Live Oak Bancshares (NYSE:LOB) operates as a bank holding company for Live Oak Banking Company; it was incorporated in 2008 and is headquartered in Wilmington, North Carolina. After an all-time high at $99.89 per share reached in late 2021, an endless decline began for this bank, and today it is trading about 75% lower: only $25.83 per share. What’s more, the banking crisis triggered by SVB’s bankruptcy has certainly not helped Live Oak to recover.

In this article I will show you my main concerns about this, and why I do not consider this bank a buy despite being undervalued based on its book value.

The picture of the situation

In my opinion there are a number of rather significant problems in this bank, which is why I would not invest in it. In any case, all the problems stemmed from one in particular: the cost of deposits.

As long as borrowing was possible at rates close to 0% it was easier to increase book value per share and net interest income, but now that situation has completely changed and Live Oak is having a hard time. Before the Fed Funds Rate skyrocketed, depositors were satisfied with receiving a negligible interest rate, but that is no longer possible. There are many alternatives in the money market whose yield is far higher than a deposit; therefore, Live Oak has been forced to offer a higher interest rate on deposits to retain its customers.

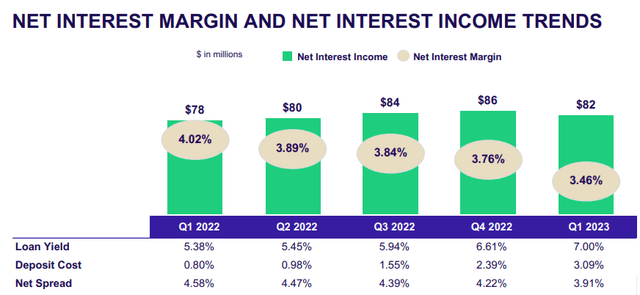

Live Oak Q1 2023

As can be seen from this image, in 12 months the cost of deposits increased from 0.80% to 3.09%, a huge increase that was not reflected proportionately in the loan yield. As a result, the collapse of the net interest margin was inevitable, and what is most worrisome is that this trend started as early as Q2 2022. Back then, the Fed Funds Rate was still low, yet Live Oak was already paying 0.98% on deposits, which is a sign that its bargaining power is rather limited. Its customers are mainly attracted by the yield on deposits, and this can be detrimental in a macroeconomic environment of rising rates.

According to Fed estimates, there could be two more hikes in the second half of 2023, and almost certainly no cuts before 2024. This means that Live Oak is likely to suffer for several more months, if not years. Two more hikes would raise money market rates even more, thereby raising the cost of its deposits and reducing the net interest margin. Indeed, the guidance for 2023 is not rosy according to the words of CFO William Losch:

So the margin will be down in the second quarter because the 50 basis point increase we made in mid-March is going to have an outsized impact in the second quarter. So second quarter NIM will be down. But in the second half, loan yields will start to flow through the balance sheet. Deposit costs will flatten is our expectation. And by fourth quarter, the margin will go back up towards the lower to middle part of that 3.50% to 3.75% range.

In short, according to management in the next quarter the net interest margin will be down about 20 basis points, but then toward the end of the year there will be a recovery due to the flat cost of deposits.

I hope so, but in my opinion there are 3 reasons why I doubt this guidance:

- The first is that we do not know how much and when the Fed will raise interest rates. There are supposedly two more hikes, but there could be more and we don’t know if there won’t be any at the end of the year. One thing we do know, however: it is highly unlikely that rates will be cut in 2023. So, I think the cost of deposits may increase even at the end of the year. This cannot be ruled out if inflation continues to be high; I am referring especially to core inflation.

- The second reason is that in the last quarter alone, the cost of deposits increased by 70 basis points, too much to believe that this growth will stop anytime soon.

- The third reason that leads me to doubt a recovering net interest margin at the end of the year is that the bank in order to get a higher yield on assets might make too many risky loans that would increase NPLs. In addition, it could dangerously increase its loan to deposit ratio.

