Granite Ridge Resources, Inc. (NYSE:GRNT) appears to be looking to bring more visibility to its assets by joining the Russell 3000 Index and simplifying its equity structure. These initiatives could bring liquidity to the exchange and enhance the valuation, which appears considerably low. Taking into account the team running Granite Ridge, the diversified portfolio of wells in highly productive areas, and recent increase in the expected 2023 production, GRNT appears to be a stock to follow carefully, as the stock price could trend higher.

Granite Ridge

Granite Ridge is a company specializing in large-scale oil and gas exploration and production, but with a non-operating strategy. Its focus is on owning a diversified portfolio of wells and land in highly productive areas, such as the Permian and other unconventional basins in the United States.

Granite Ridge did not choose to execute an IPO, which certain investors may not appreciate. The company executed a reverse recapitalization, which gave Granite access to the financial markets.

On October 24, 2022, the Business Combination closed and was accounted for as a reverse recapitalization. Source: 10-Q

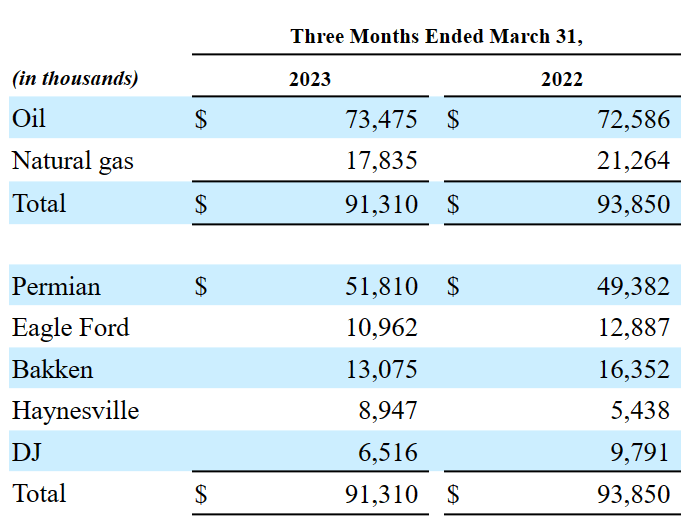

As a result of the previous transaction, now investors can buy equity from a company that owns assets in different basins in the United States, and reports quarterly sales of close to $91 million from oil sales and natural gas.

Source: 10-Q

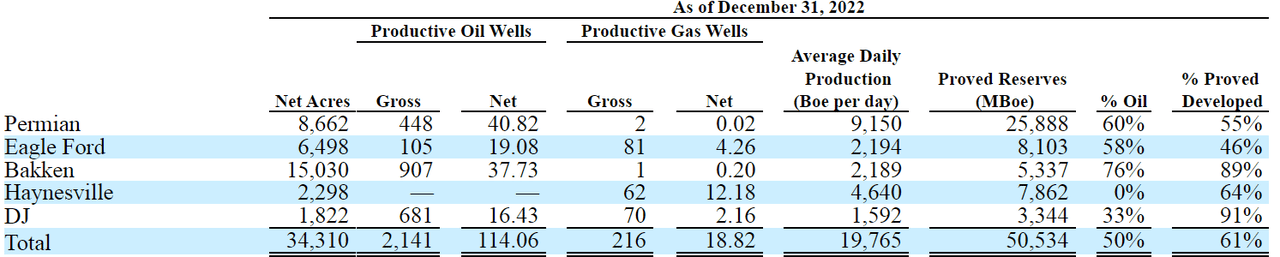

As of December 31, 2022, the company reported 34 million net acres with proved reserves of 50 MBoe. We are talking about an average daily production of close to 19.76k Boe per day. These are assets that will most likely receive fair valuation as soon as more investors assess them.

Source: 10-k

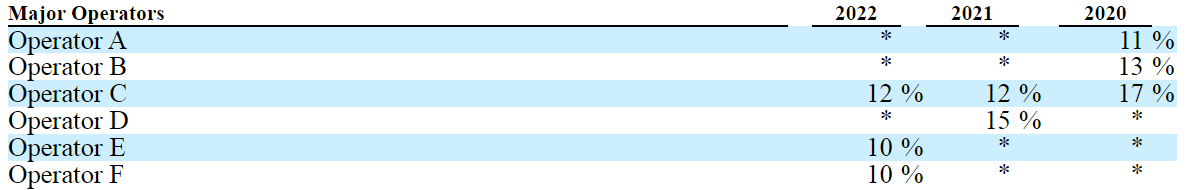

The company is also working with a number of operators, which I appreciate quite a bit. In my view, Granite will be able to negotiate beneficial operating conditions because management can talk to many third parties.

