In a matter of days, multiple analysts have come out to downgrade SoFi Technologies (NASDAQ:SOFI) in a manner similar to how penguins act. Though the stock doubled in roughly a month, SoFi only returned to the price where the stock came public via a SPAC years ago. My investment thesis remains ultra-Bullish on SoFi, especially after this dip back to $8.50 following multiple downgrades.

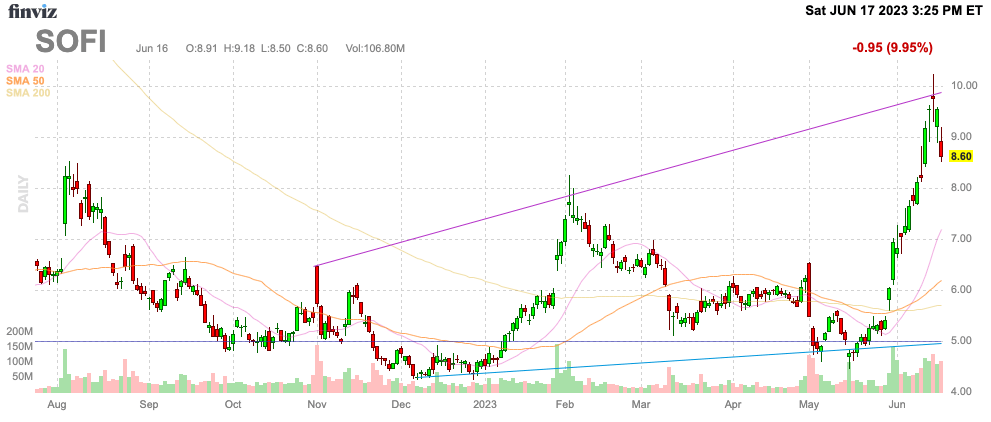

Source: Finviz

Penguin Parade

SoFi closed the going public transaction back in late 2020 with a SPAC deal at $10. The analyst downgrades hit after the stock had doubled off the recent lows around $5, but SoFi had only rallied back to $10.

In essence, 3 analysts downgraded the stock after a rally only back to the original SPAC price announced all the way back in early 2020.

- BofA cut the stock to Neutral, but hiked the price target to $10.00 from $9.50.

- Piper Sandler cut the stock to Neutral, but hiked the price target to $8.00 from $6.50.

- Oppenheimer cut the stock to Perform with a price target of $8.00.

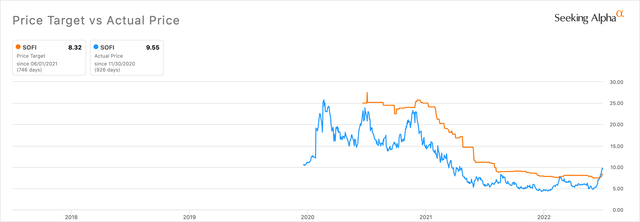

In all of these cases, the analysts were generally more bullish on the stock with even Oppenheimer increasing the 2024 revenue target by $0.2 billion to $2.6 billion. The question is why analysts have price targets 20% below the original SPAC deal while the original price targets were up above $25.

Source: Seeking Alpha

The chart above highlights how analysts tend to follow the crowd. Years ago, CNBC would run clips of penguins falling into the ocean following each other when more than 3 analysts would downgrade a stock at the same time.

The impetus for the rally was the end of the student debt moratorium by the end of August due to the debt ceiling deal. The odd part here is that SoFi grew 43% in the last quarter while student debt refinancing was weak and all signs pointed to the end of the moratorium on repaying student loans for the typical SoFi customer by October anyway.

Execution Still Matters

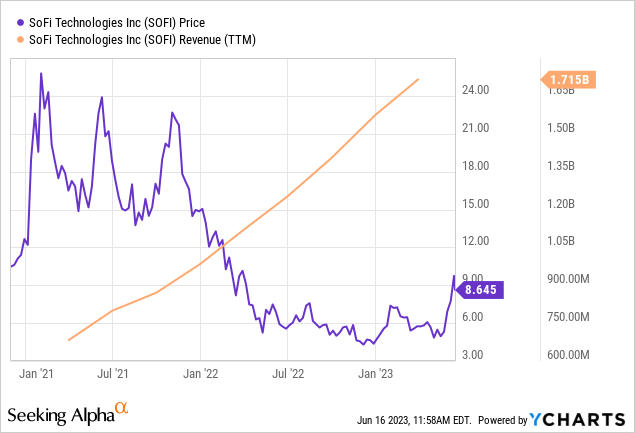

Since going public, SoFi has done nothing but execute. The fintech has grown revenues from below $0.7 billion when going public to $1.7 billion now. As mentioned above, one of the analysts is targeting 2024 revenues up at $2.6 billion.

