Strategy

Launched by State Street Global Advisors, Inc. and managed by SSGA Funds Management, Inc., the SPDR Dow Jones REIT ETF (NYSEARCA:RWR) invests in stocks of companies in the real estate space. Incepted in 2001, it is among the oldest real estate ETFs on the market, investing in diverse, market-cap weighted REITs in the United States. The fund invests in both growth and value stocks across diverse market capitalizations, and it seeks to track the performance of the Dow Jones U.S. Select REIT Index using a representative sampling technique. The index is rebalanced on a quarterly basis.

Holding Analysis

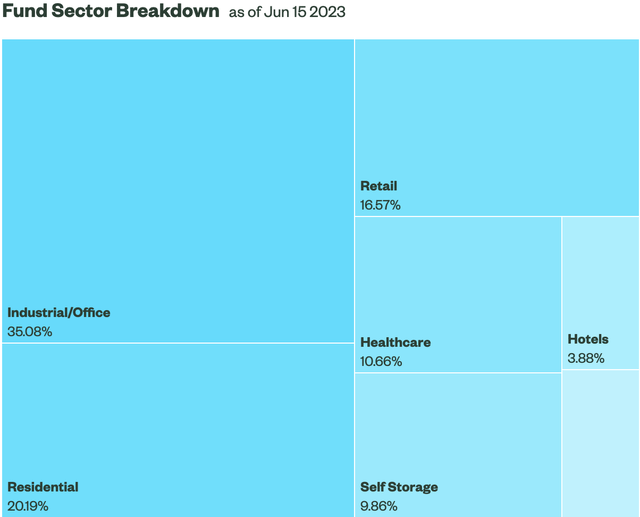

Within the real estate space, RWR does not focus on a specialized REIT category but places more emphasis on the quintessential real estate sub-sectors: commercial and residential REITs. Within its top 10 holdings, RWR assigns significantly more weight to the top 2 holdings, at 12% and 8% respectively. The weights of the rest of the top 10 holdings range from 2% to 4%. The fund invests in 114 stocks and holds nearly 50% of the portfolio in its top 10 holdings. While RWR has a predominant focus on the Industrial/Office and Residential sub-sectors, the fund also invests in the retail, healthcare, self-storage, and hotels spaces. A comprehensive distribution of the fund’s sector breakdown can be seen below.

SSGA Seeking Alpha

Stability in Yield and Liquidity

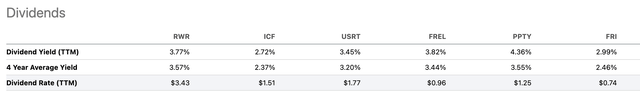

One of RWR’s key strengths is its relatively strong dividend yield and its steady dividend growth rate. The fund currently has a dividend yield of 3.77%, which is substantially higher than the median of all ETFs at 2.20%. If we compare RWR’s dividends to those of its peer competitors, RWR dividends are still higher in most other metrics as well. Its current dividend rate is $3.43, which is also significantly higher than those of its peers. The fund also has a 4-year average yield of 3.57%, which is only slightly lower than its current yield but still indicates its ability to sustain its yield over a long period of time. The highest contender is USRT, with a yield of $1.77, which is nearly half of that of RWR. RWR’s dividend growth rate is also quite attractive. It has a 5-year CAGR of 4.33% and a 10-year CAGR of 4.51%. Its dividends and dividend growth rate speak strongly to the fund’s stability over the long term.

Seeking Alpha

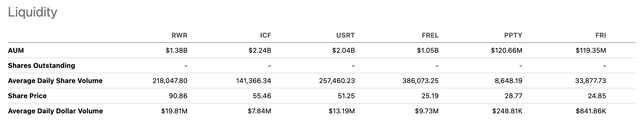

In addition to its attractive dividends, RWR also excels in its liquidity. RWR currently has an AUM of $1.38 billion, representing the 3rd largest fund within this group. Yet, RWR has the highest liquidity, with an average daily dollar volume at nearly $20 million. However, RWR’s average daily share volume is not the highest among its peers, but its high share price makes up for this. Ultimately, the fund’s attractive liquidity adds to its stability as investors can buy and sell shares without significantly impacting the fund’s price.

