Investment thesis

General Motors Company (NYSE:GM) stock delivered almost no stock appreciation over the last decade. My analysis suggests that the market has been fair to the stock, given practically no positive trends in the company’s financials over the long term. The company faces severe secular headwinds related to the rapid penetration of electric vehicles [EVs], where the company’s presence is weak. Moreover, my valuation suggests that the stock is overvalued.

Company information

General Motors is one of the world’s largest automakers, with a rich history since 1908. GM and its strategic partners produce cars and trucks in 31 countries and sell and service these vehicles through well-known brands.

General Motors website

The company’s fiscal year ends on December 31. GM reports its financials in three segments: GMNA [automotive sales in North America], GMI [automotive sales outside North America], and GM Financial, which provides customer financing services. Automotive sales in North America represented 82% of the company’s revenue in FY 2022.

Financials

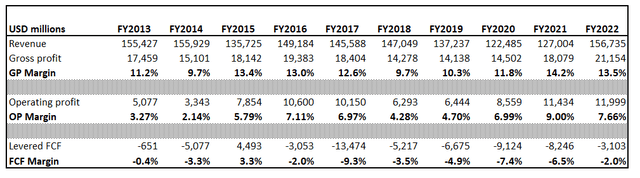

If we look at the company’s financials over the last decade, we can see that revenue increased from $155.4 billion in FY 2013 to $156.7 billion in FY 2022. That indicates a 0.8% cumulative growth or a 0.1% CAGR. If we consider that inflation has been at least 2% per annum, in real terms, the company’s revenue deteriorated.

Author’s calculations

A good sign that the company delivered both gross and operating margin expansion over the long-term, but it did not result in strong levered free cash flows [FCF]. As you can see from the above table, the company generated positive levered FCF only once over the decade, in FY 2015.

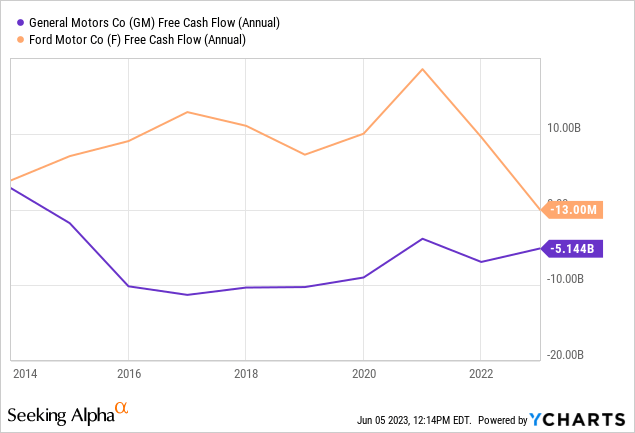

Of course, legacy automakers like GM are experiencing secular headwinds of transition to clean energy. Therefore, some people might argue that the difficulties of GM with generating cash flows are explainable. But, Ford Motor Company (F) is also a giant legacy automaker with sales at the same level as GM’s. But, according to the above chart, Ford has been much more efficient in generating positive FCF over the decade.

One of the primary reasons why GM failed to deliver sustainable positive FCF is its significant CAPEX. The company spent a staggering amount of $212 billion on CAPEX over the last decade. This was inefficient and led to excess manufacturing capacity since the company’s revenue was flat over the decade. For me, a massive expenditure on CAPEX with no revenue growth is a huge red flag meaning the management was inefficient in its capital spending.

As a result of poor cash flow margins and inefficient CAPEX, the company’s total debt amount skyrocketed over the decade. Net debt increased elevenfold over the past decade, from $8 billion in FY 2013 to almost $89 billion in FY 2022.

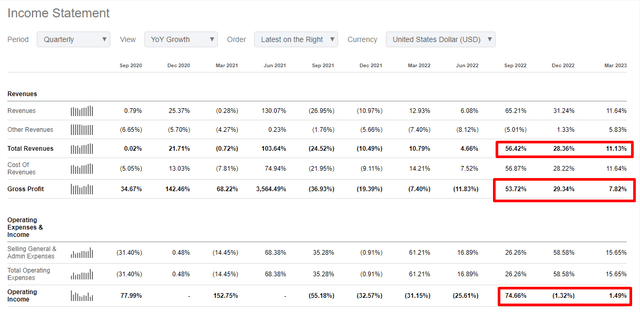

Recent past quarters demonstrated strong YoY revenue growth, but there was no good news from the FCF perspective since costs were keeping up with the topline growth.

Seeking Alpha

The company’s latest earnings announcement of April 25 was mainly positive since GM delivered double digits revenue growth and raised its adjusted diluted EPS forecast to $6.35-$7.35 from $6.00-$7.00, and its adjusted EBIT estimate to $11.0-$13.0 billion from $10.5-$12.5 billion. On the other hand, the company lowered its net income estimate to $8.4-$9.9 billion from $8.7-$10.1 billion. These estimates reflect the impact of supply-chain challenges.

