Dear readers,

If you follow my work on Atos (OTCPK:AEXAF), you know that I’ve been positive, then negative, then positive again on the company. My original positive position from back in 2022 is still at a significant outperformance – but my most recent article has resulted in negative RoR because Atos has once again somewhat underperformed. To see this company deliver a turnaround will, I believe, take time.

How much time?

We’ll have to see. What remains clear to me, however, is that while the company isn’t a risk-free investment, any fundamental danger at this time is, as I see it, minimal. By that, I mean a real danger that you may lose a majority of your investment. I do not believe that to be the case, even if you may need to wait years for that eventual upside.

Given that this is something I am used to from other investments, this does not faze me.

Let’s review 1Q23 and see if there are any sort of encouraging signs in the company at this time.

Atos – Some things are improving

It’s no secret that Atos has been through a portfolio reorientation for the past few years, ever since a bit of a scandal broke with regard to this company and some financials. As a result, the dividend was broken, and the company went down (compared to where it was previously), and to say that investor confidence was shaken would be a massive understatement.

However, as we look at 1Q23, it seems to me that we’re starting to see the beginnings of improvements here. The company has been through the fires but is starting to see the end of the flames here.

How do we see this?

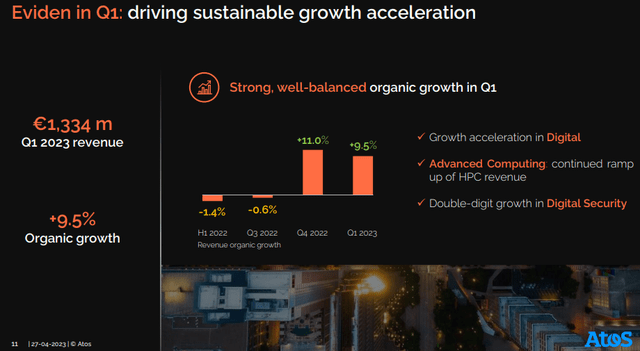

Well, organic growth is starting to be a recurring theme now. In 1Q23, that organic growth is almost 3% YoY, much of it coming from the company’s Eviden arm, which was almost at double digits. The company is far from done with its transformative journey, as evidenced by continued negative top-line development from the Tech Foundations segment, but it at least managed to stabilize core revenues in the segment, with some of the negatives related to a deliberate reduction in non-strategic activities.

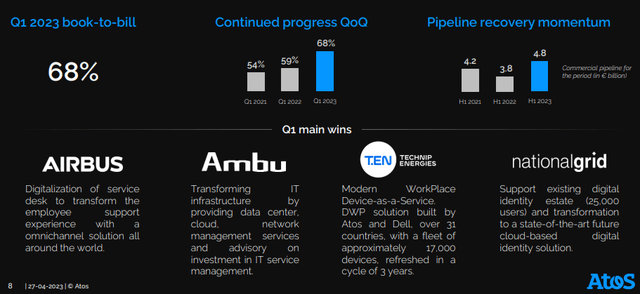

Rebuilding its base is the current common theme in this segment, and it’s going… well, decently. Many of the companies I cover boast a 100%+ book-to-bill ratio.

Atos and this segment currently manage 68%.

Atos IR (Atos IR)

Not exactly impressive, but it’s better than what it was – which is the important thing here.

Eviden is the arm that’s going well. For 2022, it had over €5B worth of revenues, and it’s represented in 53 nations across the world with 57,000 engineers and problem solvers. The business has over 2,100 patents and is 1# in managed security services, as well as #1 in performance computing in Europe – in 3rd place worldwide. Eviden is a company in the public cloud business, in data/analytics, and in performance computing and managed security services. Growth here is high, and it seems to only be somewhat slowing down going forward.

Atos IR (Atos IR)

The company has changed around its headcount significantly. This does not mean that it pays fewer people – at least not a whole lot less – but there have been over 5,000 people leaving the company, coupled with voluntary and restructuring/dismissals.

