The Merger With Viterra

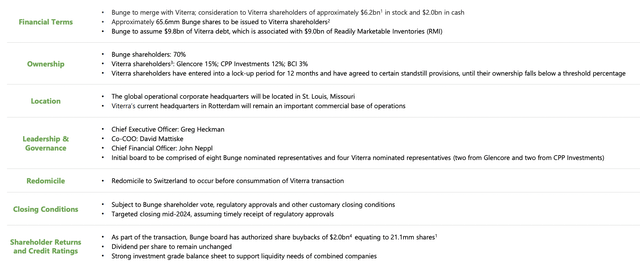

Bunge (NYSE:BG) is a Missouri-based agricultural company that specializes in oilseed processing and refining, with a strong presence in South America. The company just announced that it is merging with Glencore’s (OTCPK:GLNCY) Viterra through a whopping $18 billion deal. Bunge will pay $6.2 billion in stocks, and $2.0 billion in cash, and take on $9.8 billion of Viterra’s debt.

The deal is massive as Viterra’s size is roughly the same as Bunge’s, and the company’s post-merger EV (enterprise value) should reach ~$36 billion, making it on par with the current leader Archer-Daniels-Midland (ADM). While I generally do not prefer large-sized deals due to their complexity, I believe this one should be highly accretive in the long run.

Bunge

Substantial Benefits

I believe the combination is highly complementary and should substantially expand Bunge’s presence. Viterra is a leading agricultural supply chain company with a wide footprint of logistics and infrastructure assets. It currently has over 270 storage facilities, 29 port terminals, and 15 crush plants globally.

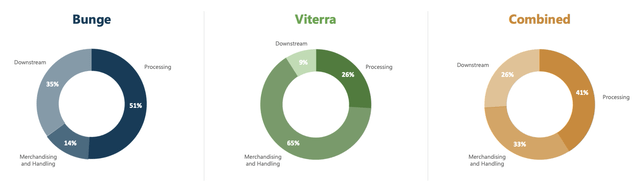

The combination should improve the company’s business mix. Unlike Bunge which generates most of its profit through processing (51% of total adjusted EBITDA), Viterra generates most of its profit from merchandising & handling (65% of total adjusted EBITDA). After the merger, Bunge will have a much more balanced business mix with processing and merchandising & handling accounting for 41% and 33% respectively, as shown in the chart below.

Bunge

Viterra is also able to expand the company’s footprint globally. Brazil has been Bunge’s only origination market, while Viterra has a much wider presence in other regions like the US, Canada, Europe, and Australia. The broadened footprint should allow the company to better manage seasonal cycles, weather, and other geo-related risks, as it can reduce its sole dependence on the Brazilian market and have a more balanced supply.

The merger also increases the company’s number of crop offerings. Unlike Bunge which only focuses on Soy and Corn, Viterra also offers Wheat, Barley, and Rapeseed. Due to the cyclical and uncertain nature of the agriculture industry, crop diversification is extremely important. The combination allows the company to reduce its reliance on Soy and diversify its offerings.

The expansion into other crops should also increase the company’s market opportunities. For instance, Barley and Rapeseed have a huge market size of $23.5 billion and $17.7 billion respectively. This should provide a stronger and more durable growth runway for the company in the long run.

Greg Heckman, CEO, on Viterra’s merger

Our highly complementary asset footprints will create a network that connects the world’s largest production regions to areas of fastest-growing consumption, enhancing the geographical balance and adaptability of our global value chains and benefitting farmers and end customers. With a diversified global mix of earnings across processing, handling and merchandising, and value-added products, we will increase the resiliency of our cash flow generation.

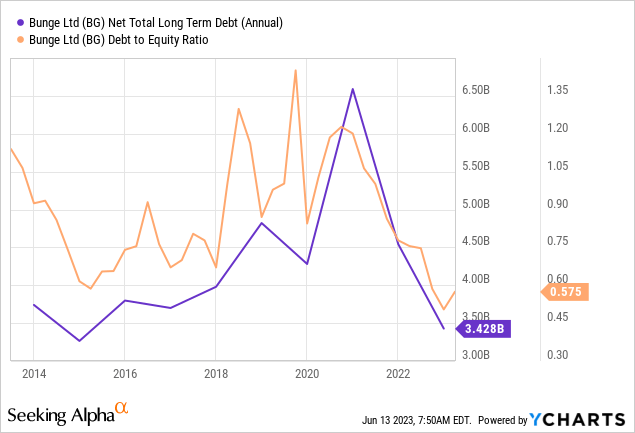

Strong Balance Sheet

Thanks to the inflationary environment in the past two years, Bunge benefited from massive tailwinds and generated substantial amounts of cash, which allows it to strengthen its financial position. As you can see in the chart below, the company paid down over $3 billion in debt since 2021 and its leverage is almost at the lowest level in the past decade.

This gives the company the financial flexibility to execute the merger without having to over-leverage its balance sheet. For instance, its adjusted leverage ratio after the combination is only 1.6x, which should be very manageable considering its consistent cash flow.

Compelling Valuation

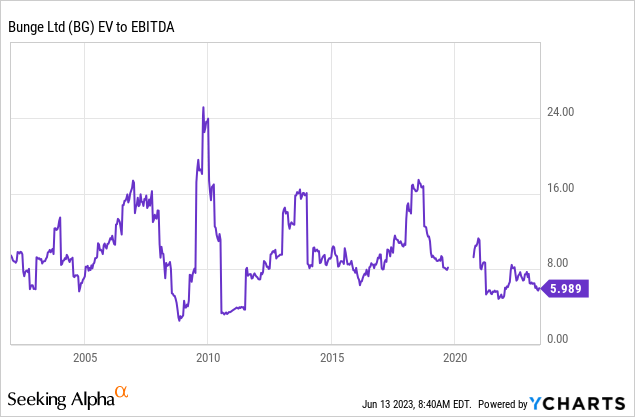

After the recent drop in share price, Bunge’s valuation looks pretty compelling in my opinion. The company is currently trading at an EV/EBITDA ratio of 6x, which is near the low end of its historical range, as shown in the chart below (I am using the EV/EBITDA ratio as it can take the debt into account).

The ratio is expected to grow to 6.8x after the merger (pre-synergies) but this is still cheap, especially when considering the increased market opportunities and improved diversification. For instance, the post-merger ratio represents a discount of 20.9% compared to its 5-year average EV/EBITDA of 8.6x.

Risks

Considering the size of the merger, integration may be a potential risk. There are a lot of moving pieces and assets involved and it will be complex to optimize the synergies. Missteps from the management team may ruin the potential value of the combination. Anti-trust may also be an issue as the SEC (Securities and Exchange Commission) has been ruthless in turning down large-sized deals.

Investors Takeaway

Overall, I really like this merger from Bunge. The deal allows the company to instantly improve its business mix and expand its presence into new geographies and crop offerings. This vastly reduces its risks and increases its market opportunities. It has also done a great job deleveraging in the past two years, which allows them to execute this deal without having to become over-leveraged.

The post-merger valuation remains attractive with multiple being discounted on a historical basis. Given the improving fundamentals and discounted valuation, I believe there should be ample upside potential and I rate Bunge as a buy

Read the full article here