Note:

I have covered Eagle Bulk Shipping Inc. (NYSE:EGLE) previously, so investors should view this as an update to my earlier article on the company.

Reflecting On A Poor Call

Three months ago, I advised investors to take advantage of the assumed buying opportunity in shares of Eagle Bulk Shipping Inc. or “Eagle” after the company reported fourth quarter earnings well below consensus estimates due to an unfortunate combination of weaker charter rates and record-high operating expenses.

Suffice to say, the idea hasn’t really played out as shares, even after some recent price appreciation, remain down by almost 20% from the time of my recommendation.

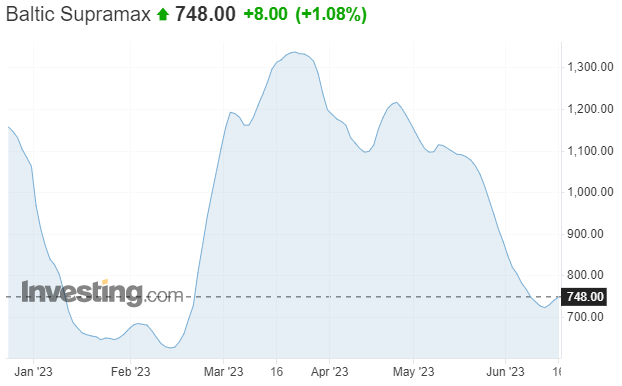

But with the Baltic Supramax Index (“BSI”) having decreased by more than 35% from the time of my recommendation, things could have been even worse:

Investing.com

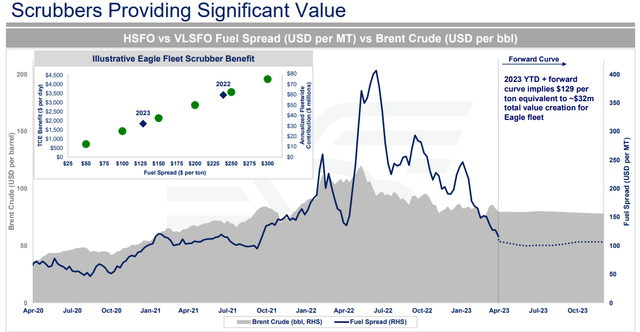

Scrubber-Fitted Fleet Tends To Outperform Market Averages

That said, thanks to the fact that virtually all vessels are scrubber-fitted, Eagle Bulk Shipping tends to outperform market averages quite meaningfully:

Company Presentation

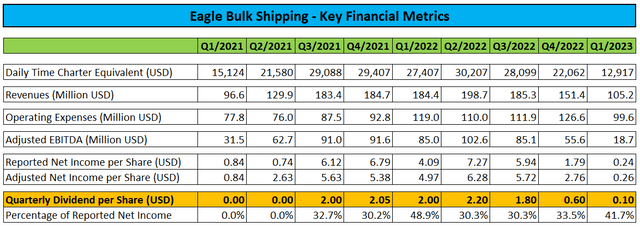

Seasonally Weak First Quarter Results

Last month, the company reported seasonally weak first quarter results with the average daily time charter equivalent (“TCE”) rate of $12,917 down more than 40% on a sequential basis.

Company Press Releases and Regulatory Filings

Please note that without a $3.3 million gain on the sale of a vessel, net income would have been negative.

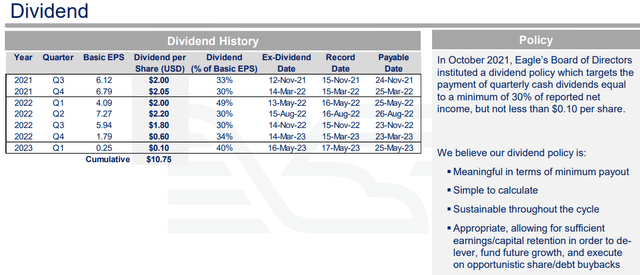

In accordance with the company’s dividend policy, Eagle Bulk Shipping only paid the minimum quarterly dividend of $0.10 per share:

Company Presentation

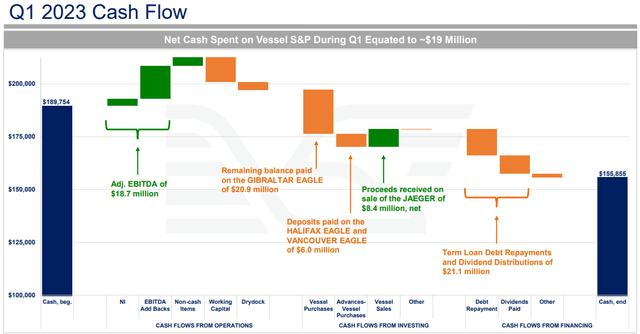

Cash and cash equivalents decreased by almost $34 million during the quarter due to substantially lower profitability, cash outflows related to vessel acquisitions, debt service obligations and dividend distributions:

Company Presentation

Strong Balance Sheet And Liquidity

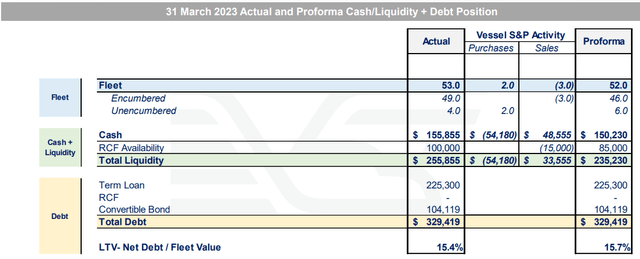

Eagle’s balance sheet and liquidity remained strong with net debt of just $173.5 million representing just 15.4% of the company’s fleet value.