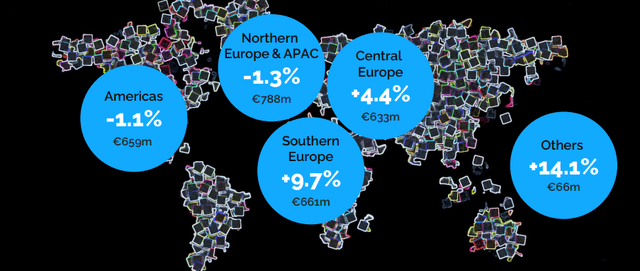

The company’s revenue growth was organic, which is what we want to see here. Any other sort of explanation for the top line would have been worrying, as we really want to see the company improving here. Regions are looking pretty good as well, with really only the Americas and Northern EU going down.

Atos IR (Atos IR)

The company also gave us a full-year outlook – another positive here, even if the forecast really isn’t that great. Between negative 1% and positive 1% in terms of organic revenue growth, which mostly means “flat”, but much of that positive from Eviden, while the Tech Foundations segment is going to continue what we can call a “managed decrease” or “rationalization”, to use a kinder wording here. Operating margins, of course massively important here, are likely going to be around 1-2% higher than in 2022 – but this is another must because the company was barely positive last year. More importantly, Tech Foundations is expected to deliver a positive year in terms of margins – and this is crucial as well.

Things to look out for?

Well, I basically said it earlier – we want to make sure that top-line growth continues, and that company margins actually improve. Since they declined massively to below 5% a few years back, this company has been in an unfavorable spiral – and it will take reorganization and changes to turn this around.

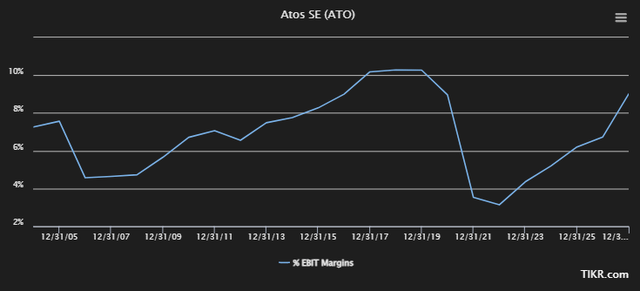

Take a look at the EBIT margins and how they’ve developed since 2019.

Atos Margins (TIKR.com)

We’re in for a recovery. At least analysts believe so – and in this case, I agree with this assumption and forecast. The specifics of it, that’s another question. To revert to full margins within around 3-4 years doesn’t seem like too positive to me, or too exuberant. And in the company’s defense, margins actually never went below 0% in terms of EBIT/operating – just very close.

That 2021 and 2022 were terrible years is not in question. Net income went deeply negative and has not yet recovered. That the company was in need of a massive reorganization, and the assumptions that came along with that have changed my way of investing – because I actually invested, initially, before the massive crash. Thankfully not significantly, but the fact that I went positive on this company back then has caused me to revisit my process to see if there was anything I could have used to more accurately predict this development.

However, after having revisited the fundamentals time and time again, checking out various models and ways of calculating the company, I have reached the same conclusion every time. The depth and severity of the crash were not forecastable by standard means. What was visible was a decline in revenues, but not severe. What was forecastable was a flatness in ROIC and cash flows – but at the same time, lower debt. Nothing in the company’s “standard” fundamentals, or filings could be used to forecast how “bad” this crash has been for the company.

Atos is a great example that just because you’re sure of a business, you never fall to overexposure to any one investment. Because even a company that seems good enough, and is already in the midst of a turnaround, can certainly fall further.

Atos has taken this to new heights, however.

