By Jim Iuorio

At A Glance

- Gold prices soared in the 1970s era of inflation, but the root causes of inflation are different today

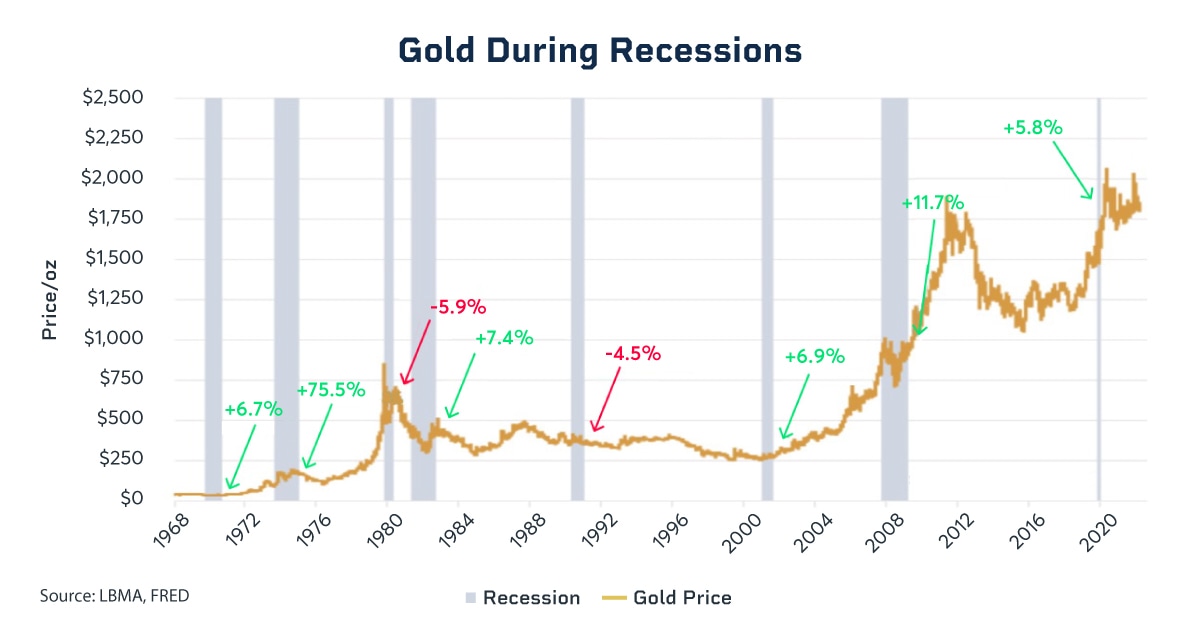

- In six of the last eight recessions, gold outperformed the S&P 500 by 37% on average

From March 8 through April 24, gold rallied over 9%, outpacing the S&P 500 which was up just over 3% in the same period. The rally seemed to correspond with headlines of banking stress that could have the potential to alter the Fed’s hiking path. For almost a year the U.S. treasury yield curve has been inverted leading many analysts to believe that the U.S. economy is headed toward a recession.

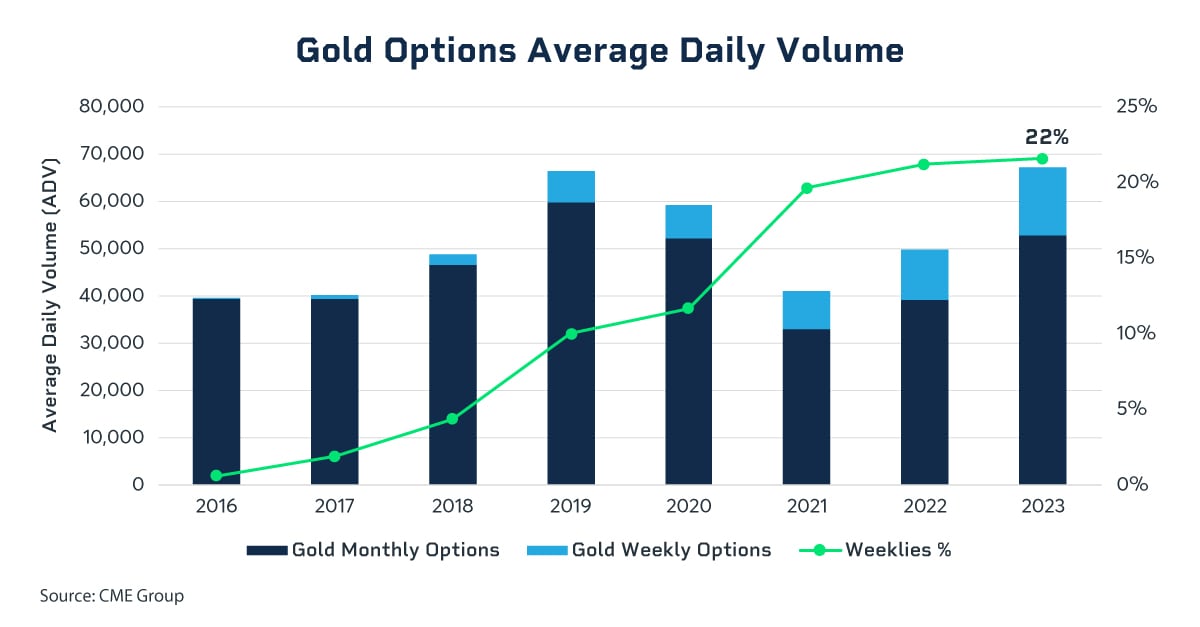

These and other factors have drawn increased attention to the gold market, where options on gold futures have reached record trading volume in 2023. Gold is believed to perform well in times of economic stress. But does it? Let’s look at history to tell us how gold performs under three scenarios – inflation, recession, and stagflation.

