Introduction

As a dividend growth investor, I seek investment opportunities in income-producing assets, mainly stocks. I usually add to existing positions when I find them attractive. I also take advantage of market volatility by starting new positions to diversify my holdings and increase my dividend income for less capital.

Waste Management (NYSE:WM) is an interesting company to analyze. The company is an industrial company with factories and complex logistics, yet its business is not as cyclical as most industrial companies. The company solves a significant challenge as people create growing amounts of waste.

I will analyze Waste Management using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Waste Management provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States and Canada. It offers collection services, including picking up and transporting waste and recyclable materials from where it was generated to a transfer station, material recovery facility (MRF), or disposal site, and owns and operates transfer stations, as well as owns, develops, and operates landfill facilities that produce landfill gas used as renewable natural gas for generating electricity.

Fundamentals

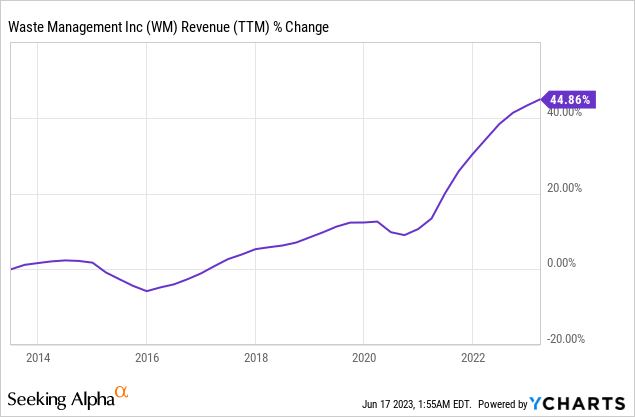

The revenues of Waste Management have increased by 45% over the last decade. The reasons for the increase in sales were price increases, service expansion to more clients, and the company offering additional services like renewable energy. In the future, as seen on Seeking Alpha, the analyst consensus expects Waste Management to keep growing sales at an annual rate of ~6% in the medium term.

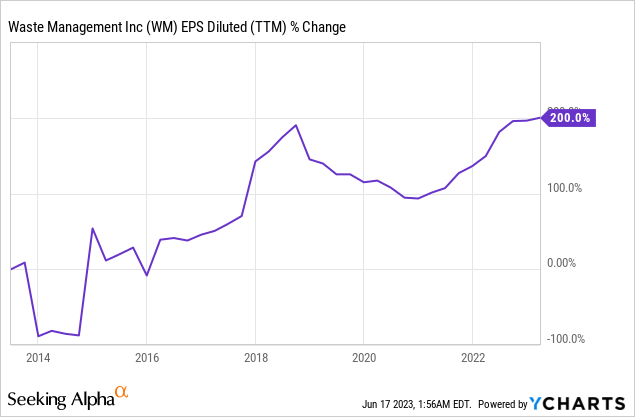

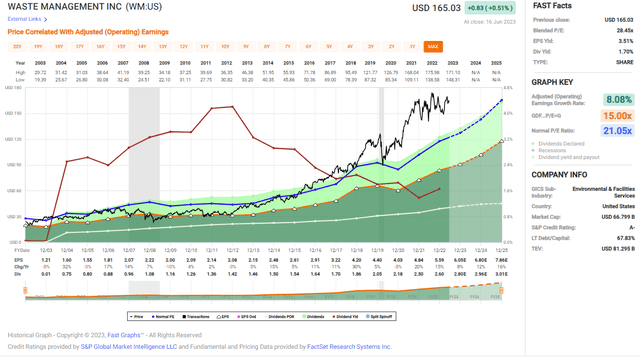

The EPS (earnings per share) over the same period has increased by 200%, which means it tripled in just ten years. EPS growth has been much faster as the company grew sales, increased prices, and cut costs to improve margins and buy back stocks. The company keeps improving solid waste margins through disciplined pricing and cost controls to keep increasing the margins. In the future, as seen on Seeking Alpha, the analyst consensus expects Waste Management to keep growing EPS at an annual rate of ~11% in the medium term.

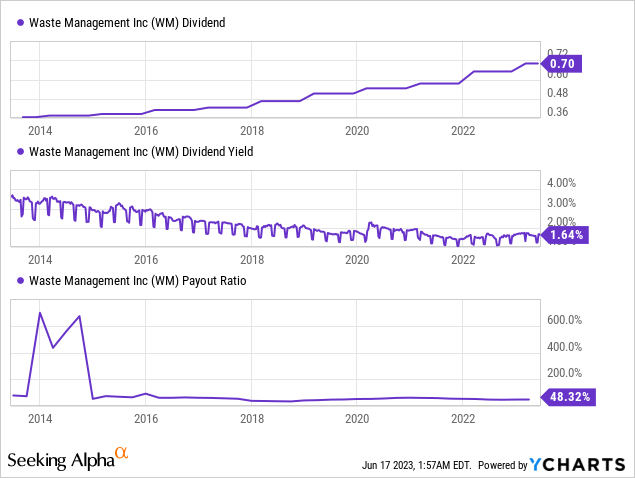

The dividend is one of the company’s crown jewels. It has been increasing the dividend steadily for 19 years and has not reduced the dividend for additional four years prior. The dividend payment may not look extremely attractive with the yield at 1.64%, but it is likely safe. The current payout ratio leaves enough room even if the EPS decline. Looking forward, investors should expect the company to keep growing its dividend at around 11% annually, which aligns with the company’s forecasted EPS growth rate.

