. With Intel 4 now in production, Intel is finally ready to open its innovation floodgates. In the next two years, Intel will perform a magic act of a kind the industry has never seen before. In the process, Intel will transform from laggard to top dog. Intel is a strong buy.

Q1 results

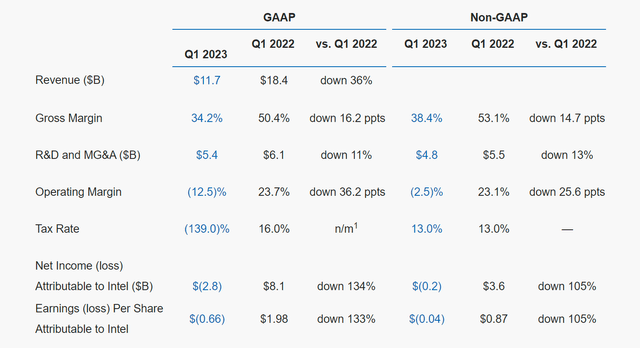

The Q1 results are shown below.

Intel

Revenue is down on strong inventory digestions in both client, data center, and network and edge. This also led to the downfall in gross margin. To some extent it might be a surprise the stock hasn’t reacted to this gross margin print, but after the guidance in January clearly the market has already started looking forward, with management reassuring that there is clear path back towards the 40s (by the end of the year), 50s and eventually even 60s (2026+).

Two specific factors were called out for the gross margin, each costing several points. First, underutilization as the fabs are to large extent idled/underloaded, resulting in higher product cost, which will continue for several quarters. Secondly, as with all major product launches, Intel is incurring PRQ costs. However, this will reverse in the second half as the products (Meteor Lake, Emerald Rapids) will then essentially get sold at 100% gross margin.

Nevertheless, as Intel 4 is a new node, it may (especially initially) carry a lower gross margin, but Intel hasn’t discussed this topic, so it is unknown how healthy Intel 4 really is in terms of yield (defect density). Note that the low 10nm yield was the primary reason (combined with the process leadership erosion) gross margin had already started to decay from the 60s into the 50s, so the incremental impact of the Intel 4 ramp on gross margin may ultimately prove to be quite limited as the new nodes have a relatively low bar (10nm/Intel 7) to clear.

As an aside, this was actually one of the big news items from the call, that Meteor Lake production has finally started. Contrary to some prior speculation, Meteor Lake will launch in the second half.

Note that there is also a third factor, which are the continuous start-up costs as Intel is going through its 5 nodes in 4 years strategy, which has essentially become 4 more nodes in the next 18 months.

Moving further, spending (R&D and MG&A) has started to decline. Annualizing the $0.7B reduction indeed confirms that Intel seems on track to its $3B target for 2023, since Intel had said $2B of the total reduction would come from this bucket. With regards to R&D specifically, while there is indeed a bit of a drop, Intel has exited 7+ businesses, so the core spending has likely largely remained unchanged; Pat Gelsinger even outright said Technology Development would not be impacted. In terms of employee count, there has been a decline of about 5k to 125k, which is still about 15k more than prior to Pat Gelsinger.

Overall, revenue and EPS slightly beat, and on a non-GAAP basis the loss was quite limited. Somewhere in the comments of one article, someone calculated that if revenue rebounds to pre-downturn levels and gross margin also rebound to 50-60%, then EPS would rise to $3-6, easily justifying the current stock price. Note that this was exactly my thesis from last year: Intel Stock Bottomed And There Is Upside Potential (NASDAQ:INTC).

Lastly, adjusted free cash flow was a stunning negative $8.8B, split between $1.8B loss from operations and $7B capex. There was also $1.5B in dividend payments.

Analysis (financials)

The financial thesis overall is unchanged from the discussion in the article just mentioned, but let’s apply this to these results.

First, contrary to the expectation at the time of writing the prior article, obviously revenue has declined by more than expected, but nevertheless this should recover over time. In this way, leverage will improve significantly, resulting in rising gross margin and strong profitability (Intel’s long-term 2025-2026 target is to reach 20% free cash flow yield).