The consensus analysts’ estimates are for SoFi to hit $2.45 billion in 2024 sales for another year of growth topping 20%. The story on this stock is more about profits, somewhat odd considering the growth trajectory.

The fintech long promoted strong adjusted EBITDA (documented as similar to adjusted profits) margins. The student loan moratorium over the last few years hurt margins due to this being their most mature product line while SoFi also decided to invest more in financial services products to expand the business.

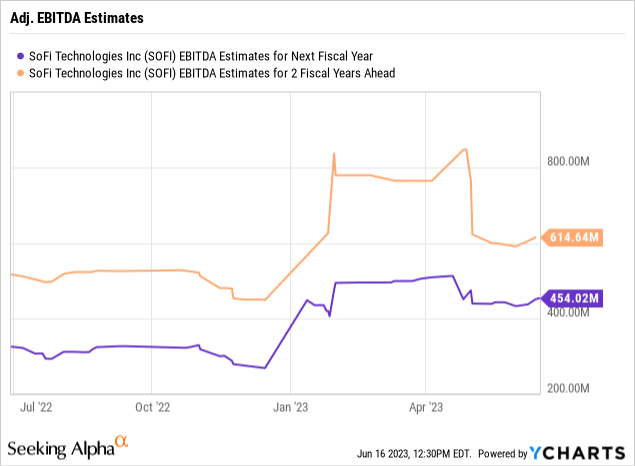

Still, SoFi has long promoted massive profits and the company is only starting to see those numbers in the actual results. The company has guided to $278 million in adjusted EBITDA profits this year with consensus targets for $454 million next year for 18% margins.

This year SoFi is nearly doubling adjusted EBITDA profits while the company is forecast to grow the profit metric by another 60% next year. The odd part of all these downgrades is to cut the stock to a Neutral rating just as the stock started trading close to 20x forward EBITDA targets.

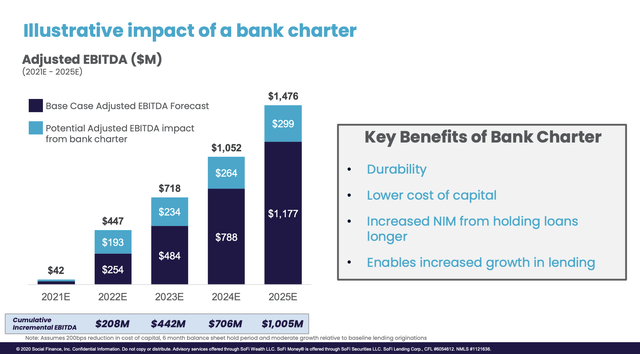

Going back to the original SPAC deal, SoFi guided to long-term adjusted EBITDA margins approaching 45% with a bank charter. The fintech got the charter back in early 2022 and has added $10 billion in deposits to fund the bank.

Source: SoFi January 2021 presentation

The big margin issue was the removal of their prime student loan refinancing business during the process. The higher interest rates will reduce the current refinancing levels, but SoFi will be firing on all cylinders heading into 2024.

The big question is how quickly the fintech can return to the adjusted EBITDA targets with 2024 revenue targets nearly matching the original SPAC goal of $2.8 billion. The current analyst EBITDA target is more than 50% below where SoFi set the goal suggesting analysts are probably too pessimistic.

SoFi has forecast 45% incremental EBITDA margins, but the big change over the period from 2022 to 2025 was the contribution margin from Financial Services turning from negative to a 47% margin, actually topping the Lending segment.

In essence, our view is that SoFi is likely to boost adjusted EBITDA targets far above analyst targets for 2024 with the student loan business full speed ahead. The stock now trades below 20x forward adjusted EBITDA growth despite far higher growth rates.

Takeaway

The key investor takeaway is that SoFi is far too cheap here for analyst downgrades. The market is too busy looking backwards to where the stock recently traded while not looking forward to the strong profit profile of the fintech.

Read the full article here