Introduction

Denver-based Royal Gold, Inc. (NASDAQ:RGLD) is one of the reliable streamers I have regularly covered on Seeking Alpha since September 2018.

This article covers the earnings Q1 2023 released on May 3, 2023 and all the following new information. This article updates my preceding article on RGLD, published on April 24, 2023.

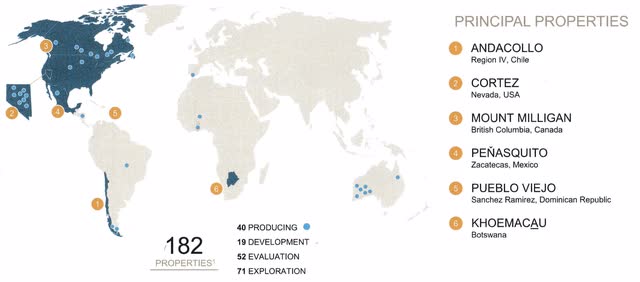

RGLD has a solid asset portfolio with six principle-producing mines and 182 properties as of March 31, 2023. The Map below is from the June Presentation.

RGLD Map Assets Presentation (RGLD June Presentation)

1 – 1Q23 Results Snapshot and recent activity

Royal Gold posted a net income of $63.88 million, or $0.97 per diluted share, compared to $65.68 million, or $1.00 per basic and diluted share, in the first quarter of 2022. The adjusted earnings per share were $0.96 in the first quarter 2022.

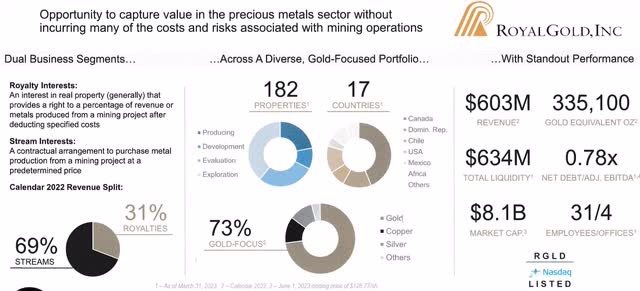

RGLD Company Overview 1Q23 (RGLD Presentation)

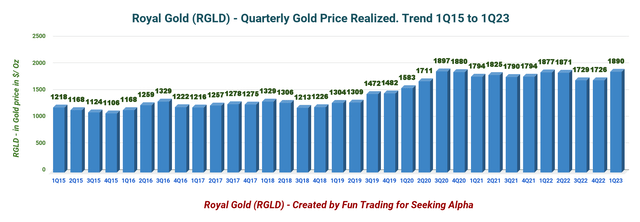

During the first quarter, Royal Gold posted total revenue of $170.39 million, comprised of stream revenue of $115.00 million and royalty revenue of $55.4 million at an average gold price of $1,890 per ounce, an average silver price of $22.55 per ounce and an average copper price of $4.05 per pound.

Gold equivalent production was weak for 1Q23 at 92.2K GEOs. Production was 39.7K Au ounces, 859.2K Ag ounces, and 3.6 Moz of copper.

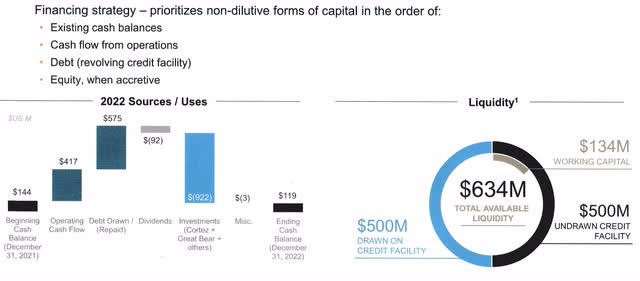

Royal Gold still has an excellent debt profile with net debt of $370 million and $634 million in liquidity.

2 – Investment Thesis

Royal Gold is an excellent long-term investment with significant liquidity at about $643 million after funding three large projects. The company pays a quarterly dividend of $0.375 per share in 1Q23 or a yield of 1.23%, which aligns with its peers FNV and WPM.