Source: 10-k

The company relies on marketing and selling its output through operating partners, which range from large publicly traded companies to privately owned companies. The sale of oil is carried out at prices linked to spot markets, while the sale of natural gas is carried out through short-term contracts with prices based on indexes or daily prices.

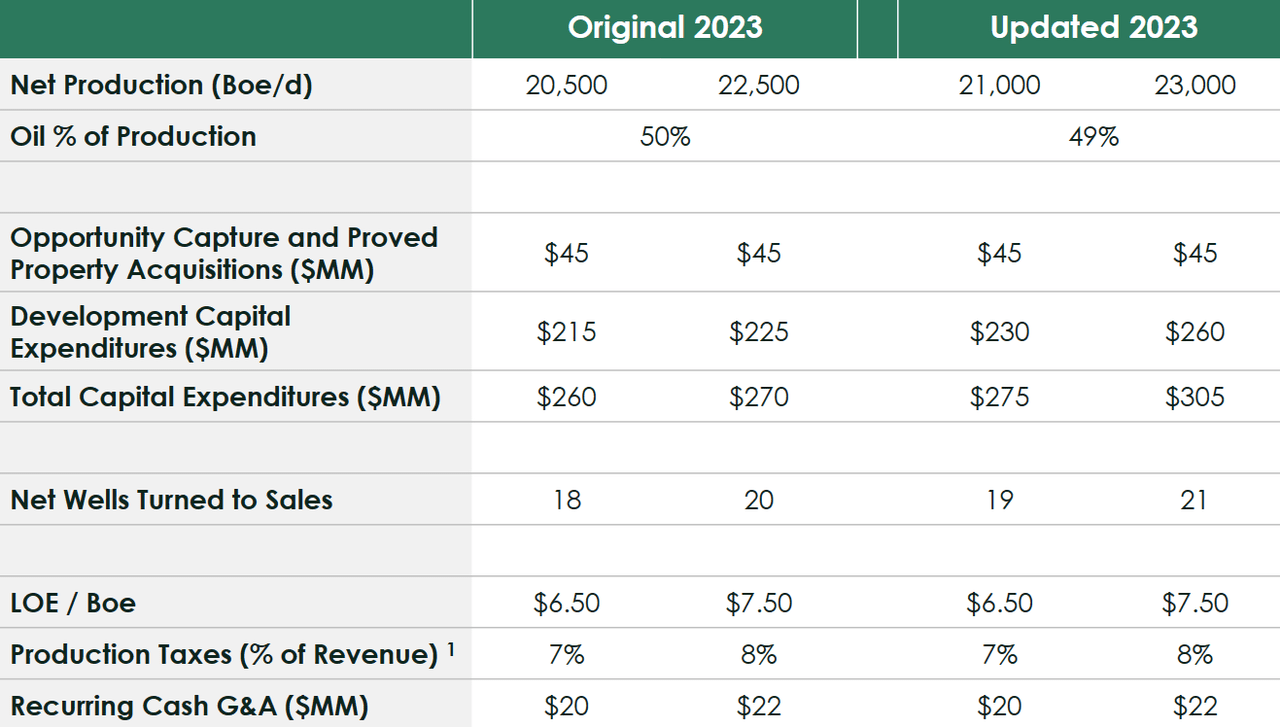

With that about the business model, I believe that the guidance given for 2023 is worth mentioning, which includes 21k-23k Boe/d, recurring cash of $20-$22 million, and capex close to $275-$305 million. The new numbers recently delivered appear to be a bit better than those given in previous quarters.