Secondly, to continue the free cash flow discussion, there is simply no way Intel needs to spend $7B in order to deliver ~$12B in revenue. This should be obvious, but it should certainly be pointed out as the FCF print in isolation would be very misleading. As case in point, Intel said about half of its capex is going towards building fab shells (which are probably depreciated over several decades). Another 10% of capex is going to IFS, which also currently generates negligible revenue. Thirdly, there is also some (undisclosed) fraction going towards Technology Development to make the 5 nodes strategy reality. While this spending is absolutely necessary, it is compressed given the current accelerated pace of technology introduction.

Overall, Intel expects to return to positive free cash flow in the second half of the year due to lower capex and increased capital offsets. The broad point is (remains) that the underlying business is still profitable with healthy unit economics.

We’ve gotten ourselves [in 2026] this, let’s say, significantly higher startup costs that we are incurring behind us as well. And then as you point out, you have the benefits of the scale of revenue that we would expect. And then lastly, you have, as Pat was talking about, this whole notion of the internal foundry model, which just drives a lot of attention on cost and where we think we’re going to get a lot of that $8 billion to $10 billion of savings exiting 2025.

Segment results

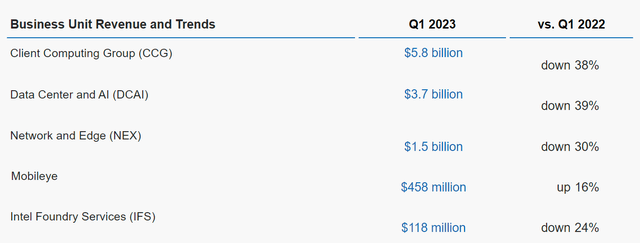

The segment results are shown below.

Intel

Intel said it gained share in CCG, which given AMD’s (AMD) results in the last two quarters seems credible. However, some people said that Intel would also have claimed that it gained share in DCAI, but this is erroneous. Pat Gelsinger only said that its market share in Q1 beat Intel’s expectations and was “stable”. This likely simply means Intel had a lower loss of market share than expected.

Anyhow, bears probably used this print yet again to point to Intel’s market share trend. AMD’s report is soon, but while AMD may still show some YoY growth, the ongoing QoQ slowdown will likely continue. In any case, if a 38% decline in CCG revenue is possible – due to a continued TAM contraction and inventory digestion – without incurring a loss in market share, then at least in principle the same would be possible in DCAI, as well as NEX where there is much less AMD competition, and indeed this segment also declined by 30%.

Within DCAI, PSG had a record quarter.

IFS was down 24%, but Intel said it removed automotive revenue. This is bit surprising perhaps as this would be part of IFS, and the segment still contains IMS Nanofabrication, which is an e-beam equipment company that has little to do with foundry services. Intel said packaging revenue grew 67% sequentially.

Lastly, Mobileye (MBLY) was up 16%. The stock was down on its report, likely because the company reduced its 2023 guidance which even prior to the reduction had already baked in a slowdown in growth. On Twitter, I made a joke where I removed the up/down arrows from Intel’s infographic, which ‘showed’ that Mobileye was Intel’s worst segment.

Finally, besides adjusting the IFS segment a bit, Intel also completely removed AXG (the GPU segment, although it also contained the now EOL’d Blockscale chip) following its reorganization. Investors may note that the current segments where created in the wake of Pat Gelsinger’s CEO transition, as he sought to bring investors more insight (and hence accountability) into how Intel’s major businesses were performing. Of those, AXG was one of Intel’s three big bets, with a stated goal of revenue “approaching” $10B by 2026. But with Raja Koduri leaving, it is unknown to what extent this target still stands.

With a separate P&L for the manufacturing group, we will also provide you with a cleaner comparison of the BUs to their external fabless peers.

So with AXG integrated again, it likely won’t be possible to compare AXG to Nvidia (NVDA).

Business updates

Intel finally launched Sapphire Rapids and Ponte Vecchio, which led to Pat Gelsinger calling Q1 a turning point for this business. As mentioned, Intel also started Meteor Lake production. While this is not unexpected given its 2023 launch, obviously this finally starts to make the node real. As Intel said, the process has been PRQ’d since Q4, but MTL will only PRQ later in the year.

