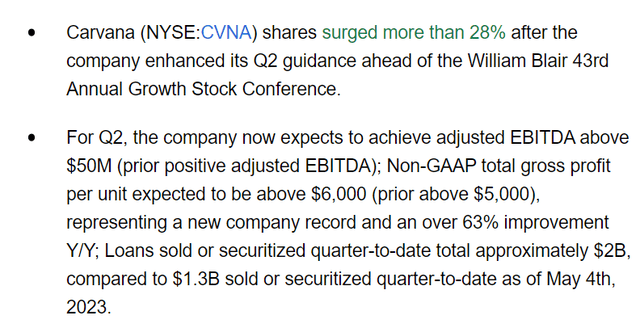

This article will be devoted to a phenomenon that has been much discussed among retail investors lately – a short squeeze. A good example of what we mean by this term is the recent performance of Carvana’s stock (CVNA), which has risen more than 68% since the beginning of the month as management issued more positive guidance, creating increasing buying pressure that forced short sellers to cover their bets against the stock.

Seeking Alpha News

As a potential candidate for a similar “fate,” I see Fisker Inc. (NYSE:FSR), which plans to actively expand sales in the next few quarters. In addition, FSR could make progress on EPA and CARB approvals shortly. All of this could provide a bullish speculative catalyst for the market to play with given all the shorts in FSR.

Why Do I Think So?

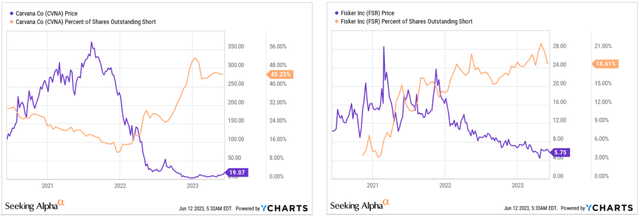

First of all, without touching on Fisker’s operations yet, I think the company has a very similar setup for a short squeeze if we compare its short interest and price dynamics to Carvana’s:

YCharts, author’s compilation

It may seem that FSR stock has a relatively low percentage of shares sold short [relative to CVNA], but other sources talk about more than 30% – it’s obvious that there are a lot of short sellers now.

Fintel data [June 12, 2023]![Fintel data [June 12, 2023]](https://inteltexta.com/wp-content/uploads/2023/06/49513514-1686564540829829.png)

Fisker Inc. develops, manufactures, markets, leases, or sells electric vehicles, based on Seeking Alpha description. But in fact, FSR has no sales yet – it’s in the process of transitioning from a startup to a revenue-generating car company. According to the CEO’s words during the latest earnings call, Fisker has already opened customer centers and lounges in Vienna, Copenhagen, and Munich, allowing potential customers to interact with the vehicles and provide feedback. More customer centers and lounges will be opened in the coming months, including one in Los Angeles.

The CEO also highlighted the progress in preparing for the production ramp of the Fisker Ocean. The Fisker Ocean offers the longest range in Europe for any SUV, and initial deliveries have begun in Europe, with regulatory certification expected soon in the US. Since the launch edition will be limited to 5,000 units and will start at $68,999, the company should, in this case, get ~$345 million in sales by the end of September, according to electrek.co.

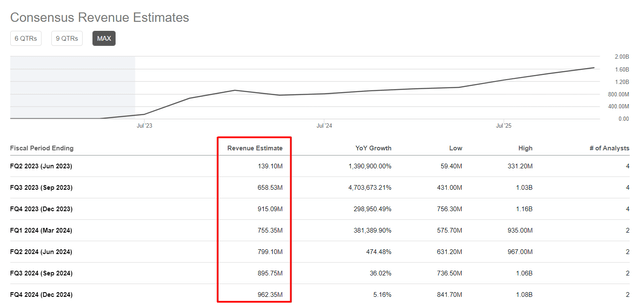

But the launch of the company’s Fisker Ocean sales, in my opinion, isn’t the main catalyst, because this expectation has most likely already been priced in by the market:

Seeking Alpha Premium, author’s notes

More important, in my opinion, is the approval for the sale of cars in the U.S., which will be a truly new and hitherto “little-priced-in” event for the public:

We completed the U.S. Federal NHTSA self-certification and the EPA completed its confirmatory testing at its lab in Michigan, and we are now waiting for the EPA test results to confirm our test results performed by a third-party [indiscernible]. We are intently focused on the [indiscernible] EPA and CARB approval, which we expect this month [May 2023].

We completed the U.S. FMVSS and NHTSA testing requirements in the U.S. and internally validated European NCAP. The Ocean has proved to perform at the highest standards, and we are very proud of these results.

Source: Fisker’s CTO, Burkhard Huhnke [author’s emphasis added]

electrek.co [author’s notes]![electrek.co [author's notes]](https://inteltexta.com/wp-content/uploads/2023/06/49513514-16865665001881535.png)

In my opinion, short sellers are now in a rather fragile position, as the risk-reward ratio skewed to the negative side for them. In fact, any positive news about the progress of registration in the United States can now trigger short covering.

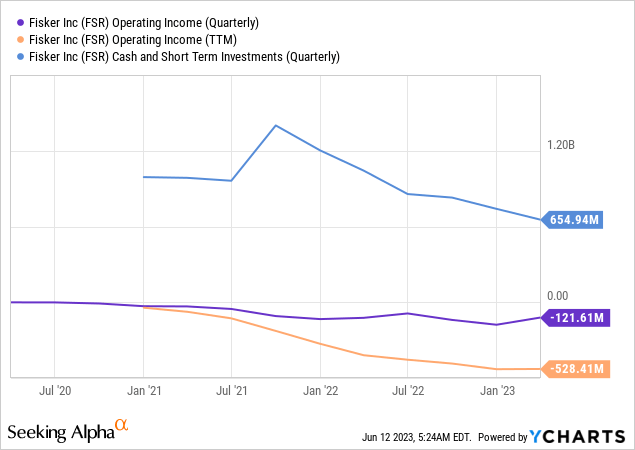

On the other hand, I can’t be sure yet that Fisker will be able to significantly reduce its burn rate even against the backdrop of a full sales launch:

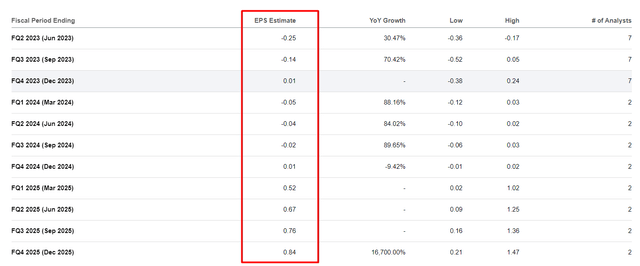

In addition, the market expects Fisker to report positive earnings per share as early as Q4 FY2024, which is too optimistic in my opinion:

Seeking Alpha Premium data, author’s notes

The Verdict

Even though Fisker will ramp up production and start selling/delivering soon, it’s still a very young, unprofitable company with the liquidity of a little over a year ahead [total cash over operating expenses]. In any case, it’ll need to issue additional shares to cover ongoing expansions, as these are also likely to grow rapidly, in my view.

On the other hand, everyone knows Fisker’s financial position – that’s why so many people or institutional players have a short position. For the stock to fall significantly, the market needs a new negative reason, and that’s not in sight other than massive selling in the broad market. As strange as it may sound to you [and me], FSR stock seems to have some pretty impressive upside potential – if the market continues to get positive news, this stock has a chance to shoot up in my view.

Because of all this, you should note that this article presents a speculative idea that carries a lot of risks – so you see a Neutral rating from me this time.

Thanks for reading!

Read the full article here