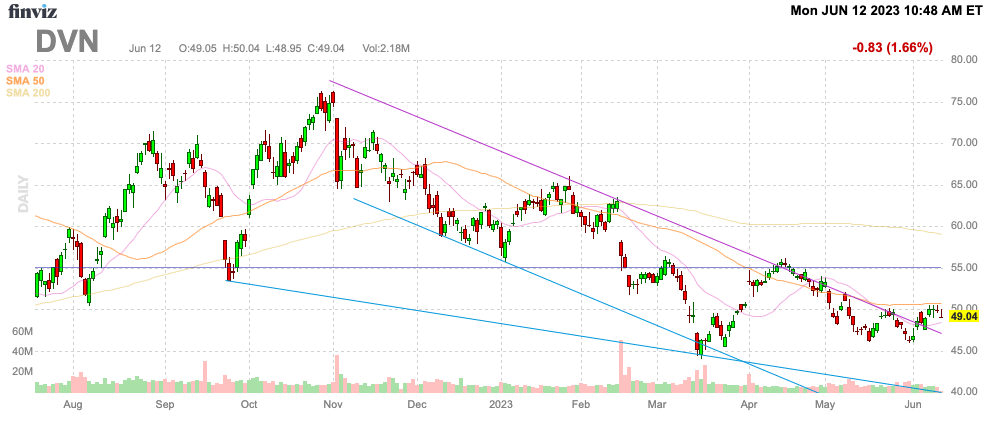

As oil prices dip below $70/bbl, Devon Energy Corporation (NYSE:DVN) is finally facing lower risk of energy price weakness. The energy company with half of production tied to natural gas, the business actually has upside potential from an increase in those prices. My investment thesis is Bullish on the stock following the near double bottom at $45.

Source: Finviz

Following Oil

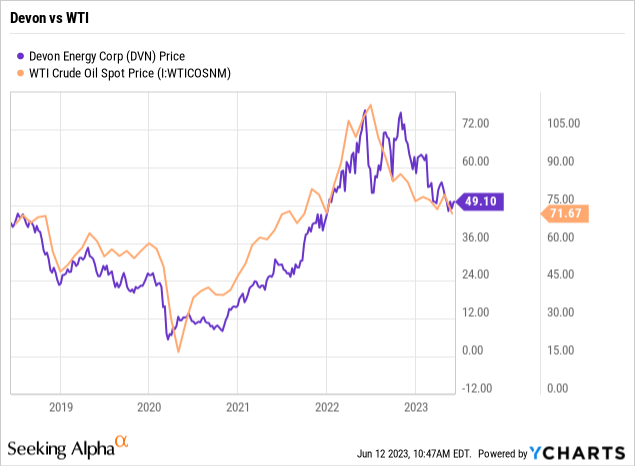

Over the last several years, Devon has traded generally in line with oil prices. Though Goldman Sachs continues to push higher oil prices with a new target still up at $86/bbl, the path appears generally lower for the energy commodity.

Based on price action in the past few years, Devon could definitely fall with WTI oil prices collapsing from here. One has to judge how much risk they see in lower oil prices actually occurring with China still trying to rebound from covid and the US headed towards pausing interest rate hikes.

For Q1, Devon averaged production of 641,000 oil-equivalent barrels (BOE) per day. The energy company has ~50% of production from oil, with 11% growth in the quarter.

Unlike most larger energy companies, Devon has a growth profile with a target for up to 5% annual oil growth. The company is achieving the growth without excessive capital spending, with a target for less than $1 billion per quarter.

Devon produced $1.7 billion in operating cash flows during Q1, when oil prices were $74/bbl. The company had $0.7 billion in free cash flow during the quarter, leading to the strong capital returns discussed below.

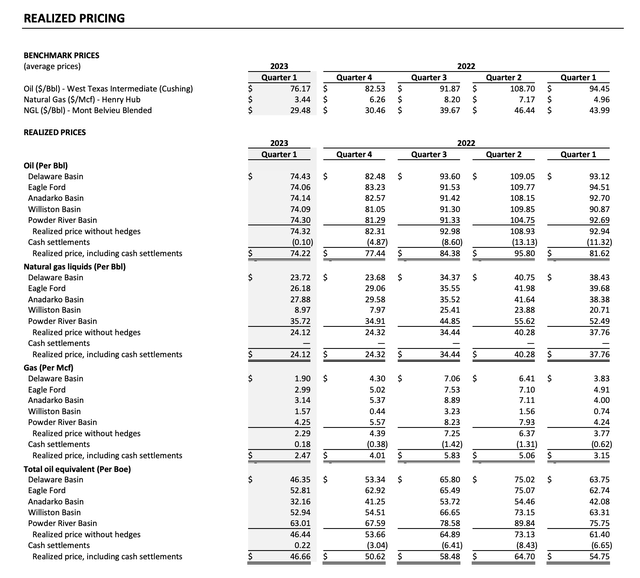

The amazing part is that Devon is producing this free cash flow when half of production is being sold at low natural gas prices. Though, the company did manage to sell natural gas at $2.47/mcf during Q1’23.