Intel further reiterated all of its major public roadmaps. First, the client one which includes Arrow Lake and Lunar Lake in 2024. Arrow Lake is based on the 20A process. Lunar Lake is presumably on 18A, although this hasn’t been confirmed yet. Note that Pat Gelsinger on the previous call said that the goal was to PRQ Lunar Lake in 2024, which means the actual launch could actually happen in Q1’25, although this quarter the word “launch” was used explicitly.

Secondly, the DCAI roadmap as discussed at the recent webinar, with Sierra Forest and Granite Rapids in 2024 (Intel 3), and Clearwater Forest in 2025 (18A).

Thirdly, the process technology roadmap. While Intel keeps talking about 5 nodes in 4 years, if Lunar Lake is 18A, then essentially there are 4 nodes left in about 18 months.

Analysis (tech)

With 4 nodes in 18 months, Intel is set for an almost miraculous transformation in what is in semiconductor terms an unprecedently short time. This ultimately marks the core investment thesis.

The point here is the same as with the Meteor Lake ramp. People keep talking about how behind Intel is etc., but (any delays notwithstanding, but for the last nearly three years there haven’t been) in exactly one year from now 20A will be in volume production, beating TSMC (TSM) to PowerVia and RIbbonFET by 2.5 and 1.5 years respectively. As the quote goes: “To see what is in front of one’s nose needs a constant struggle.” ― George Orwell

Perhaps an analogy is in order. If in a soccer match one team (read: Intel) is 3-0 ahead on the other one (TSMC), then it is fair to say that the first team is in pole position to win the match. As such, when people say TSMC is ahead, they are basically referring to previous matches (read: N7, N5, N3), not the current one (N2).

We also have significant milestones planned in Q2 for Intel 3, Intel 20A and Intel 18A, and look forward to providing more details as we execute.

As case in point, and besides the Meteor Lake ramp this was the second major item from the earnings call, Intel was asked if (besides performance per watt) it could also provide a roadmap for when Intel would reach cost parity. To which Pat Gelsinger replied that this node was (also) 18A, referring to both cost and area (transistor density).

Although this transistor density part actually confirms my prior analysis that 18A would also achieve transistor density leadership, after the BK and Mark Bohr/Bill Holt era Intel had become pretty quiet about transistor density leadership after losing it. So this was the first time Intel has commented about transistor density. Given TSMC’s snail’s pace of improving density at N3 and N2 this wasn’t a surprise, but an official confirmation again makes it a bit more tangible.

Guidance

Revenue will be slightly up sequentially. Gross margin will be flat at best, but there will be a slight improvement in EPS. Intel expects that the bulk of the CCG inventory digestion will be done by the end of Q2, saying that it undershipped the sell-through TAM by around 20% in Q2. Hence, Intel expects further sequential improvements in Q3 and Q4, but also seemed more cautious than analyst estimates when questioned about those. As mentioned, FCF was guided to return positive in the second half.

Earnings call notes

These can be found here.

Investor Takeaway

It is not sure if the stock reaction was due to the beat or the guidance (which also beat), but in any case the stock is (apparently, as there could be further dips) starting to look forward to the sequential improvements that are looming going forward.

Essentially, with Sapphire Rapids launched, Intel 4 ramping and the absolute Q1 bottom in terms of revenue, GAAP profitability, gross margin and free cash flow, the turnaround starts now. Luckily, it will be a blisteringly fast one, with 4 nodes (including two traditional ones) ramping in 18 months, which is completely unprecedented. The turnaround will be even more so apparent as TSMC is currently in the midst of its own execution issues, moving at a snail’s pace from N5 to N3 to N2 that is even slower than Intel’s 5-year cadence (3-year delay) of 10nm.

In the near-term though, Intel is not forecasting a V-shaped recovery to the kind of financials last seen Q1’23, although there should be gradual improvements throughout the year, weighted towards the second half. So while the market may finally start to look forward a bit, there could be further dips. But in the grand scheme of things, the stock remains well down from its previous $50+ level, making for a solid opportunity.

Perhaps a rule of thumb kind of forecast could be that the stock price may tend to follow the gross margin. Although there is a more probable chance it will lag the gross margin, as Intel is expecting margins to rise well into the 40s by the end of the year, which would be a bold stock prediction. More realistically, the financial/stock returns will follow only after the tech turnaround over the next 18 months.

Read the full article here