Source: Corporate Presentation

Financial Position

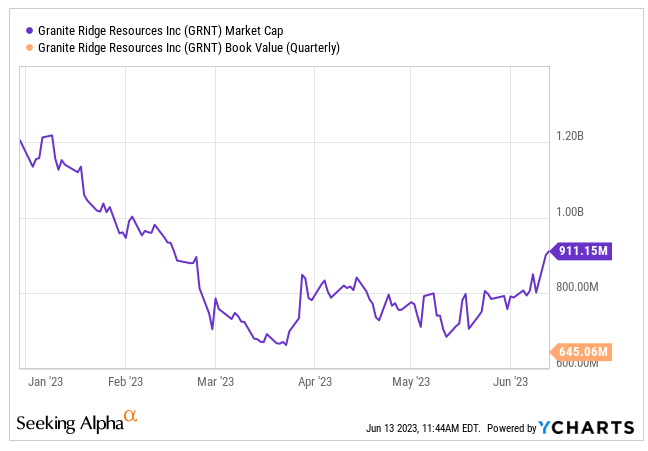

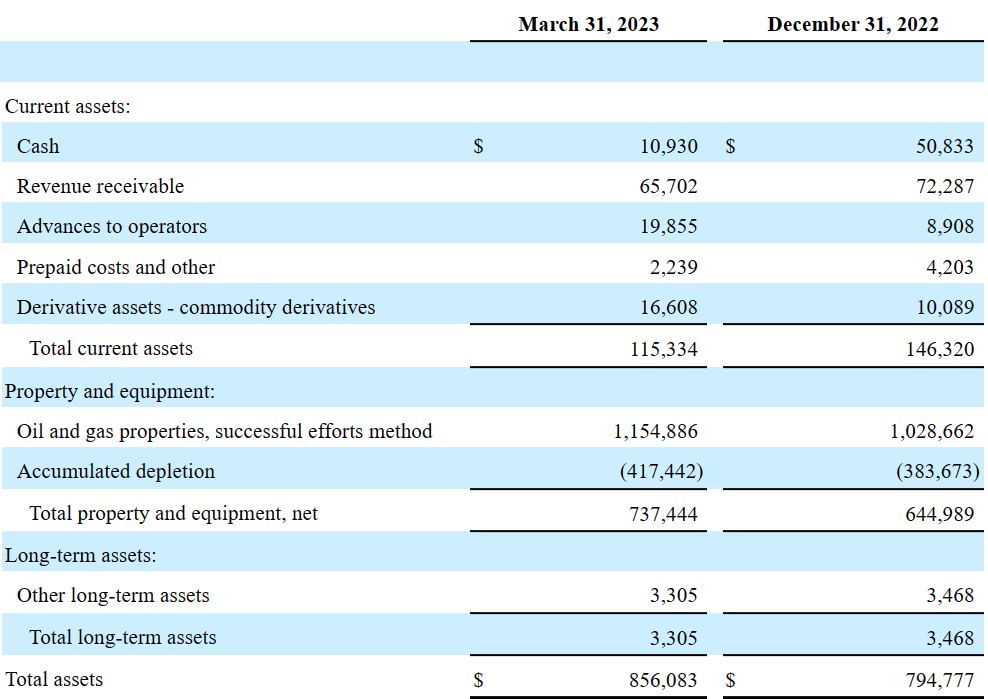

I believe that the balance sheet shows a beneficial image about the financial situation of Granite. The company reports a large amount of assets as compared to the total amount of liabilities and a massive amount of oil and gas properties worth close to $1.15 billion. The amount of oil and gas properties appears to be worth more than the current market capitalization, and the book value appears not far from the current equity valuation. With this in mind, I believe that the balance sheet shows that there exists a certain level of undervaluation.

Source: Ycharts

More in particular, as of March 31, 2023, the company reported cash worth $10 million, revenue receivable close to $65 million, advances to operators worth $19 million, and derivative assets of about $16 million. Total current assets are equal to $115 million.

With the oil and gas properties, total property and equipment, net stands at close to $737 million, with total assets of $856 million. The asset/liability ratio stands at close to 4x.

Source: 10-Q

The list of liabilities includes accrued expenses worth $69 million, long-term debt of $25 million, common stock warrants close to $6 million, and total liabilities of about $211 million. Considering the expected FCF and the total amount of oil and gas properties, I believe that most investors would not be worried about the total amount of debt and obligations.

Source: 10-Q

DCF Model

Granite Ridge invests in a smaller portion of a larger number of wells drilled by proven operators, allowing it to reduce overhead and long-term drilling obligations. The company reinvests the cash flow generated by its wells in the development of new projects, the acquisition of additional rights, and the consolidation of non-operated assets using its scalable technology platform. Under this financial model, I assumed that this strategy may be successful mainly because I assumed that management has a significant amount of expertise in the energy industry.