Is Gold an Inflation Hedge?

It would be nice if the answer to that question was a simple yes or no, but, unfortunately, it’s more complicated. The last major bout of inflation in the U.S. was the period between 1973 and 1979. During this time inflation averaged approximately 8.8% per year and gold gained an astonishing 35% annual return.

This would seem reasonable as inflation is associated with a weaker dollar and, in this environment, market participants are usually drawn to commodities to preserve purchasing power. But if we look a little deeper, we see another element. Elevated oil prices were the primary driver of the 70’s inflation/stagflation. This is significant because it alters the way the Federal Reserve and the government feels it can fight inflation. Aggressive rate hikes are an effective tool if the cause is simply excessive demand in the system, but when the cause of inflation is an elevated input price like oil, the Fed can’t fix it as easily with rate hikes alone.

Perhaps the gold market in the 70s was signaling a lack of confidence in the overall economic outlook and the Fed’s ability to achieve success in its task. It wasn’t until the 1980s that Federal Reserve chairman Paul Volker decided that rates needed to be massively hiked to end inflation, even if it added to the economic stress. The current inflation is dissimilar in a couple of ways.

The 2021 inflation was caused by government spending, supply chain disruption, and rates held too low for too long. The first sign of inflation was seen in March of 2021 when the Consumer Price Index (CPI) ticked up significantly, printing a year-over-year increase of 2.62%. At the time, gold was trading around $1,700 per ounce. Over the subsequent months, both gold and inflation began heading higher with the CPI topping at 9.06% in July of 2022 and gold hitting its cycle high near $2,050 in March of 2022.

In the seven months following gold’s high, it lost 20% of its value, bottoming in October of 2022 at $1,625. But what happened in March of 2022 that turned gold south? Perhaps it wasn’t a coincidence that March also marked the beginning of one of the Federal Reserve’s most aggressive and most telegraphed hiking cycles in history. Predictably, the dollar rallied, and gold tumbled. It wasn’t until October that the market began to envision an end to higher rates. At this point, gold seemed to change its focus from the current high-interest rates to the market’s prediction of coming rate cuts to combat a potential recession.

On balance, gold seems to benefit from inflation but less so if the expectations are for the Fed to act decisively against it. Simply put, gold likes inflation but doesn’t like the higher rates or the strengthening U.S. dollar that the Fed may engineer to combat it.

Does Gold Perform Well During a Recession?

There have been eight recessions between 1973 and the most recent in 2020. In all but two of these, gold has outperformed the S&P 500. The exceptions were in 1981 and 1990. 1981 was unique in that the Federal Reserve chairman Paul Volker aggressively raised interest rates to combat the massive inflation of the 1970s. 1990 was a mild recession and it came at a time when the world’s central banks were net sellers of gold due to good macroeconomic conditions globally. Gold did very well in the other six instances. From six months before the start of the recession to six months after the end of the recession, gold has rallied 28% on average and outperformed the S&P 500 by 37%.

The reason for this appears to involve the Federal Reserve and federal government’s response to the recession more than the recession itself. As the economy begins to contract, the Fed’s response has been to cut rates and inject liquidity. The federal government’s response has been the Keynesian principle of increasing borrowing and spending. Gold likes low rates because it reduces the opportunity costs of holding gold.

Gold also benefits from the overall increase of money in the system, particularly when weakness in the underlying economy acts as an impediment to investing in economically sensitive stocks. 2008’s Great Financial Crisis was a perfect example. The Federal Reserve cut the funds rate from 4.75% in late 2007 to essentially 0% by 2009 and left rates near zero for the next six years. Gold prices rallied almost 50% during the period.

How Does Gold Perform During Periods of Stagflation?

Stagflation is defined as a period of stagnant growth, high inflation, and high unemployment. The most significant bout of stagflation was in the mid to late 1970’s as high oil prices fueled inflation and acted as a high hurdle to general economic growth. OPEC’s oil embargo drove crude prices from $25 per barrel in 1973 to $144 by 1980.

High crude prices were causing a significant economic slowdown. A stagnating economy opens the door to Federal Reserve stimulus and increased government fiscal intervention. In normal times, this would benefit individual companies and their share prices by lowering their borrowing costs. During times of stagflation, however, investors are not confident that the initiative will be successful as companies struggle to remain profitable.

Consequently, the liquidity that is injected into the system tends to shy away from traditional company stocks. Gold is often the alternative beneficiary. Stagflation creates economic uncertainty because it challenges the traditional relationship between inflation and unemployment. Historically, gold benefits in economic uncertainty.

Unfortunately, the data set on gold performance during periods of stagflation is limited because we’ve only seen one instance of it in modern times. What’s interesting about this discussion is that we are currently in a time where economic activity appears to be slowing and energy prices have been inching higher, particularly after OPEC’s surprise production cut in April and the hint of the U.S. government beginning crude purchases to restock the Strategic Petroleum Reserve in coming months.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here