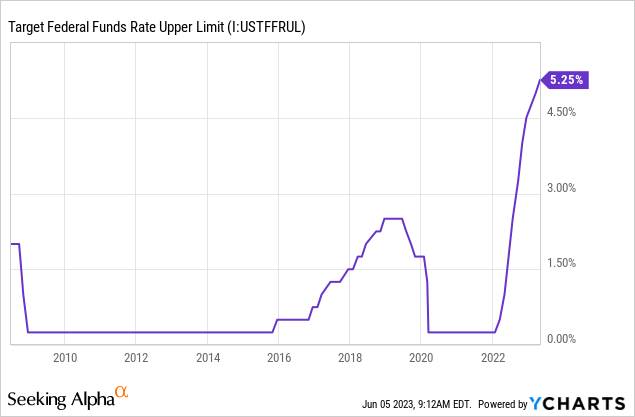

REITs yielding 4-6% were wonderful investments throughout the past 15 years when the Federal Reserve mostly kept its rate near zero and never exceeded 2.40%.

REITs were particularly attractive to retirees with large IRAs or 401Ks as their nonqualified dividends were usually much higher than the dividends thrown off by other kinds of dividend growth stocks. So through an extended period retirees grew comfortable relying on them.

Of all the REITs popular with income investors, perhaps the most impressive is Realty Income

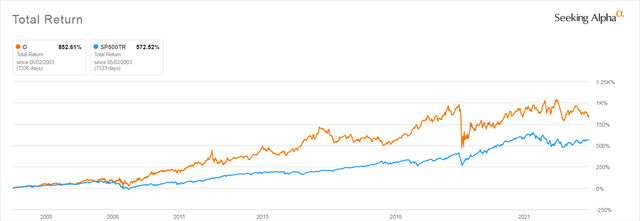

Realty Income (NYSE:O) is a member of the S&P 500. It is an S&P dividend aristocrat, too. That’s because it has raised its dividend every year for more than 25 years. It has not only delivered income, either. Investors in O have done well over the past two decades, beating the S&P 500 in total return. It’s also very attractive to retirees because it pays its dividend monthly unlike most other REITs and dividend growth stocks that only pay out quarterly.

Realty Income and S&P 500 Total Return 6/2003 – 6/2023

Seeking Alpha

REITs Rely on Borrowing and Realty Income’s Credit Rating is Superior to That of Other Popular REITs

Credit is an important issue for REITs, since by law they have to distribute 90% of their taxable income to investors. When they need funds for continuing operations or to buy new properties they need to either issue more shares, diluting existing shareholders, or go to the markets to borrow. As rates rise, borrowing becomes much more expensive, particularly for companies whose credit ratings aren’t very good.

Realty Income has the highest credit rating of the popular REITs Seeking Alpha analysts are currently recommending. It’s S&P Global rating is currently A-, This puts it in the middle range of investment grade. In contrast, fellow S&P 500 member REIT Regency Centers (REG) is rated BBB+, a step lower. Digital Realty Trust (DLR), also a S&P 500 member’s credit is rated another step down at BBB, which puts it into the lowest group of investment grade ratings. VICI Properties (VICI), a much newer REIT that is often extolled by writers here on Seeking Alpha has a credit rating one step lower, BBB-, which puts it at the very bottom of investment grade, one step above junk.

Have Surging Fixed Income Rates Made Realty Income Less Attractive?

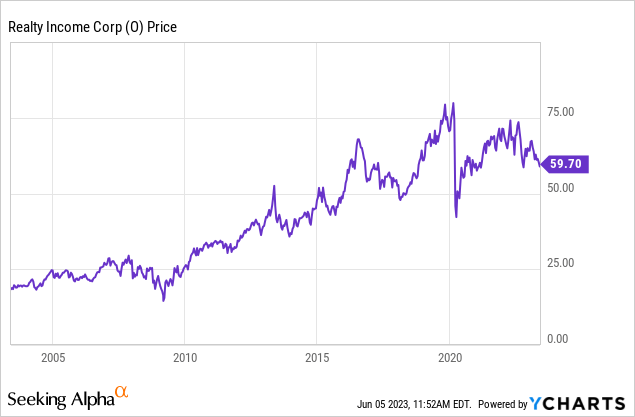

The success and growing popularity of Realty Income over the past 20 years owes a lot to the fact that after the 2008 Financial Crisis the Federal Reserve pursued an unrelenting policy of keeping rates artificially low, so low that at times the Federal Fund rate neared 0%. Faced with the choice of receiving 1 or 2% from a safe CD or treasury investment or investing in riskier REITs paying anywhere from 4-6%, many retirees accepted the risk and bought into REITs. You can see from the chart above how Realty Income’s returns only took off, compared to the S&P 500 after the beginning of the Fed’s rate suppression.