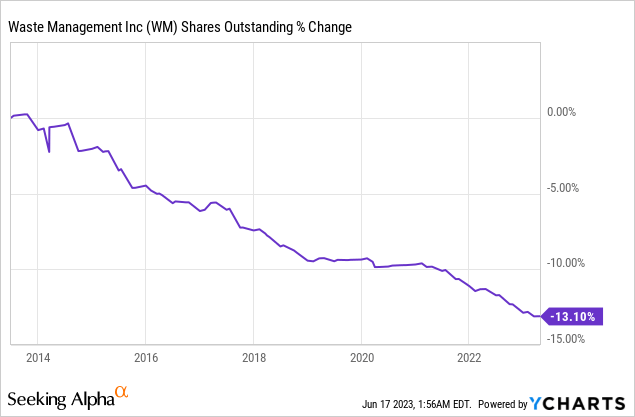

In addition to the dividend, the company returns capital to shareholders via buybacks. These share repurchase plans support EPS growth by lowering the number of outstanding shares. Over the last decade, the number of shares decreased by 13%. Waste Management is buying back shares, yet it doesn’t do it aggressively. It makes sense, as aggressive buybacks should be used when the shares are highly undervalued.

Valuation

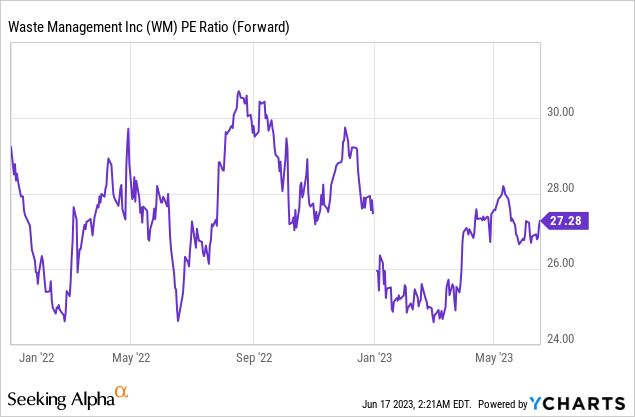

The company’s P/E (price to earnings) stands at 27 when considering the 2023 EPS forecast. Paying more than 27 times earnings for a company with an 11-12% growth rate seems high. While the current valuation aligns with the average valuation over the last twelve months, it is still hard to justify such a premium. It is extremely hard to justify the premium when interest rates are higher and risk-free interest is around 5%.

The graph below from Fast Graphs emphasizes how the company has traded for a premium since 2018. The average P/E ratio of the company over the last two decades was 21. It is still high, but not nearly as high as the current P/E of 27. The company is forecasted to grow faster than it did in the past twenty years, but I believe it is still insufficient to justify the premium. The company is trading for a valuation higher than tech companies like Alphabet and Meta.

Fast Graphs

Opportunities

The first opportunity for Waste Management is that the company is fully integrated. It helps the company in two significant ways. First, the company can enjoy a better cost structure as each chain within the value chain supports the other chains. It has fewer expenses and one headquarters to coordinate the activities. Moreover, it makes the company stickier than some of its peers, as it is harder to replace an integrated company. Replacing it means finding another fully integrated option or managing multiple companies to do the same job.

Other two opportunities for Waste Management revolve around sustainability and environmental trend as more states and municipalities show a growing interest in it. Regarding renewable energy, Waste Management is investing in renewable natural gas power plants. It will take advantage of natural gas created in its landfills and turn it into electricity that it can sell back to the grid. It means that the company creates a new chain in the value chain.

Recycling is the second opportunity regarding the trend. The company realizes that people are trying to reduce waste and become more efficient. Therefore, Waste Management is investing in improving its recycling activity. The company invests money in building new materials recovery facilities, and it also invests in its automation. There are 43 planned new or automated facilities, and they are expected to add 2.8M incremental tons of recycled managed.

Risks

Competition and regulation are two main challenges that Waste Management is dealing with. When it comes to competition, the world of recycling, renewable energy, garbage disposal, etc, is very competitive. While not all companies are integrated, they can still offer some level of competition versus Waste Management. It is also highly regulated as most clients are cities, counties, and states. The company deals with hazardous materials and is under scrutiny by regulators and politicians. A change in the regulatory environment may increase costs and hurt the EPS.

Inflation is another risk for Waste Management, especially if it persists around the 4%-5% mark. Waste Management’s business requires significant investments in its workforce and machinery. Higher wages and higher prices of raw materials impact the company’s expenses. Suppose we continue to see substantial annual inflation. In that case, it will be harder for Waste Management to maintain its 17% operating margin, and we may see it decline more from the 18% it enjoyed in 2019.

The lack of margin of safety is a long-term risk for the investors in the company. The company trades for a high valuation, meaning any miss in its execution may send the stock down. When a company is priced for perfection, investors take a significant execution risk. Good results may not be enough to justify the valuation. If the company returns to its average valuation, it will be down 23% from the current price.

Conclusions

To conclude, Waste Management is a solid company on track to becoming a dividend aristocrat. The company has good fundamentals with the steady growth of its top and bottom lines, which drive dividend growth and share count reduction. The company has what I believe are several great growth opportunities and an integrated structure that both protects it from the competition and helps it capitalize on new opportunities such as renewables and recycling.

However, while the company has manageable risks, such as competition, inflation, and regulation, there is some uncertainty regarding the margin of safety. The current valuation leaves the company with no margin of safety, and it must execute flawlessly. This increases the level of uncertainty to a point where I am not comfortable, as even returning to average valuation will result in significant capital depreciation. This is why I believe that shares of Waste Management are a HOLD.

Read the full article here