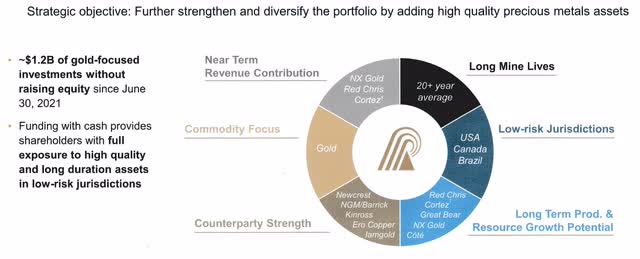

The long-term growth potential is clear.

RGLD Recent Transactions (RGLD Presentation)

CEO Bill Heissenbuttel said in the conference call:

Our portfolio performed well, and we saw continued progress at several assets in the portfolio that should provide interesting news flow in the near to medium term.

I do not own RGLD because I already own Franco-Nevada Corporation (FNV), Wheaton Precious Metals Corp. (WPM), and Sandstorm Gold Ltd. (SAND), but I consider it one of the strongest with Franco Nevada and Wheaton Precious Metals.

Note: Bank of America downgraded RGLD today to Underperform from Neutral with a $130 price target, trimmed from $149, citing heightened operational and execution concerns around key assets in the streaming company’s portfolio.

I find the downgrade quite surprising and harsh. Mount Milligan production issues have been largely factored into the price already, especially if the BofA commodities team calls for the gold price to average $2,200/oz later this year.

I recommend short-term trading LIFO, 40%-50% of your long-term position, due to the volatility of the streams & royalties industry. This dual strategy has been encouraged in my marketplace, “The Gold and Oil Corner,” I believe it is the best way to maximize your gain over a long period while reducing the risk of a sudden downturn.

3 – Stock Performance

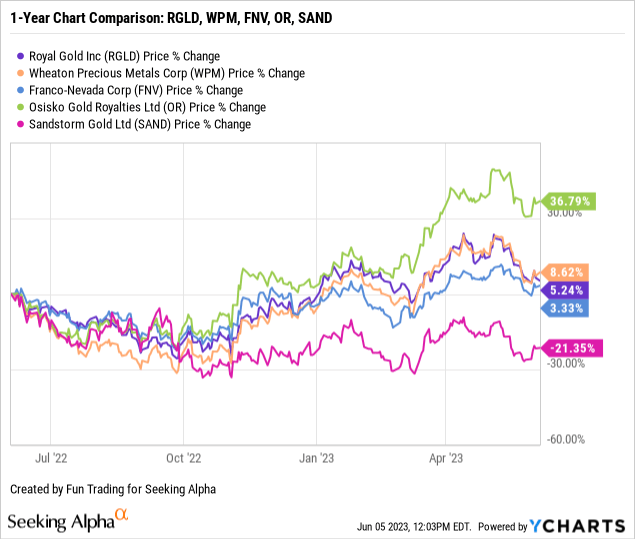

Royal Gold, Inc. has dropped significantly since February 2023 after the Fed turned hawkish again and signaled more increases to fight stubborn inflationary pressures. However, gold strengthened significantly after April and trades at over $1,950 per ounce.

Royal Gold is up 5% on a one-year basis, which is in line with its peers, excluding SAND, which continues to underperform, and OR, which outperforms the group.

Royal Gold Inc: Balance Sheet And Production History Ending In 1Q23 – The Raw Numbers

| Royal Gold | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Total Revenues in $ Million | 162.36 | 146.44 | 131.43 | 162.98 | 170.39 |

