Recap

On April 3, we published an article titled “New CEO Likely To Walk The RealReal Towards Profitability” recommending a “Buy” rating for The RealReal, Inc. (NASDAQ:REAL).

Since then, the stock has increased by 40%. We are still holding this name.

Many investors held relatively bearish views on this name as the company still lost money. Our bullish argument was based on the company’s shift from focusing on business-to-consumer (“B2C”) to business-to-business (“B2B”), specifically targeting consignor customers. We believe this shift in focus can improve its margin and ultimately lead the company to profitability.

Consignment clients, who generally are experienced buyers or businesses, are less likely to choose physical store sellers for services and may favor e-commerce sellers for product uniqueness and transparent pricing.

We believed that leveraging its online platform would allow the company to capitalize on its strengths, as experienced consignor customers would benefit more from the selection and convenience of its services compared to retail customers.

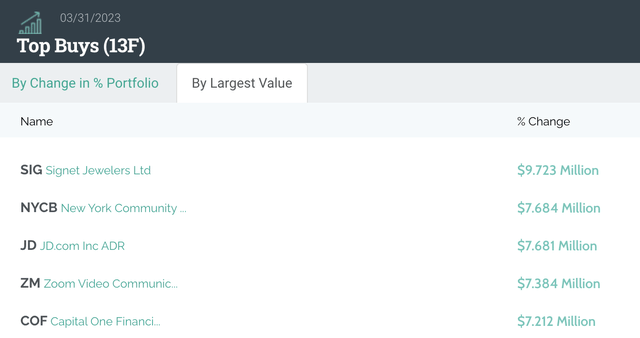

We were not the only ones who saw the potential in this company. Michael Burry, a hedge fund manager, also bought 684,000 shares of it by the end of March.

Additionally, we should also point you that on February 17, we rated “Signet: A Well Positioned Value Stock” with a “Buy” recommendation. In Q1, Mr. Burry made a significant investment in this company, and as of March 31, it was the largest position in his portfolio.

Michael Burry’s portfolio (Whalewisdom)

Key takeaway from Q1 earnings:

The company released its Q1 2023 earnings report on May 9, 2023.

Meeting Expectations: Company’s Progress on Track

Some of the financial indicators and trends are in line with our forecast. As anticipated, the company showed promising progress in expanding its consignor customer base, with consignment revenue growing by 22% compared to the previous year.

Significant Margin Improvement

Regarding margins, in our previous analysis, we highlighted the positive impact we believed the change in commission pricing structure would have on the company’s margin.

In addition, the management’s initiatives to shift the focus to high-value items may better cater to the needs of consignors. Consignor customers would prefer to sell high-priced items so that they can leverage the shipping costs. The company will also benefit from initiatives as it can further leverage the authentication and fulfillment operation costs.

The company had done a great job. It significantly increased its gross margin in the first quarter, increasing it by 980 basis points over the same period last year. This was attributed to a number of reasons, including an increase in the firm’s take rate, a decrease in the balance of its company-owned inventory, and a year-over-year shift away from lower value supply toward higher value supply.

Positive Customer Growth

Surprisingly, contrary to our concerns about a potential decline in the number of customers due to pricing changes, the company continued to grow its buyer base, reaching a milestone with total active buyers surpassing 1 million for the first time in its history.

Management’s Confidence in Annual Projection

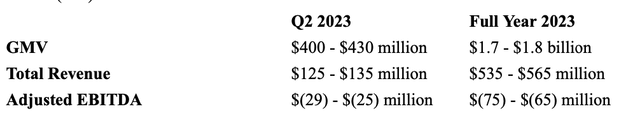

Since things were going according to plan, management felt more confident in sharing its annual prediction. The company’s projection for 2023 indicates an estimated adjusted EBITDA in the range of -$75 million to -$65 million. This represents a further improvement compared to the -19% adjusted EBITDA margin achieved in 2022.

Guidance (REAL)

Over the past two months, the company has carefully assessed its cost structure and discovered additional possibilities to minimize operating expenses. The management is optimistic about attaining profitability, specifically in the second half of this year or the next. The company’s objective is to achieve breakeven for adjusted EBITDA by 2024.

Decreasing Capital Burn Rate

The risk of its solvency decreased as its financial situation improved. The company had $450 million in convertible notes and $247 million in cash as of March 31, 2023. Due to the company’s lower cash burn rate, investors now have more faith in it.