Source: Devon Energy Q1’23 supplement

The company earned $1.46 per share during Q1 off, mainly due to the solid oil realization of $74/bbl. Of course, the average natural gas prices were only $2.29/mcf without hedges.

The biggest risk to the story is clearly current energy prices, with WTI trading around $67/bbl, but natural likely provides some upside here at lows near $2/mcf. The consensus estimates are for quarterly EPS to top the Q1 levels, but current energy prices would support a dip in profits, at least in the short term.

Big Capital Returns

The investment story really gets interesting, with Devon Energy having the cash flows to return a lot of capital to shareholders. The company just announced an additional $3 billion share buybacks plan for a stock with a $32 billion market cap.

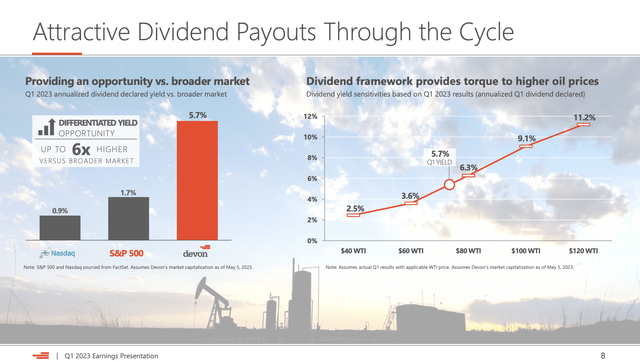

Even with that, Devon has a strong dividend with a yield of 1.6% based solely off the fixed portion of the divined. The energy company pays a much larger variable dividend based on income, with the recently announced June dividend payout of $0.72.

Devon Energy Q1’23 presentation

The company forecasts a 6% to 7% dividend yield based on current WTI prices. In addition, Devon repurchased 12.9 million shares for $692 million during Q1’23.

Considering the large dividend payouts, the share buybacks are mostly a bonus to shareholders. With the stock relatively cheap compared to peers, the stock buybacks are solid ways to reward shareholders by reducing share counts, including a 12 million share reduction in the last year.

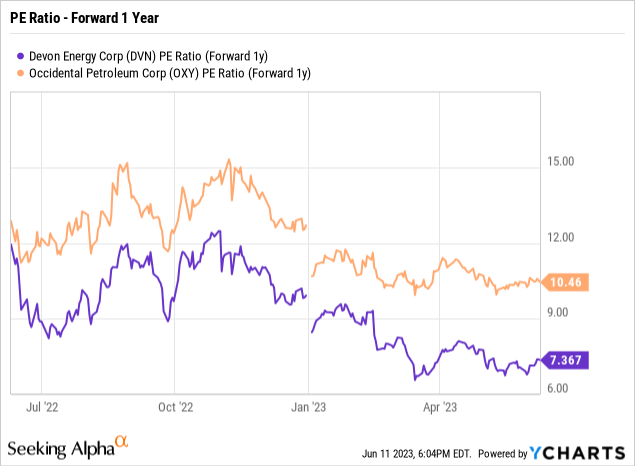

A prime example of the deep valuation here is the discount compared to Occidental Petroleum (OXY) loved by Warren Buffett. Devon has ~50% upside to match the forward P/E ratio of Oxy.

The fact Berkshire Hathaway Inc. (BRK.B) is constantly buying Oxy, including a recent $273 million purchase at current prices, keeps the stock price elevated compared to Devon. Both stocks rallied to highs of around $75, but Devon has fallen to below $50 while Oxy still trades near $60 due to Buffett constantly buying shares.

Takeaway

The key investor takeaway is that Devon Energy Corporation has reduced risk to buy, with energy prices trading towards multi-year lows. The stock appears a very solid buy on another dip to $45, while the valuation is very appealing at the current levels.

Read the full article here