Investment Thesis

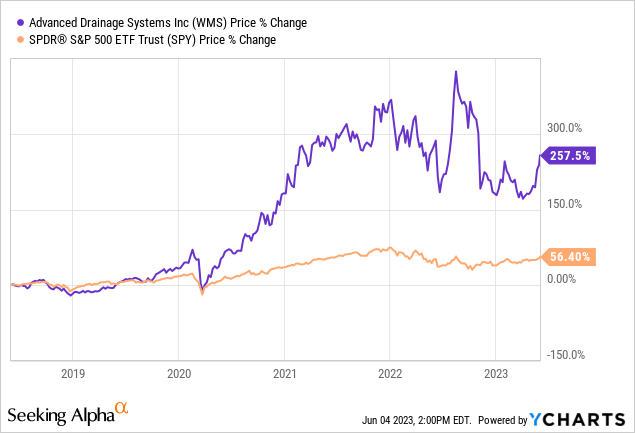

Advanced Drainage Systems (NYSE:WMS) has quietly returned over 250% in the past five years, vastly outpacing the broader indexes. While the company is up 26% year to date, it is still down over 30% from mid-August last year. I believe the pullback presents a great buying opportunity for this hidden gem in the attractive water industry.

The company’s products for water management should continue to benefit from the increasing importance of water and sustainability. The rebound in construction spending for water supply should also be a meaningful near-term tailwind. Despite the recent rebound in share price, the current valuation remains pretty discounted, especially when compared to other water companies. If the company can continue to execute, I believe its valuation will eventually catch up with peers, which should offer meaningful upside potential.

Market Opportunities

Advanced Drainage Systems is an Ohio-based company that provides water management products and solutions for stormwater and onsite septic wastewater. The company offers a wide range of products for water conveyance, treatment, storage, and capture, as shown in the picture below.

Advanced Drainage Systems

The water management market is large and expanding quickly. According to Markets and Markets, its global market size is forecasted to grow from $13.8 billion in 2021, to $22.4 billion in 2026, representing an upbeat CAGR (compounded annual growth rate) of 10.1%. The market expansion is mainly driven by the growing importance of water and the rising awareness of sustainability. People are now seeking ways to better capture and treat water in order to reduce wastages and leakages, which should continue to boost the demand for water management products.

The company is also benefiting from other favorable trends in the stormwater and onsite wastewater markets. Onsite wastewater treatment systems are gaining popularity as they are much more cost-efficient and environmentally friendly. According to the company, one-third of the new single-family homes built in the US now use onsite wastewater treatment systems.

On the other hand, stormwater is a major cause of water pollution and flooding in the US, and the current infrastructures in place are inadequate. With climate change increasing the frequency of stormwater, the need for better water management products should continue to rise.

Mixed Earnings

Advanced Drainage Systems’ latest earnings were pretty mixed but this is largely expected given the slowdown in the macro environment and the strong results from the prior year. The company reported net sales of $618 million, down 9% YoY (year over year) compared to $678 million. The drop was mostly driven by the Infiltrator segment, which declined 21.3% from $130.6 million to $102.7 million. The domestic pipe segment was also quite weak, which dropped 9.9% from $396.7 million to $357.4 million. The weakness was caused by the lowered construction activity amid higher interest rates.

The bottom line was much stronger as the company continue to show great operating leverage. Gross profit increased 16.9% YoY from $190.2 million to $222.4 million, while the gross profit margin expanded 800 basis points from 28% to 36%. This is largely due to favorable product pricing and lowered material costs. Material costs should continue to be a tailwind as inflation eases further. The adjusted EBITDA increased 2% YoY from $169 million to $172 million, as the figure was dragged down by higher interest expense and the loss on disposal of assets and activities. The adjusted EBITDA margin expanded 300 basis points from 24.8% to 27.8%. The diluted EPS was $1.06 compared to $0.54.

The company’s balance sheet remains healthy with $217 million in cash and $1.38 billion in debt. This translates to a leverage ratio of just 1.2x, which provide ample financial flexibility. The company bought back $575 million worth of shares in the past year with $425 million still remaining under the current share repurchase authorization. The ongoing buybacks should continue to provide some support for the EPS figure.