Tyler S. Farquharson is Granite Ridge’s Chief Financial Officer. Mr. Farquharson has over 16 years of experience in the energy industry. Source: Tyler S. Farquharson – Chief Financial Officer – Granite Ridge Resources

From 2007 to 2012, Mr. Perry worked as a financial advisor with UBS and Deutsche Bank. During his tenure in these positions, Mr. Perry worked to grow assets under management from $300 million to $500 million. He is also a member of the Cotton Bowl Board. Mr. Perry holds a BA in economics and history from Vanderbilt University. Source: Griffin Perry – Director and Co-Chairman of the Board – Granite Ridge Resources

From 2008 to 2013, Mr. Miller served as a Vice President at Bluescape Resources, a company focused on finding distressed upstream U.S. oil and gas investment opportunities. Prior to Bluescape Resources, Mr. Miller worked at McKinsey & Co. from 2006 to 2008 Source: Matthew Miller

Under my DCF model, I assumed that the company will successfully create a diversified portfolio of oil and gas assets, which may make future net sales line a bit less volatile. Besides, in my view, if the company continues to invest in different areas and basins, supply chain troubles in one basin may not affect all the operations of Granite.

I also expect that management will try to maintain an appealing financial situation, maintain a healthy balance sheet, prudently manage risks, and maintain liquidity to seize opportunities and meet credit covenants.

Many employees inside the organization worked in the finance industry, so I do believe that they will know how to show appealing financial statements. Granite Ridge pays quarterly cash dividends, considering them a fundamental part of a sustainable business model. As a result of these initiatives, I believe that demand for the stock would most likely improve.

Finally, it is worth noting that Granite is focused on getting deals directly and capturing growth opportunities with potential for improvement. The company seeks to mitigate the price risk of raw materials through the use of hedging derivative instruments. Under my financial model, I assumed that hedging and new deals will turn out to be profitable for Granite.

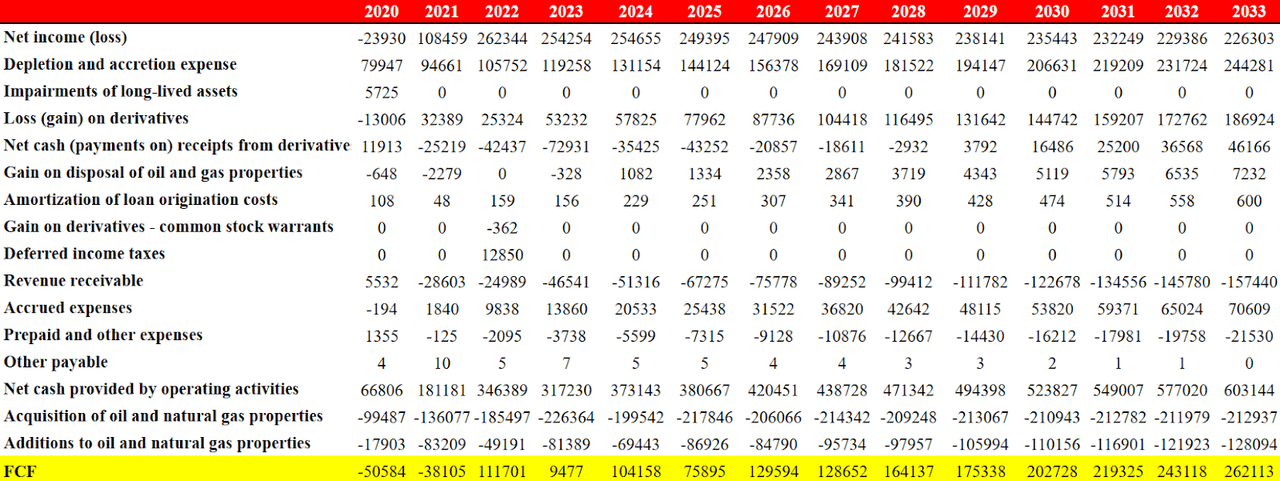

I believe that my assumptions were rather conservative, even more than that of other financial analysts. From 2023 to 2033, I assumed net income growth ranging from -3% to 1% with net income growth close to -1.34%.