| Net Income in $ Million | 65.68 | 71.14 | 45.79 | 56.37 | 63.88 |

| EBITDA $ Million | 130.15 | 110.82 | 103.46 | 124.54 | 135.45 |

| EPS diluted in $/share |

1.00 |

1.08 |

0.70 |

0.86 |

0.97 |

| Operating cash flow in $ Million | 101.13 | 120.20 | 94.99 | 101.03 | 108.66 |

| Capital Expenditure in $ Million | 37.80 | 0.04 | 677.99 | 206.33 | 0.00 |

| Free Cash Flow in $ Million | 63.33 | 120.16 | -583.00 | -105.30 | 108.66 |

| Total cash in $ Million |

183.71 |

280.62 |

122.24 |

118.59 |

126.82 |

| Long-term debt in $ Million | 0 | 0 | 446.33 | 571.57 | 496.82 |

| Dividend per share in $ | 0.35 | 0.35 | 0.35 | 0.375 | 0.375 |

| Shares outstanding (diluted) in Million | 65.65 | 65.68 | 65.66 | 65.66 | 65.71 |

| Gold Production | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Gold Equivalent ounce Production K Geo | 86.5 | 78.3 | 76.0 | 94.3 | 92,0 |

| Gold price realized $/ GEO | 1,877 | 1,871 | 1,729 | 1,726 | 1,869 |

Data Source: Company release and Fun Trading.

Analysis: Revenues, Earnings Details, Free Cash Flow, Debt, And Production Details

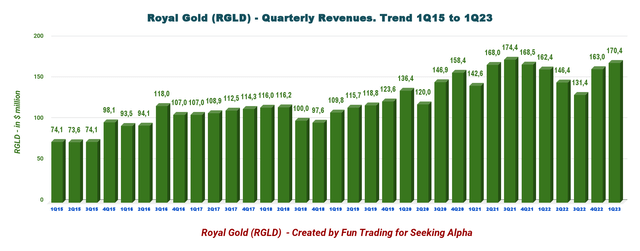

1 – Revenues Were $170.39 Million in 1Q23

RGLD Quarterly Revenue History (Fun Trading)

As of March 31, 2023, Royal Gold reported total revenues of $170.39 million, comprised of stream revenue of $115.0 million and royalty revenue of $55.4 million at an average gold price of $1,890 per ounce, an average silver price of $22.55 per ounce and an average copper price of $4.05 per pound.

The revenue increase was primarily due to higher gold and copper sales at Mount Milligan, higher gold production attributable to Royal Gold’s interest at Cortez due to the newly acquired royalties, and higher silver sales at Khoemacau due to the ramp-up.

Net income for the quarter was $63.88 million or $0.97 per diluted share, from $65.68 million or $1.00 per diluted share last year. Adjusted earnings were $63 million or $0.96 per share.

Net cash provided by operating activities totaled $108.7 million for the first quarter, compared to $101.1 million for the prior year.

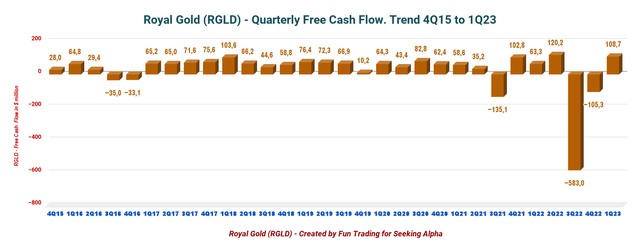

2 – Free Cash Flow was $108.66 million in 1Q23

RGLD Quarterly Free Cash Flow History (Fun Trading)

Note: The free cash flow is the cash from operating activities minus CapEx.

The quarterly free cash flow was $108.66 million in 1Q23, and the trailing 12-month free cash flow was a loss of $459.49 million.

The quarterly dividend is $0.375 per share for 1Q23.

The Free cash flow is negative for the year after Royal Gold acquired a sliding-scale gross royalty (the “Cortez Complex Royalty”) on an area including the Cortez mine operational area and the Fourmile development project in Nevada (the “Cortez Complex”) for $525 million in cash consideration. Also, On September 9, 2022, Royal Gold announced that it had completed the previously announced acquisition of all of the issued and outstanding shares of Great Bear Royalties Corporation for approximately $151.7 million in cash consideration.

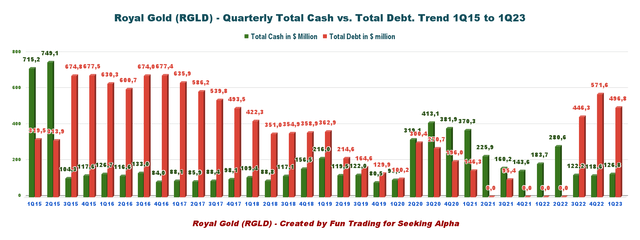

3 – $634 million available in Liquidity at the end of March 31, 2023.