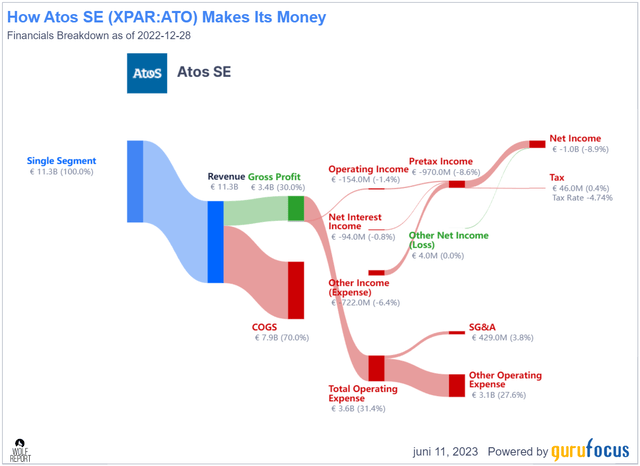

However, the upside in this company is non-trivial, in the case of normalization. While the current revenue/net income looks something like this for 2022…

Atos revenue/net (GuruFocus)

… I do not think this is what will dictate or characterize the company’s future results. I do think things will turn around. While it’s easy to characterize the company as a “value trap” here, and it might even be correct, I think it would be wrong to ignore the company’s upside potential.

Let’s clarify.

Atos valuation – there is much to like here

My article in September of 2022 still has a positive 30%+ RoR to this, even if my latest article showcases a negative RoR. This does not change the thesis. The company is undervalued here, for what it is. That is something I believe, not because of the “great” results the company currently delivers, but what it potentially will deliver once its 100,000+ employees are turned around in full.

I maintained a €25/share native ticker price target in my last article, and that is still the case I hold for this particular article. This is above most analysts following the company at this time – but I hasten to add that only 1-2 years ago, these analysts were as high as €50/share for the company. Out of 11 analysts, only 3 are at “BUY” or equivalent, and that makes sense given what else is available on the market today.

That the company is able to perform so much more becomes clear once we look at projected and potential FCF and earnings, and sales multiples. Once we start including those, and look at the company from a peer-average perspective, it’s not hard to see the company being worth well above €40/share. But that is, of course, if the company were to perform well, which it currently does not.

Margins are below average and sub-par, and as of the latest quarter, there is no concrete sign of a full turnaround. The same is true for the coming full year – estimates are really not good enough yet for a full turnaround.

However, this does little to impact my longer-term positive thesis for the company, which is as follows.

If the company recovers somewhat to a 13-14x P/E as a result of eventual margin recovery, which is the company’s 4-5-year average even including the past few years of trough, this could result in a more than 200%+ total RoR with over 50% annually, even without the company’s dividend.

So the upside is most certainly there, though it requires that you’re willing to take the risk of having to own this company long-term. That’s also why I am now keeping my position in the company and why I won’t be moving to sell anytime soon.

I don’t see fundamental deterioration as a likely outcome in the sense that you’re going to lose your invested capital – not at this stage, with most of the deals and moves lined up to really move the company into a better overall position.

While the recovery is slower than most, my base case remains that you can discount the company however you choose to – the upside is still there, and its significant here.

The following is my updated thesis for Atos.

Thesis

- Atos is still a fundamentally questionable company at this time – but the substance is solid, once the company gets its flow from top to bottom line under control once again.

- We have seen the beginnings of this turnaround, but it will take time.

- The question is how long this will take. When FCF turns positive and when operating margins tick up above 3% for more than a quarter at a time, I would be seriously interested in this company again. I maintain my position here, but FCF isn’t positive yet, and OM is only above 3% in parts of the last fiscal.

- For now, it’s a rare “Speculative BUY” with a PT of around €25/share for the native share.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

It’s not yet considered fundamentally safe, but I do consider it qualitative given its progress, and I do consider it cheap and with an upside. The lack of a dividend may kill it for most of you though. It’s a 3/5 for my criteria, but I go for a “Spec BUY” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here