Source: My Financial Model

I assumed that 2023 net income would be close to $226 million, with depletion and accretion expense of about $244 million, net cash receipts from derivatives of close to $46 million, and changes due to revenue receivable of close to -$158 million.

Also, with changes due to accrued expenses of $70 million and changes for prepaid and other expenses of -$22 million, 2033 net cash provided by operating activities would be about $603 million. Finally, with acquisition of oil and natural gas properties of -$213 million and additions to oil and natural gas properties worth -$129 million, 2033 FCF would be close to $262 million.

Source: My Financial Model

If we assume an EV/FCF of 6.6x, 2033 terminal FCF would be $1.745 billion. If we also include a WACC of 9.7%, the implied enterprise value would be around $1.566 billion. With cash of $10 million, long-term debt close to $25 million, and derivative liabilities of $6 million, the implied equity valuation would be $1.495 billion, and the implied price would be around $11.66 per share, with an internal rate of return of 6.066%.

Source: My Financial Model

Risks

In my opinion, one of the risks for Granite Ridge comes from volatility of oil and natural gas prices. Prolonged declines in prices can adversely affect future cash flow statements. If prices remain low for an extended period, the company’s profitability and ability to reinvest could be compromised. To mitigate this risk, Granite Ridge must implement effective risk management strategies, such as financial hedging or asset portfolio diversification, to protect its financial position as well as to ensure business continuity in a volatile price environment.

I also believe that the fact that Granite mostly works with third parties could create certain problems. Third parties offering services to Granite such as drilling or production tests may decide to renegotiate their prices, which may be very detrimental for future FCF growth. There is also the fact that third parties may not be willing to successfully produce the expected amount of oil or gas. Management provided significant commentary about this issue in the annual report.

We have only participated in wells operated by third parties. The success of our business operations depends on the timing of drilling activities and success of our third-party operators. If our operators are not successful in the development, exploitation, production, and exploration activities relating to our leasehold interests, or are unable or unwilling to perform, our financial condition and results of operation would be materially adversely affected. Source: 10-k

Transportation, access to drilling tools, logistics, and supply chain risks also affect Granite. If management fails to find pipeline systems close to its assets, or has to pay too much to use them, the FCF margin may lower. As a result, I believe that some of the assets may not be profitable, which could also lead to a decrease in the book value per share. The company provided information about these risks in the last 10-k.

The marketability of our oil and natural gas depends in part on the availability, proximity and capacity of pipeline systems, processing facilities, oil trucking fleets and rail transportation assets owned by third parties. The lack of available capacity on these systems and facilities, whether as a result of proration, growth in demand outpacing growth in capacity, physical damage, adverse weather events or natural disasters, equipment malfunctions or failures, scheduled or unscheduled maintenance could result in a substantial increase in costs. Source: 10-k

Intense Competition

Granite Ridge faces intense competition in the oil and natural gas exploration and production industry. The company competes with other companies in the sector, some of which have more cash, and can invest more in exploratory prospects and producing properties. As a result, investors may be more interested in buying equity from peers, which may increase the cost of equity of Granite.

The oil and natural gas industry is subject to rapid and significant advancements in technology, including the introduction of new products and services using new technologies. As competitors use or develop new technologies, we may be placed at a competitive disadvantage, and competitive pressures may force our operating partners to implement new technologies at a substantial cost. In addition, competitors may have greater financial, technical and personnel resources that allow them to enjoy technological advantages, and that may in the future, allow them to implement new technologies before we or our operating partners can. Source: 10-k

I also believe that competition for Granite Ridge’s target assets may increase in the future. Larger and more integrated competitors may be better able to deal with existing laws and regulations as well as any changes thereto, which could adversely affect Granite Ridge’s competitive position.

Conclusion

In my view, Granite Ridge counts with an experienced team with experience accumulated in relevant oil and gas corporations and several well-known banks. I would not only expect brilliant investments, I also think that management will know how to make adequate presentations to investors. As a result, I think that we can expect demand for the stock. Also, with a solid financial situation and a diversified portfolio of oil and gas resources, Granite will most likely produce sufficient FCF to justify higher target prices. Even taking into consideration that competition in the industry is intense, and supply chain and relationships with third parties could go wrong, I think that the current valuation is simply not adequate.

Read the full article here