RGLD Quarterly Cash versus Debt History (Fun Trading)

RGLD has a debt of $496.82 million in 1Q23. Liquidity was $634 million, with total cash of $126.82 million at the end of March 2023.

However, RGLD repaid $75 million this quarter, reducing total debt to $496.82 million and increasing total available liquidity to $634 million.

RGLD Balance Sheet Liquidity (RGLD Presentation)

CFO Paul Libner said in the conference call:

we expect to repay the $500 million outstanding revolver balance as cash flow allows. Absent any further business development activity and accretive amount of prices, we anticipate repaying this amount by around mid-2024.

4 – Production In Gold Equivalent Ounce And Details

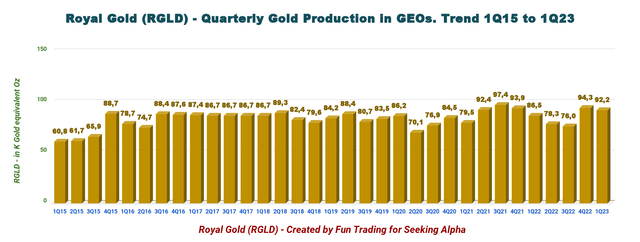

RGLD Quarterly Production GEO History (Fun Trading)

Royal Gold reported a quarterly production volume of 92.2K GEOs (Gold Equivalent Troy Ounces) compared to 86.5K GEOs in the same quarter last year.

Gold, Silver, and copper commodity prices dropped significantly in the first quarter.

This quarter’s average prices:

- $1,890 per ounce for Gold

- $22.55 per ounce for Silver

- $4.05 per pound for Copper.

RGLD Quarterly Gold Price History (Fun Trading)

Note: Royal Gold expects stream segment sales of 54K-59K GEOs for the first quarter of 2023. Complete 2023 guidance will be available in the second quarter of 2023.

Technical Analysis (Short Term) And Commentary

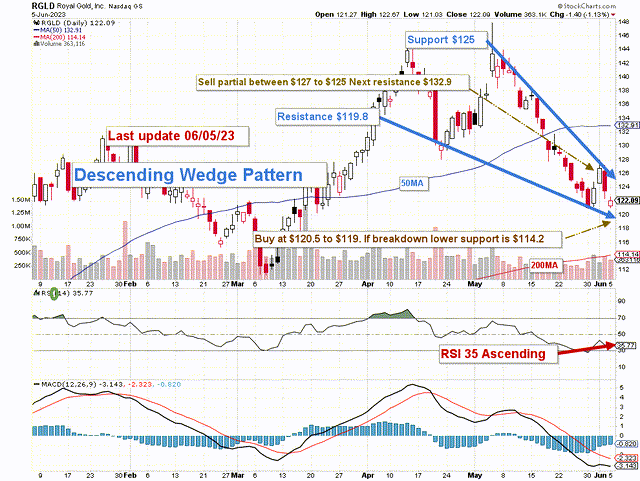

RGLD TA Chart Short-term (Fun Trading StockCharts)

Note: The chart is adjusted for the dividend.

RGLD forms a descending triangle pattern with resistance at $125 and support at $119.8.

The falling wedge is a bullish price pattern that represents a story about the market in which bulls are preparing for another push.

The short-term trading strategy remains the same as in my preceding article. I suggest trading LIFO for about 40%-50% of your position.

I recommend selling between $125 and $127 with potential higher resistance at $132.9 and waiting for a retracement to buy back RGLD between $119 and $120.5 with possible lower support at $114.2.

Trading LIFO allows you to sell your most recent purchases, assuming a profit (of course) while keeping your long-term position underwater until the stock has appreciated enough to consider selling your core position. It is about taking small profits using the chart pattern and Fundamentals by repeating the process as often as possible.

Watch gold like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here