Vanguard Short-Term Bond Index Fund ETF (NYSEARCA:BSV) tracks the Bloomberg U.S. 1–5 Year Government/Credit Float Adjusted Index. BSV holds both corporate and treasury investment-grade bonds. This ETF also has a 30-day SEC yield of about 4.6%. BSV’s yield is lower than some practically zero-risk assets. Buying BSV over ultra-short treasuries is adding risk to your portfolio in return for a lower yield. Even if someone is investing for capital appreciation instead of yields, there are better options. Because of this, I rate BSV a Sell.

Holdings

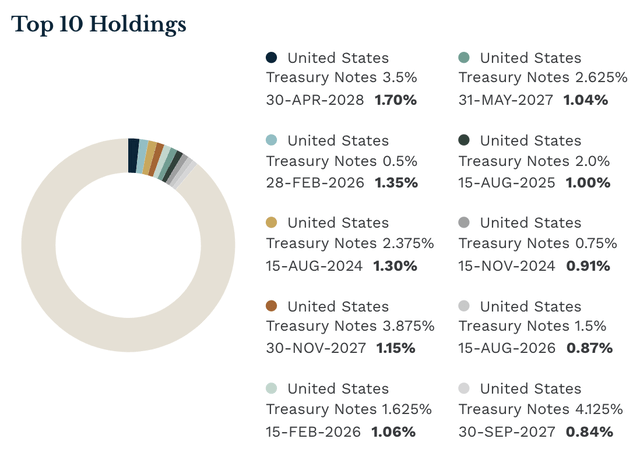

BSV holds 2667 corporate and treasury investment-grade bonds with maturities dates between 1-5 years away. BSV’s top 10 holdings make up about 11% of the fund.

BSV’s top 10 holdings (ETF.com)

Considering that this ETF has over two and a half thousand holdings, this ETF is slightly skewed to the top, but BSV still offers good diversification. BSV also holds about 67% of its holding in US treasuries and only 33% in corporate bonds.

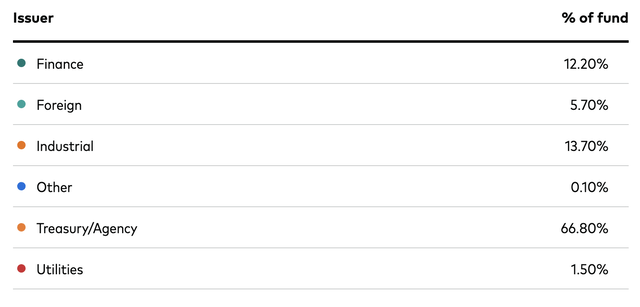

BSV’s holdings by issuer (vanguard.com)

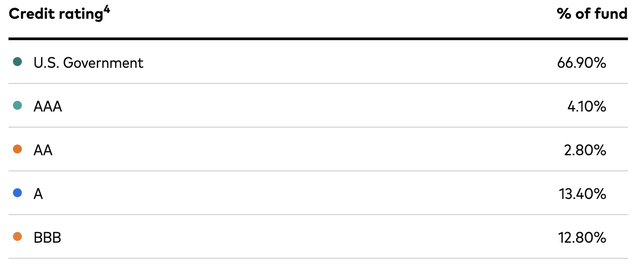

Investing mostly in treasuries reduces the overall volatility and yield. Outside of treasuries, BSV holds investment-grade corporate bonds. Most of the holdings are A and BBB-rated bonds.

BSV’s holdings by credit rating (vanguard.com)

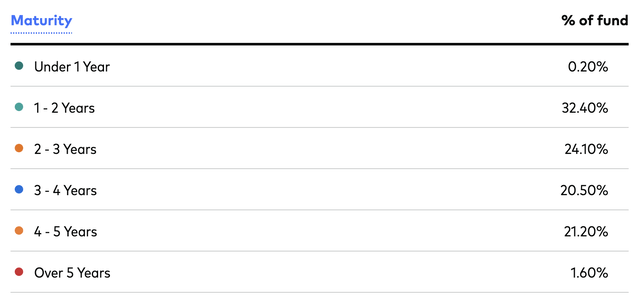

Finally, BSV holds bonds maturing in 1-5 years. BSV has a pretty even distribution between the bond maturities, with a slight lean toward 1-2 year bonds.