At this complicated stage, I think it is worth investing in banks that have not achieved too much reduction in net interest margin, and are only recently struggling with the rising cost of deposits. Live Oak has already been showing signs of weakness for several quarters, which leads me to avoid investing in it.

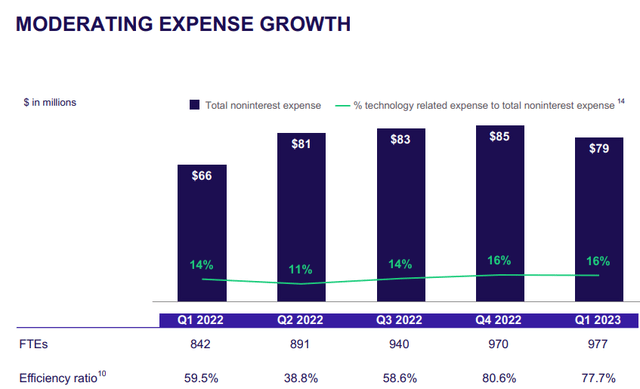

Live Oak Q1 2023

Finally, profitability problems are also plaguing the efficiency ratio, which is definitely deteriorating. A value of 77.7% implies mismanagement of overhead.

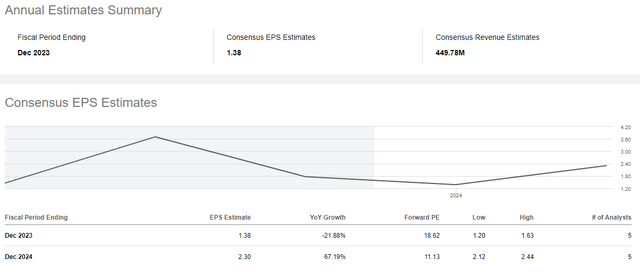

Seeking Alpha’s forecast

We have seen what management’s forecast is for the cost of deposits, but what do analysts expect for EPS?

Seeking Alpha

According to these estimates from Seeking Alpha, FY 2023 EPS is expected to be lower than FY 2022 by 38 basis points. In short, it will not be a rosy year going forward.

However, also in accordance with the CFO’s estimates, 2024 should be the year of recovery and EPS will be 54 basis points higher than 2022. However, EPS of $3.70 in 2021 will not be reached. Again, as before, I remain quite puzzled about the feasibility of these estimates.

The most significant negative consequences triggered by restrictive monetary policy do not occur when rates are raised, but when they are kept high for a long time. In 2024 we will be more than a year into a difficult macroeconomic environment, and we could be heading for a recession that would certainly not benefit banks. In short, to believe that 2024, the year when rates could be cut to revive the economy, is the year of recovery, I find rather unlikely. I could be wrong, but historically when interest rates are high and banks are reluctant to lend money, the economy has hardly fared well in the following months/years. In the event of a recession, EPS will disappoint expectations.

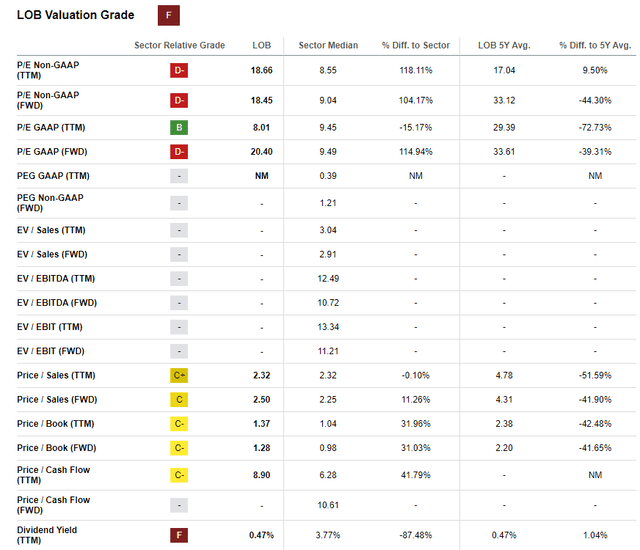

Valuation

So far I have set out my main concerns about this bank; however, overall I do not consider it a sell. The reason lies in the fact that, when analyzing the book value, Live Oak seems highly undervalued. This means that the slump suffered is unjustified considering the current level of equity.