Valuation

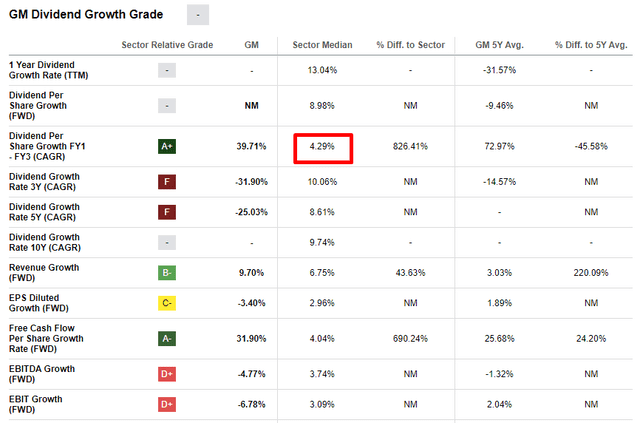

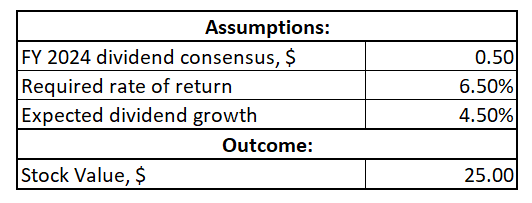

I cannot call General Motors a growth company because the company’s financials are stagnating, as we have seen in the above passage. Therefore, I will start my valuation analysis with the discount dividend model [DDM] approach. Valueinvesting.io estimates the company’s WACC at 6.5%. Dividend consensus estimates expect FY 2024 dividend to be at $0.5 per share. Dividend growth is tricky since the company has struggled to raise dividends recently. For my DDM, I will simulate the calculation with sector median expected dividend growth, which is at 4.3%

Seeking Alpha

Incorporating all the above assumptions into the DDM formula returns a fair stock price of $25 per share, more than 30% lower than the current level.

Author’s calculations

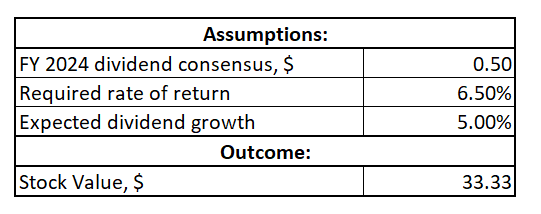

I would like to emphasize that GM does not have a consistent history of dividend hikes in recent years. Therefore, DDM calculations are relatively optimistic. Even if I implement a 5% dividend growth rate, the stock still looks slightly overvalued.

Author’s calculations

Please do not be misled by multiples. If you go to Seeking Alpha Quant valuation ratings, you can see that the company’s multiples are substantially lower than the sector median and its historical 5-year averages. I believe that ridiculously low valuation ratios are fair, given weak cash flow generation and low and unstable dividends.

Maybe Morningstar Premium would argue with my pessimistic view of the company’s valuation. The resource assigned GM’s stock a five-star rating meaning that the company is trading at a substantial discount according to them. But, historically, GM stock consistently traded far below Morningstar’s fair value estimations. The stock went close to the fair value estimations only during the 2020-2021 stock market frenzy.

Risks to consider

I think a secular shift to clean energy is a significant risk for the company. The competition in EV space is a real massacre and I believe that GM is lagging behind its competitors. For example, the electrified version of the company’s most iconic model, the Chevrolet Silverado, is expected to be released in late 2023 or early 2024. At the same time, Ford has been selling its electrified iconic F-150 pickup since 2021. In 2022 Ford sold 15,617 all-electric F-150 Lightnings, according to Barron’s. Rivian Automotive (RIVN) also offers comparable-sized trucks, which were even more popular than F-150 Lightning in 2022. Tesla’s (TSLA) Cybertruck delivery event is also expected in autumn 2023. That said, we can see that electrified Silverado will face very tough competition among EV trucks.

Let me also remind you that EVs are not purely about how vehicles are powered. EVs are also very much about sophisticated software like autonomous vehicle solutions. TSLA’s Full-Self Drive [FSD] software is learning itself rapidly, driving more than 1 million miles per day. GM has to invest vast resources to keep up with technology disruptions like Tesla’s FSD. Significant R&D investments are always a risk that investments will not pay off.

The company’s vast net debt position is also a considerable risk, especially given the still negative levered FCF, meaning there is almost no room for the company to improve financial leverage metrics. Such a prominent net debt position gives fewer options for the company to fuel growth or R&D expenditures.

Bottom line

To conclude, I am not investing in GM and assign its stock a “Hold” rating. I don’t like companies with stagnating financials and meager dividends. The stock is traded at a substantial discount from a valuation ratios perspective, but I consider this discount fair, especially given the outcomes of my DDM calculations. In my opinion, the company is weakly positioned to face unfavorable secular trend of rapid EV adoption.

Read the full article here