BSV’s holdings by maturity (vanguard.com)

Because BSV holds short-term bonds, the volatility and risk are low. When there is a lower risk, the yield tends to be lower. Also, because two-thirds of BSV is in treasuries, which are safer than corporate bonds, the risk of the ETF further decreases, also causing the yield to be lower. This lower yield is my main issue with BSV.

Where BSV falls short

What I look for in an investment is a good risk-reward ratio. BSV has higher risk and lower yield than some of its peers, specifically SGOV and BIL. SGOV and BIL are ultra-short-term and ultra-safe treasury bond ETFs. They are currently yielding about 5.1% and 4.9% respectively.

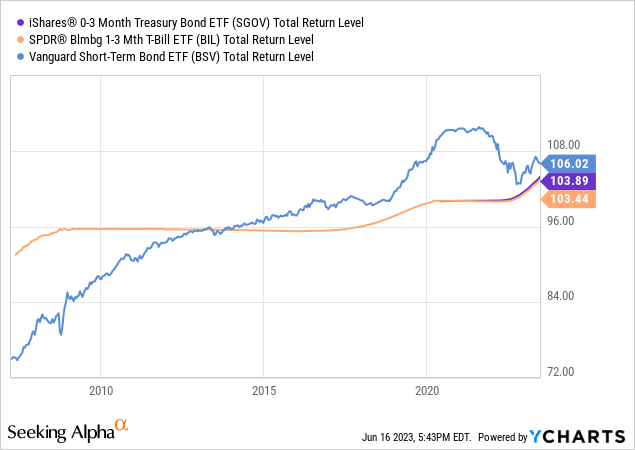

The chart above shows the total return of SGOV, BIL, and BSV. As the chart shows, compared to SGOV and BIL, BSV has much higher volatility. Currently, BSV has more risk, and in return, it comes with a lower yield. This is not a fair trade-off in my opinion.

Fed Chairman Powell also said that there will likely be two more rate hikes in 2023. As rates go up, the price of bonds goes down. Because SGOV and BIL’s holdings are ultra-short-term bonds, they have less price movement, whereas BSV’s price will depreciate. So not only does BSV have a lower yield, but it also is likely to depreciate.

Even BSV’s strengths fall short

BSV’s price sensitivity towards interest rates can work in its favor in some situations. When rates fall, the price of BSV will appreciate. This makes BSV a good candidate for a low-risk investment that also has appreciation potential. I just don’t think that any capital appreciation from falling rates will happen any time soon.

After this week’s Fed meeting, we now have more insight into what will likely happen to interest rates in the near future. There will likely be 2 more rate increases, followed by 2 more rate increases, with any cuts not coming until 2025. Once we get closer to these rate cuts, the capital appreciation aspect of BSV gets more enticing, but until then, it’s just a higher-risk, lower-yield asset.

Even when we have already had the two predicted rate hikes, there are better options for capital appreciation, specifically Vanguard’s intermediate corporate bond ETF, VCIT. This ETF offers a current yield of about 5.4% and has a better chance of capital appreciation than BSV because of its longer maturities. Although investing in VCIT is riskier, I think the risk is justified by the higher yield as well as the higher chance of capital appreciation.

Conclusion

BSV offers exposure to short-term treasury and corporate bonds. Although this ETF is riskier, it also has a lower yield than ultra-safe assets. I think taking on more risk in return for a lower yield isn’t worth it in the current circumstances. Although BSV has some capital precipitation potential, it is not likely to happen before 2025. Because of all this, I rate BSV a Sell.

Read the full article here