The average price / book value ratio from the IPO to date has been 2.64x; multiplying this figure by the current book value per share of $18.58, the fair value amounts to $49.05 per share. In short, much more than the current price of $25 per share. However, there is an important point to mention. I tend to evaluate the average price / book value over a longer time frame, 10-15 years, because in this way the average ratio is influenced by multiple macroeconomic contexts that have occurred over the years. In this case, however, it is not possible since the earliest available data goes back to the IPO in July 2015. As a result, this assessment may be overly focused based on a historical context that does not correspond to the current one. Another valuation method that might give us some more insight into Live Oak’s valuation is to compare its current multiples with those of its competitors.

Seeking Alpha

From this point of view, Live Oak presents less than encouraging results. Except for GAAP P/E (TTM), in the other ratios it presents values above the industry median. Troubled EPS in the coming months certainly does not help, particularly in the case of GAAP P/E (FWD). In short, the problem is not the results achieved, but especially the results expected in the future. In my opinion, I think the strong undervaluation on a book value basis is partly offset by the disappointing ratios results.

Conclusion and final thoughts

Overall, Live Oak is a bank in difficulty because its funding sources are more expensive than its competitors. This is an important sign of weakness, but the stock may not necessarily continue to fall. The market may have already discounted a pessimistic scenario, certainly it has already discounted the declining net interest margin for Q2 2023. Personally, despite being undervalued on paper, I prefer to avoid it, partly because its past performance does not meet my investment criteria.

When I have to choose whether to invest in a bank, there are at least four conditions that must be met even before assessing whether it is undervalued or not:

- Long-term EPS must be growing, possibly with a net interest margin that also tends to improve or at least remain stable in difficult times such as the current one.

- Deposits must be of quality and, above all, must be cheap. This characteristic is typical of banks with bargaining power.

- Tangible Book Value per share must experience significant long-term growth.

- The dividend per share must be increasing over the long term and possibly the dividend yield must be above 3%.

At present, Live Oak reflects only the third characteristic, which by the way appears to be struggling in recent months.

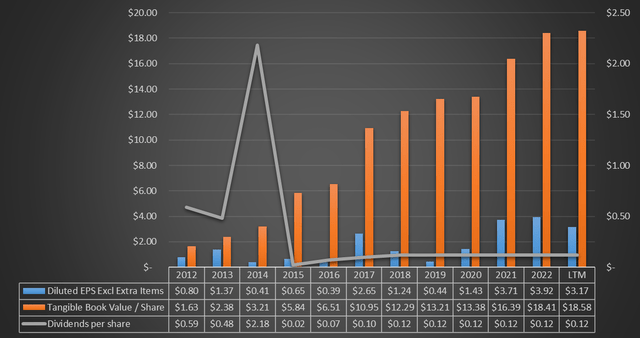

Seeking Alpha data

As can be seen, diluted EPS has never been consistent over the long term: there are good years and others definitely not. In addition, the dividend per share has been stagnant since 2018 and far from its 2014 high.

Finally, tangible book value per share deserves a separate discussion. On the one hand, its steady growth since 2012 cannot be denied; on the other hand, it is good to point out in what macroeconomic context it has occurred. Recalling the previous discussion, today it is no longer possible to think like 10 years ago when rates were close to 0%. All it took was one year of tight monetary policy to see tangible book value per share slow down dramatically. In my opinion, I would not be surprised to see it trending downward in the coming months and at that point the third condition would not be met either. Regarding deposits, we have seen how their cost is a major issue.

Read the full article here