Introduction

RocketLab USA (NASDAQ:RKLB) is an American aerospace company specializing in satellite design and reliable space launch systems. They are known for their small satellite launches, which have quickly become some of the most quickly launched rockets in the United States. RocketLab has experienced a decline in stock price since its IPO, primarily due to increased expenses for a variety of the company’s programs. However, its position as a prime contractor of both the defense industry and NASA, alongside an increase in funding for its large rocket programs and the satellite industry writ large, have put it in an excellent position for sustained long-term growth.

Company Overview

RocketLab’s revenue primarily comes from the launch of the Electron, their small-launch vehicle, which has had 37 successful launches, deploying over 163 satellites till date. RocketLab also sells parts for a variety of space systems, including space-based solar power, radios, and separation systems. Their launches and systems have served customers such as NASA, The United States Space Force, DARPA, and Canon.

Industry Overview

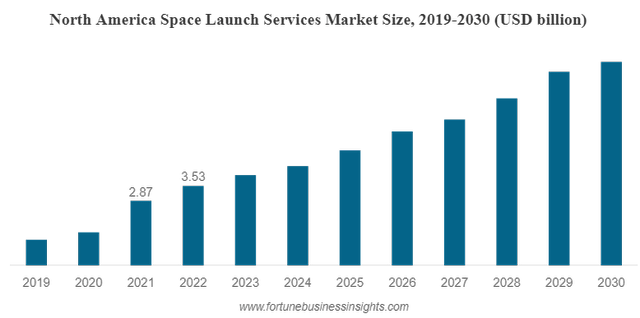

The aerospace and space launch systems industry is projected to grow at a CAGR of 12.2% to 20.54 billion by 2030, primarily due to an increased need in satellite systems as internet penetration grows. Some of this growth is also due to an increase in defense contracting, particularly geospatial intelligence systems. With the launch of NASA’s Artemis program and projected Mars missions, the aerospace sector will see further growth well into the 2030s. The market for the aerospace and space launch systems industry is currently dominated by SpaceX, with RocketLab coming in at second.

Fortune Business Insights

Competitive Analysis

RocketLab spans the gamut of the aerospace industry, sponsoring and servicing governmental, private, and even civilian space projects. They have an incredibly dynamic and speedy launch system, supported by three company-owned launchpads, which combined with the latter gives the company a very unique position amongst other contractors. RocketLab also provides a whole suite of other services relating to satellite and launch systems, including software and manufacturing for certain satellites, as well as solar panels and radio communication designed for spaceflight. RocketLab’s biggest competitor is SpaceX; with a private valuation of 125 billion USD compared to RocketLab’s 2.5 billion USD, SpaceX launches over 50% of all active satellites launched, with RocketLab coming in second. Even with this massive hold over the market, it still remains to be seen which company will come out ahead, however, amidst missions to Mars and beyond. For the time being, RocketLab’s combination of products and products makes it an incredibly unique player in the larger aerospace industry.

RocketLab USA Inc.