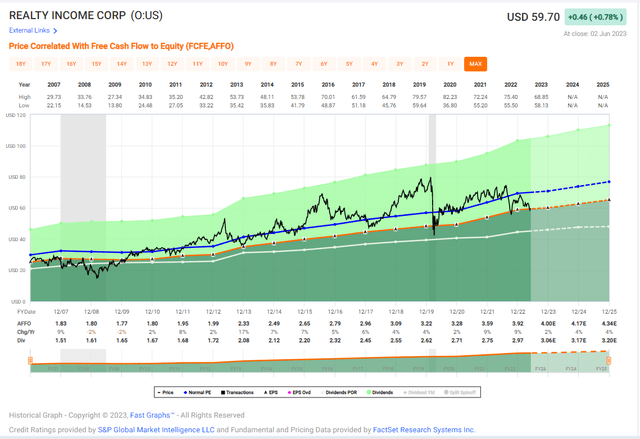

The rising rates that began in mid-2022 and continue to the present day presented income investors with the first viable alternative to investing in risky stocks since 2008. As a result, Realty Income’s price took a hit from rising rates. As you can see, after many years of mostly high valuations it currently looks fairly valued–assuming that analysts’ estimates of its future earnings are correct, which is, as always, a questionable assumption to depend on.

fastgraphs.com

Realty Income is now priced at about the same price it was at in November of 2018. That was the last time it appeared to be at fair value and was also, not so coincidentally, as you will recall, the last time before the present when the Federal Reserve was raising the Federal Funds rate.

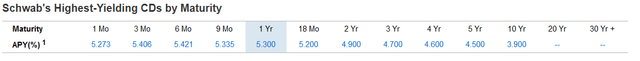

Realty Income’s Yield Is No Longer Compelling

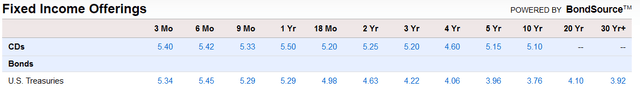

Realty Income currently is yielding 5.13% If I wanted to invest in an income product that present far less risk than any REIT I can do it now. Below you can see the rates currently offered for brokered, noncallable FDIC insured CDs available at Schwab and other brokerages that use BondSource. As you can see CDs with a maturity of a few months up to 18 months have a better yield than does O right now.

Brokered CD Rates at Schwab 10:39 6/5/2023

Schwab.com

Since O’s dividend like that of most REITs is not a qualified dividend, there is no advantage to buying O rather than a CD for investors investing in taxable accounts.

For the investor in a taxable account, shorter treasuries now are yielding even more than CDs of the same maturity and have the advantage for those investing in taxable accounts that they are not subject to state and local taxes. This can make their real yield significantly higher for well-off taxable investors living in states with high income tax rates.

Treasury Rates at Schwab 6/5/2023 11:00 AM (CD rates quoted in this display include callable CDs)

Schwab.com

Realty Income’s Price Will Suffer if Inflation Persists

Investors in a CD and Treasuries are guaranteed to get back the money they invest in their CD or Treasury if they hold it for its full term. Realty Income, like any stock, may see its shares lose value. As many income investors learned in 2022, a high dividend isn’t very fulfilling if the share price drops more than the amount paid out in dividends. So although Realty Income has indeed seen its price increase over the past decades, investors should not cling to the false belief that its share price will always keep increasing with only occasional declines when the market suffers some shock.

Historical Evidence that Realty Income’s Price Is Closely Tied to the Federal Funds Rate when Rates are Not Artificially Suppressed

In the period before the 2008 Financial Crisis and the beginning of the long period when the Federal Reserve suppressed rates, its yield appears to have tracked pretty closely to that of the Federal Funds rates. For example, on December 31, 2007, its annual yield was 5.19%, slightly more than its current yield of 5.13%. Throughout much 2007, the Federal Funds Rate was between 5.25% and 5.00%, averaging 5.02% for the year, not far from Realty Income’s 5.19% yield. Note how these numbers are very similar to Realty Income’s yield and that of the Federal Funds rate just now.

This close relationship of Realty Income’s yield to the Federal Funds rate disappeared only after the Federal Reserve embarked on its campaign of artificially lowering interest rates, QE. For example, while the average Federal Funds Rate for 2012 was .14%, Realty Income’s for 2012 was 4.41%.