Seeking Alpha

Performance Analysis

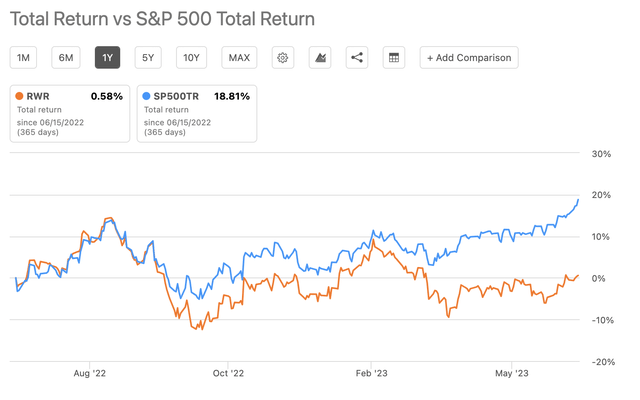

While the fund’s stability is clearly demonstrated through its attractive dividends and liquidity, its past performance doesn’t necessarily contend with the same level of consistency. In the latter half of 2022, RWR’s returns largely mimicked that of the S&P 500, but there was a slight divergence towards the end of the year. From the onset of 2023, the performance gap between RWR and the S&P 500 widened significantly. Currently, the fund is trailing the S&P 500 by nearly 20% in its total return rate.

Seeking Alpha

From a 5-year standpoint, RWR has shown very little growth, as it is only up by 0.22%. The fund experienced a large setback in 2020 as a result of the pandemic and has shown relatively steady growth following the drop. However, this growth is still relatively slow, and as of the beginning of 2022, the fund has experienced a consistent downturn.

Seeking Alpha

Why I’m Bullish on REITs

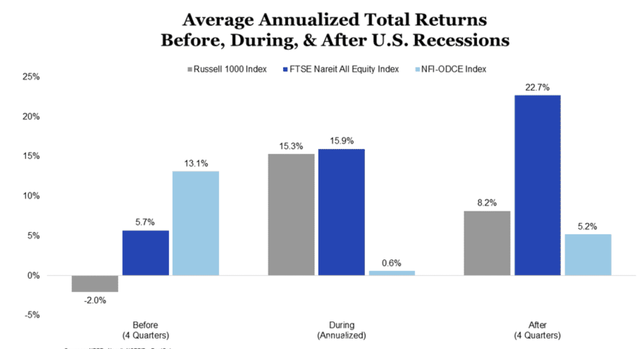

Despite the fund’s slow growth throughout the years, I remain quite bullish on REITs and optimistic in their ability to navigate economic and market uncertainties in 2023. Overall, REITs have generally outperformed both private real estate and the broader stock market during and after the last 6 recessions. If we look at the chart below, it is clear that REITs underperformed private real estate in the 4 quarters before a recession, but REITs outperform private real estate during a recession and 4 quarters after a recession. Furthermore, REITs outperformed their equity market counterparts before, during, and after a recession.

Nareit

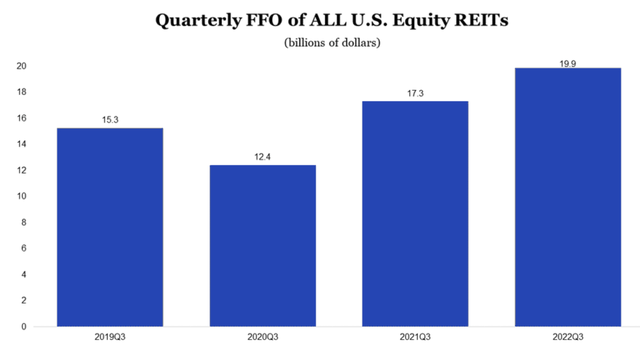

REITs also have demonstrated resilience from an operational perspective despite economic headwinds and lower valuations. From 2020 to 2022, REITs’ funds from operations have steadily grown even in periods of economic uncertainty in 2021 and 2022, as shown in the chart below. I believe this growth should continue into an uncertain real estate market in 2023 and beyond.

Nareit

Threats to Commercial Real Estate

While I may be bullish on REITs throughout 2023 and beyond, I cannot say the same for the commercial real estate sector. With over 35% invested into this sector, I believe that these concerns are valid and have major implications for RWR. My biggest concerns for the sector include the increasing risks associated with rising interest rates and tightening monetary policies. Commercial real estate transaction volumes were down 65% year-over-year in the first quarter of 2023. Since March of 2022, the Federal Reserve has hiked interest rates at the fastest rate in four decades. This has ultimately led to higher borrowing costs, diminishing demand for real estate, and subsequently, causing real estate prices to fall in the past few months. Meanwhile, lenders also contend with challenging financing conditions as banks have grown more conservative in their lending practices following the collapse of Silicon Valley Bank and others in recent times.

Conclusion

RWR presents a certain level of stability with its solid dividend yield and liquidity. The fund stands out within the REIT market with higher dividends and liquidity than most other funds. However, its recent performance paints a less consistent picture, as the fund trails the S&P 500 by almost 20% in 2023. The fund invests a substantial portion of its portfolio in commercial real estate, a sector that faces potential risks from rising interest rates and tighter monetary and lending policies. Despite this, I remain quite bullish on the performance of REITs in times of economic uncertainty, given their historical resilience. My ultimate rating for RWR is Hold, but this rating is likely to change if the real estate market rebounds in the near term.

Read the full article here