Company Presentation

Second Quarter Outlook

As of May 4, 65% of available days for the second quarter had been fixed at a an average daily TCE rate of $16,030 but considering the precipitous decline in the BSI in recent weeks, the final number is likely to be lower.

Please note that the company’s second quarter results will include an up to $17 million gain from the recent sale of three non-scrubber fitted Ultramax vessels as disclosed in the company’s quarterly report on form 10-Q:

On April 13, 2023, the Company signed memorandums of agreement to sell the vessels Montauk Eagle, Newport Eagle and Sankaty Eagle (each, a 2011-built Supramax) for total consideration of $49.8 million. The Newport Eagle was delivered to the buyer on May 3, 2023. The Montauk Eagle and Sankaty Eagle are expected to be delivered to the buyer in the second quarter of 2023. The Company expects to record a gain of approximately $17.0 million for the year ending December 31, 2023 in connection with the sales of these vessels, subject to customary closing conditions and the timing of delivery of each vessel.

According to the company’s dividend policy, the company will be paying a quarterly cash distribution “equal to a minimum of 30% of net income“. Including the $17 million gain, net income for Q2 is likely to exceed $20 million. Under this scenario, I would expect the Eagle to distribute at least $0.50 per share for the second quarter.

Upsizing And Extension Of Existing Credit Facility

On May 17, the company announced a $175 million upsizing and extension of its existing credit facility:

The senior secured Amended Credit Facility (the “Facility”) totals $485 million, comprised of a $300 million term loan and a $185 million revolving credit facility, and bears an interest rate of Adjusted Term SOFR plus a margin of between 2.05% and 2.75%, depending on leverage and the Company meeting certain sustainability-linked criteria. The term loan will continue to amortize at a rate of $12.5 million per quarter, while starting in September, the availability under the revolving credit facility will reduce at a rate of $5.5 million per quarter. The Facility will mature on September 28, 2028.

As of today, $260 million remains available under the Facility, $75 million under the term loan, and $185 million under the revolving credit facility.

Eagle’s CEO, Gary Vogel, commented, “Following the recent acquisition of four modern Ultramax vessels, this financing has significantly increased our liquidity position, with cash and available borrowings now totaling over $400 million. Our enhanced liquidity profile positions us well to continue to take advantage of opportunities and create value for our stakeholders, including the potential retirement of our convertible bond which matures in 2024.”

2024 Convertible Note Maturity

Investors should note the reference being made to the company’s $104.1 million in convertible notes scheduled to mature in August 2024.

But given the current conversion price of $32.19 per share (subject to reduction for future dividends) and very limited trading activity in the convertible notes, the company would likely have to privately negotiate a potential repurchase with noteholders.

Last year, Eagle repurchased $10.0 million of the notes for $14.2 million in cash.

At current trading prices, the company would have to utilize an estimated $150 million in cash to avoid noteholders exercising their conversion rights next year.

Valuation

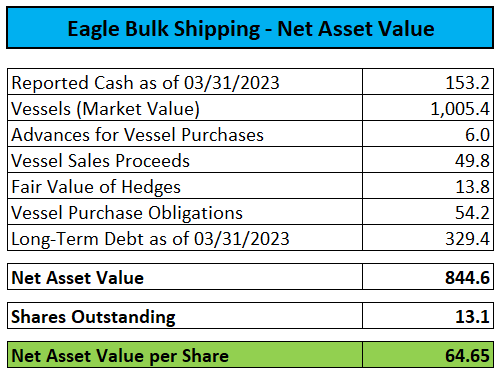

From a valuation perspective, Eagle Bulk Shipping is currently trading at an estimated 30% discount to net asset value (“NAV”):

Company Press Releases and Regulatory Filings / MarineTraffic.com

Danaos Corporation Accumulates 9.99% Stake

Apparently, the substantial discount has attracted Greece-based containership lessor Danaos Corporation (DAC) or “Danaos” which surprisingly revealed a 9.99% stake in Eagle Bulk Shipping after the close of Friday’s session thus putting back to work some of the proceeds from the sale of its stake in container liner ZIM Integrated Shipping (ZIM) last year.

That said, with Danaos trading at an even higher discount to estimated NAV than Eagle, Danaos shareholders would certainly prefer the company buying back its own shares more aggressively.

At least in my opinion, Danaos management might have picked an opportune time to get exposure to dry bulk shipping.

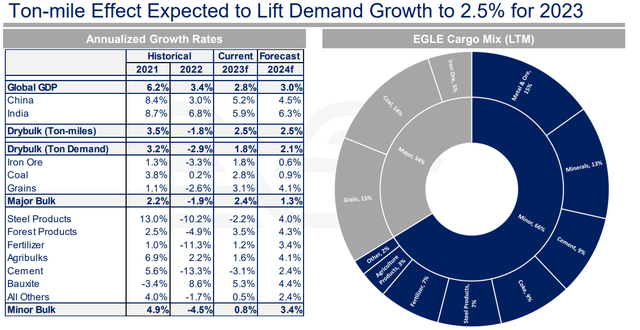

With very limited global fleet growth and expectations for increases in dry bulk demand, there’s decent potential for a recovery in charter rates going forward:

Company Presentation

Bottom Line

Apologies for a poorly-timed call on Eagle Bulk Shipping.

While current charter rates remain nothing to write home about, at least in my opinion, the company represents one of the best investments available in the dry bulk shipping segment based on its large fleet of scrubber-fitted vessels, strong balance sheet and liquidity as well as the absence of corporate governance issues.

With the Q2 dividend likely to surprise to the upside and Danaos Corporation having accumulated almost 1.4 million shares in recent months, investors should consider to initiate or add to existing positions.

Read the full article here