Not so surprisingly, once the initial shock of the Great Financial Crisis wore off, investors seeking income in a zero-rate fixed income world piled into Realty Income. Between 2003 and 2007, its price surged, near tripling from its price of $26.58 in January of 2010 to its high of $79.83, which it reached in February of 2020, just before the Pandemic changed everything.

Realty Income Price, 2003 to Present

Investors Now Must Hope Realty Income’s Dividend Increases Keep Up With Inflation

QE is over now. The Federal Reserve’s mandate requires it use its tools to control inflation. The latest data suggests that inflation is still quite high. The Fed also has a mandate to support employment, but employment too continues to be aggressively healthy. So it is very likely the Fed will be forced to raise rates several more times.

What people who did not invest in fixed income back before QE might not know is that historically the Federal reserve kept its rate one or two percent above the current inflation rate. Other lending rates were then traditionally another point or two above the Fed rate. With the healthy profits they earned from selling mortgages and other loans at rates above those at which the banks were borrowing, banks could pay CD investors rates that were another point higher than the Federal Funds rate, too.

Right now, inflation appears to be running at an annual rate very close to 5%, which is the current Federal Funds Rate. If we look at historical rates, as I am sure the members of the Federal Reserve FOMC do, that leaves at least another 1% before their rate is really at a level that could be considered tightening. Thus unless inflation takes a sudden, increasingly unexpected drop, we can expect to see the Fed rate rise to 6%. That would push the better CD rates up to 7% and bank lending rates up to 8% and more depending on borrowers’ creditworthiness.

Dividend Increases will Take A While to Match another 1% Rise in Rates

Investors in Realty Income may find themselves enjoying annual dividend increases. But if Realty Income needs to spend more due to the rising costs of goods and services in a continuing inflationary environment, the money it has to payout to investors may decrease. It only gave investors a 2.14% raise in 2021. The 2% annual growth of a 5.13% yield is not enough to keep up with another .25, .50, or even 1% rise in the Federal Funds Rate. As its rate becomes less competitive with a ladder of short term treasuries or CDs, the income-hungry retirees who swelled the ranks of Realty Income investors may cash out, putting their money into safer CDs and treasuries that are yielding more with far less risk, and leaving REITs to the smaller core of investors who did not just invest in REITs for the higher yield.

But What if the Fed Folds?

I constantly see readers posting in comment sections that they are certain that the Federal Reserve will tank rates again at the first sign that the U.S. is entering a recession. This is supposed to counter any argument that relies on the idea of rates staying at their current level or rising further. A return to near 0% fixed income rates would, of course, once again make dividend stocks like Realty Income more attractive to investors.

But it is almost certain that over the past two years the Fed has learned a painful lesson about how continually suppressing rates inflates asset bubbles and leads to the kind of hard-to-control inflation we are now experiencing. They have certainly learned the less that they were taught in the 1970s about how prematurely reducing rates in response to small decreases in inflation can lead to double digit inflation that can’t be controlled without raising rates to near 20%.

That’s why I believe that the only reason that the Fed will drop its rate to a level that made the yield of Realty Income’s yield attractive again would be if the U.S. entered a severe and prolonged recession, along the lines of what we saw begin in 2001 and 2008.

But think this through. If we were to enter that kind of recession, the companies that rent Realty Income’s properties would also be hit hard, and that could cause its income to decline, which would also damage its share price and its ability to raise its dividend or even keep it at the current level, should the recession last more than a few months.. As you can see from the graph above, Realty Income’s price took a big hit both in 2008 and during the 2020 Pandemic.

Bottom Line: Realty Income Now is Strictly a Real Estate Investment, Not a Superior Income Investment

Realty Income’s value to investors right now depends entirely on the quality of its investments. If, like me, you have very little knowledge about commercial and industrial real estate investments, you probably don’t have the skills needed to make an educated guess about Realty Income’s future prospects and will have to depend on the advice of people who present themselves as experts.

I prefer to invest in stocks selling products and services which I am more capable of understanding. And for income, I much prefer investments where my principal is going to be returned to me at a set date. I’d prefer to risk missing out on capital gains if it means I will also miss out on capital losses when I’m investing for income.

For me, fixed income has always been not only about generating income, but about reducing the risk of losing the assets I have been fortunate enough to acquire over a long life. If I were to invest in a REIT right now I would treat it as part of my riskier stock allocation, not as an income-producing fixed income proxy.

The long drought of safe fixed income opportunities has finally come to an end and retirees who like to sleep well at night have regained the option to invest in much safer investments that REITs.

Read the full article here