Rebounding Water Supply Spending

While the slowing economy is putting meaningful pressure on Advanced Drainage Systems, the ongoing increase in construction spending should help offset some of that weakness, as the company generates 86% of its revenue from the construction industry. According to the Federal Reserve Economic Data, the US seasonally adjusted annual rate of total construction spending continues to edge up and reached a historical high of $1,908 billion in April, up 7.1% compared to $1,781 billion in the prior year.

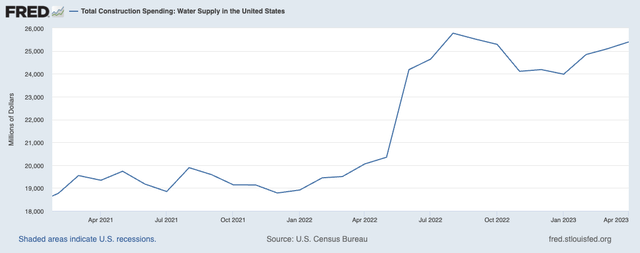

The construction spending for water supply was particularly strong. After the drop since August last year, the segment’s spending started to rebound in February and is now up 5.8% compared to the low in January, as shown in the chart below. I believe the unprecedented rebound in spending should provide solid support for the company in the near term.

FRED

Discounted Valuation

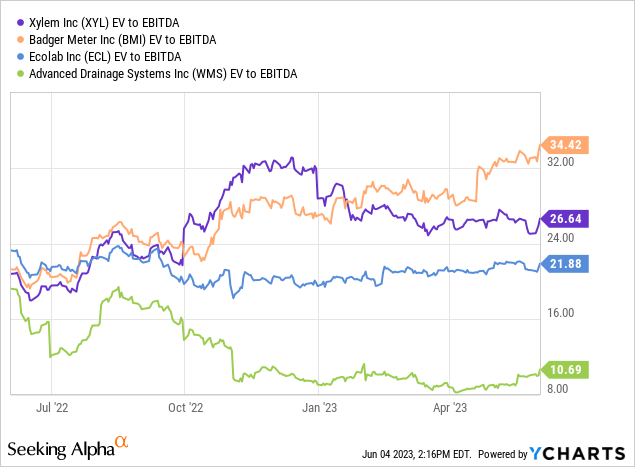

Despite the recent rally, Advanced Drainage Systems’ valuation still looks very attractive in my opinion. The company is currently trading at an EV/EBITDA ratio of just 10.7x which is discounted compared to both peers and its own historical average (I am using the EV/EBITDA ratio as it can take its debt into account).

As shown in the chart below, the current multiple is substantially lower than other notable water companies such as Xylem (XYL), Ecolab (ECL), and Badger Meter (BMI). Its valuation has diverged from others since mid-last year and is now trading at a discount of 61.2% compared to peers’ average EV/EBITDA ratio of 27.6x. On a historical basis, the company is also cheap. The current multiple represents a solid discount of 28.2% compared to its 5-year average EV/EBITDA ratio of 14.9x.

Risk

The macro uncertainty continues to be the major risk of Advanced Drainage Systems, as the company is pretty exposed to the broad economy. While construction spending for water supply rebounded recently, it may fall once again if the economy continues to deteriorate or enter a recession. This will significantly impact demand and put immense pressure on the company’s financials. I believe the pace of construction spending is something worth keeping track of moving forward.

Investors Takeaway

Advanced Drainage Systems is an often overlooked water company. While many are unaware of the company, it is actually a top-10 holding in notable water ETFs including Invesco Water Resources (PHO) and First Trust Water (FIW). The company should be well-positioned to benefit from the growing water management market and the favorable trends in its submarket. While the latest financials are being pressured by the slowing economy, the rebound in construction spending should provide solid support in the near term.

The company’s valuation is very compelling as the market is still pricing it like an infrastructure play rather than a water play. The valuation gap between the company and its peers could translate to massive upside potential if the company can continue to demonstrate solid growth. I believe the risk-to-reward ratio should be favourable at the current levels therefore I rate the company as a buy.

Read the full article here