Financials

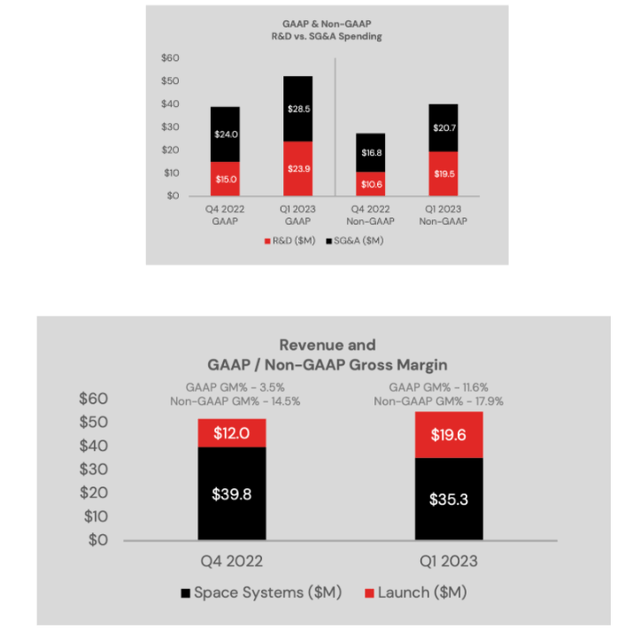

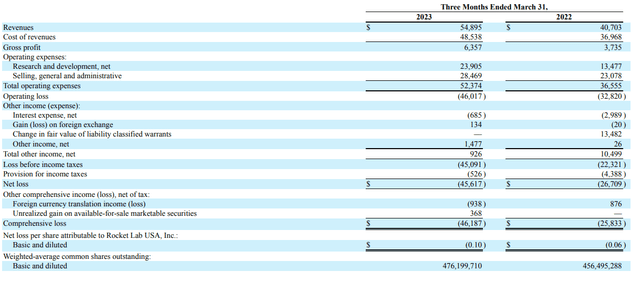

RocketLab reported a 2023 Q1 revenue of 54.9 million USD, with operating expenses reaching 52.4 million USD in the same time period. 2023 Q2’s revenue expectations are between 60 and 63 million USD, an increase of roughly 9.28%, and Q2 expense expectations are between 55 and 57 million USD. The company expects an earnings loss between 22 and 24 million USD for 2023 Q2 before interest and taxes. The increase in predicted revenue stems primarily from upcoming missions and holdover contracts, as well as contracts slated to be confirmed in Q2. RocketLab’s increase in expenses was primarily due to increased R&D spending for their mega-constellation-launcher, the Neutron. Audits and other compliance expenses also played a role.

RocketLab 10-Q

Catalysts for Growth

The biggest catalyst for RocketLab’s growth is the company’s contracts with NASA, particularly with regards to the CubeSat CAPSTONE, a veritable first step in NASA’s Artemis program to return to the Moon by 2024. The primary objective of the satellite is to calculate predicted orbital trajectories for NASA’s Gateway program, a lunar space station that will make it easier for astronauts to journey to the surface of the Moon. The mission will also demonstrate the autonomous navigation and long-distance communication systems needed for future missions. RocketLab has a myriad other contracts with other private companies, including an industrial development testing facility with Varda Industries, an unmanned, orbiting mission to Mars with Escapade, and a mission to deploy IoT satellites across 5 missions with Kinésis. The company is also sponsoring the first private search for life on Venus. These upcoming missions, all slated for 2024 and beyond, will help grow RocketLab, both in terms of launch and space systems revenue.

Valuation

Though RocketLab has both a multitude of incredibly interesting projects and an amazing number of successful launches, their predicted losses and low profitability is quite concerning. The company’s market capitalization is 2.49 billion USD. This is compared to a market capitalization of 4.49 billion USD at IPO. Additionally, RocketLab’s one-year Forward P/E ratio is approximately -14.91, indicating negative earnings and that the company is operating at a loss. Such a decrease in valuation is primarily because RocketLab is not classified as a growth stock, with a ROE of -22.56% for Q1 compared to an overall ROE of 9.87% for the aerospace/defense industry, and because the company has only just begun launching for its contractors in addition to focusing heavily on R&D for additional projects. Furthermore, RocketLab’s newer, multistage rockets are due late next year, meaning sustained spending for the next few quarters, explaining the low P/E ratio for the time being.

ESG Metrics

RocketLab’s ESG metrics are also incredibly good. Over 44% of intern staff identified as women in 2021, with that number projected to grow as the company signs more contracts. RocketLab also donated over 76k USD to education initiatives for Maori youth in New Zealand. They have also made continual progress in terms of DEI, increasing funding for women in STEM and in their Laboratory settings through scholarship funds and changes to hiring practices. Additionally, the company also prioritizes making their rocket systems reusable, which minimizes negative impacts on the environment. By signing multi-project commitments with companies such as Care Weather and Unseenlabs, they have also made sure their satellite technologies make a positive change upon harmful environmental practices through monitoring climate change.

Risks

In spite of RocketLab’s many contracts, investing in the company poses many risks. Both the company’s profitability and valuation are incredibly low. Furthermore, the company’s EBITDA is approximately -117.08 million USD, and is expected to decline further as the company increases R&D spending into the Neutron. This makes up a bulk of spending for the company into the late 2020s, as the ship prepares for its flagship deep space journeys, alongside other developments to support such missions both through RocketLab and its contractors. The company also has a profit margin of -68.77%, indicating ineffectiveness in cost-cutting measures and inaccurate operating expense predictions. RocketLab also has an ROA of -9.03%, indicating a similar predictive ineffectiveness in expense predictions and generating profits.

Conclusion

Since its debut in late 2021, RocketLab has had a hard two years adjusting as a public company and answering to its shareholders while simultaneously maintaining its scientific developments and satellite technology commitments. In this new space race of both public and private contractors, however, the company has positioned itself to become one of the main leaders of the aerospace/defense industry. Despite disappointing metrics, the innovations and contracts RocketLab holds makes the company a valuable long-term hold as NASA gears up its Artemis missions to the Moon and future missions to Mars.

Analyst recommendation by: Ratul Chakraborty

Read the full article here