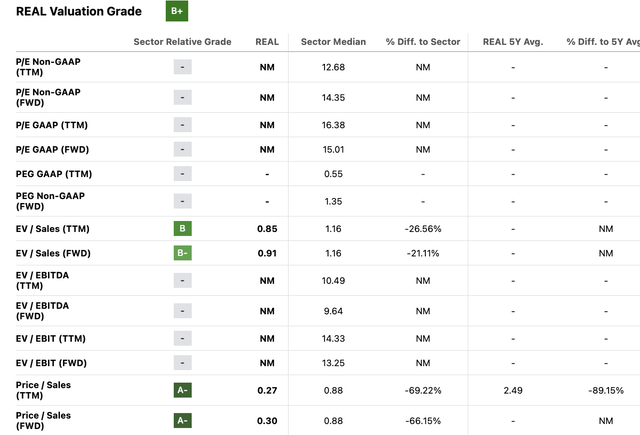

Valuation

Despite the fact that the company’s stock has increased by 40% since our piece, it still trades at a discount to the sector median or its 5-year average.

Valuation multiple (Seeking Alpha)

The distressed valuation multiple suggests that many investors still have concerns about the company, especially its business model. However, we see that the company successfully raised its take rate through a pricing change and maintained a robust 70% gross margin on its consignor business. This accomplishment lays the groundwork for proving that the company’s concept can be a profitable business model in the online marketplace for luxury consignors. Investor caution is natural, but they should be aware that this is precisely what they should expect if they want to invest in a new business strategy.

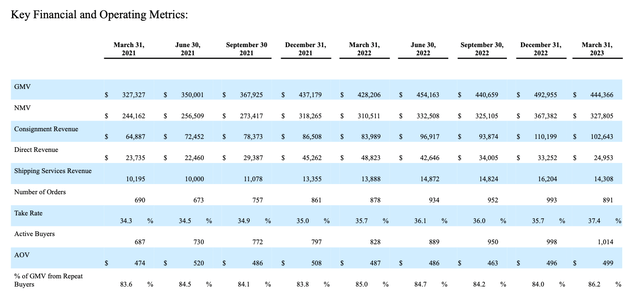

Its improving operational indicators showed a resilient and expanding customer base despite the macroeconomic environment’s inflation and ambiguity.

Its average order value (“AOV”) started to rise again. Additionally, the percentage of its Gross Merchandise Volume (“GMV”) that was purchased repeatedly by the same customers rose to 86% in Q1, showing strength in client retention.

Operating metrics (REAL)

Despite numerous encouraging developments, we acknowledge that this company is best suited for investors with a high risk tolerance because it faces competition from stronger players in the market, like eBay (EBAY). However, we hold a favorable view of this name due to its position as the largest online luxury resale platform and its consistent growth in the number of active buyers. The online luxury market is still an emerging company model, making it a fragmented sector of the economy. So, at this point, the risk of competition can be limited.

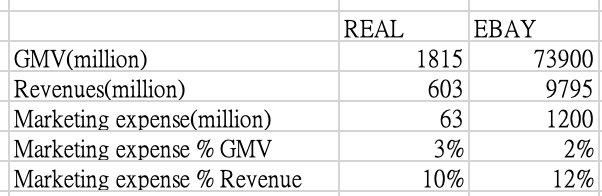

We believe that trust-building plays a crucial role in the current stage of sector development. The company has been actively engaged in educating and nurturing customers, helping them become comfortable with online shopping through the authentication process. It is also important to note that the business is substantially smaller than eBay. However, the company’s marketing expense ratio was marginally lower than eBay’s, which we attributed to its purely luxury customer base.

REAL vs EBAY (SEC)

Summary

We continue to hold this name despite a 40% increase in stock already.

We anticipate that the stock’s potential return will primarily stem from a successful turnaround, leading us to hold a relatively optimistic outlook for this company in the short and medium term.

Despite the fact that we consider this to be a small-cap and short- to medium term hold name, we often exit positions if the fundamentals deteriorate or the stock is markedly overpriced.

If the stock falls far below our cost price, if there are new growth drivers or prospects for margin improvement, only then will we consider adding more positions.

Considering the company’s ongoing efforts to improve profitability and its healthy cash position for the next two years, the risk of imminent bankruptcy is relatively low. As a result, we maintain our “Buy” rating.

Read the full article here