The past three years have been highly tumultuous for technology stocks, partially excluding the more established technology giants. In 2020, a stimulus-driven retail investment activity surge led to immense speculation surrounding “socially popular” companies. In general, newer stock market investors usually prefer buying stocks in companies they are familiar with or those that attract excess media attention. On the one hand, buying stocks in familiar brands and companies naturally leads investors toward buying “high growth” stocks; positive social attitudes toward a company is an unquantifiable fundamental trait that usually accelerates a firm’s customer and employee growth. That said, investing solely based on brand popularity can often cause valuations to rise to nonsensical levels, creating “boom and bust” bubbles.

Accordingly, stocks such as Tesla (TSLA), Zoom (ZM), and Roku (ROKU) performed exceptionally well in 2020 and early 2021 and terribly in 2022 as higher interest rates caused corporate and household financial conditions to tighten. Extremely low-interest rates and immense money creation in 2020 naturally created excess free capital disproportionately deployed toward these “socially/culturally popular” companies. As consumer prices rose, later pushing interest rates much higher, the capital glut became a capital shortage – leading to considerable declines in most stocks that performed the best in 2020. Today, tight financial conditions remain; however, in most cases, the valuations of these stocks are near, and occasionally below, pre-2020 levels.

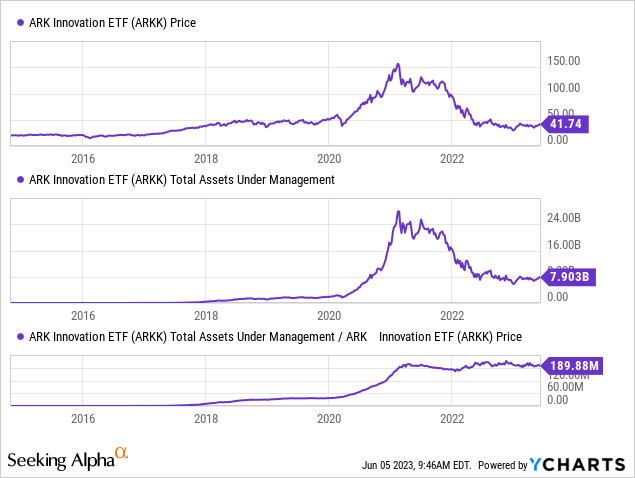

The most obvious and highly publicized example of this “boom and bust” trend are the “Cathie Woods” funds, such as the ARK Innovation ETF (NYSEARCA:ARKK). That ETF rose by a staggering 3X from 2020 to its 2021 peak, eventually reversing all those gains over the following 18 months. The fund’s assets under management rose even faster in 2020 as more speculators and investors piled into high-momentum “culturally popular” stocks. Notably, since its 2021 peak, the fund’s AUM has declined at roughly the same rate as its price, meaning its total existing shares have remained constant – implying very few ARKK owners have sold since 2021 (or, more specifically, fund flows have been flat). See below:

There has been minimal change to ARKK’s strategy since its crash, and most of its core holdings remain the same. The stability of ARKK’s outstanding shares despite an extreme drawdown suggests many investors in the ETF remain hopeful that it will eventually rebound. Indeed, the valuations of many of its holdings are lower today, and the fund has risen by ~37% this year, starting to push closer to its ~$45-$50 historical resistance zone. Increased speculation around AI and related innovations may catalyze a more significant rise in the ETF; that said, there remain substantial fundamental headwinds that I believe greatly limit ARKK’s potential over the coming year and potentially beyond.

Are ARKK’s Holdings Fairly Valued Today?

ARKK, and many of its peer group ETFs, is notorious for owning stocks with extremely high “P/E” ratios. Many of those companies are larger but are more focused on growth than profitability, so it can be difficult to judge the true valuations of those firms (as their growth potential is uncertain). However, other metrics, such as the price-to-sales ratio, can give us an idea of the overall direction of the valuations of these stocks.

Around its 2021 peak, ARKK’s forward “P/E” was stupendously high at around 109X, with significant price-to-sales of 14.5X and a price-to-book of 8X. Of course, due to the technology-growth-centered nature of these stocks, these metrics are not entirely useful when compared to more established stocks. That said, ARKK’s forward “P/E” is around 48X today (44% of 2021 peak), while its price-to-sales is 3.8X (26% of peak), and its price-to-book is 2.45X (30% of peak). Accordingly, the fund’s “valuation” is around a third of its level in 2021. Unsurprisingly, ARKK’s price is around a third of its 2021 peak level, implying no significant fundamental change in its underlying holdings since then.

Today, ARKK is trading at a ~66% discount to its 2021 peak and a slight discount to its pre-2020 levels. Of course, its holdings have changed since pre-2020, although many remain the same, and its core strategy remains identical. From an absolute standpoint, ARKK’s forward “P/E” is still very high today at nearly 50X, over twice that of the S&P 500. If we assume that companies should be worth the discounted value of their future cash flows, the cash-flow growth of these firms must still be immense. That is particularly true considering long-term interest rates are much higher – meaning there is greater discounting of predicted future cash-flows. Therefore, growth stocks usually fall the most as long-term interest rates rise. Although there has been some improvement in growth stocks year-to-date, long-term rates remain high, creating valuation headwinds for these stocks.

Additionally, high-interest rates generally decrease financing capital availability to growth stocks (as investors prefer more stable higher, yielding investments), directly limiting these firms’ growth potential. I believe many growth stocks, including those in ARKK, are still valued based on the ~2012-2019 paradigm of excessively low-interest rates that funneled money into “unicorn” companies. “Unicorn” companies are large firms with immense venture capital backing (often garner social and media attention) but do not necessarily have a clear path to profitability. ARKK’s “strategy” is to buy unicorn companies quickly after IPO. In my view, as long as high-interest rates and quantitative tightening constrain the financing market, investors should not expect “pre-earnings” companies to survive indefinitely off of outside capital – meaning they must improve margins over pursuing growth.

Problematically, eight of the ten largest holdings in ARKK (with the top ten collectively accounting for ~64% of the fund’s assets) have negative operating income. Tesla and Zoom, its largest two holdings, have positive operating income, with Tesla being the only one with substantial operating margins of 15%. Zoom and Block (SQ) have operating margins of 1.5% and -1.9%, respectively, meaning they are on the cusp of operational profitability. The other seven stocks in this group have operating margins below -10%, meaning they are likely years from consistent profitability or have fallen out of favor (such as Coinbase, Shopify, and others). In my view, the riskiest of this bunch are Shopify (SHOP) and Coinbase (COIN), which were profitable but have reversed toward significant losses, implying their business models are not resilient.

Where these firms lack profitability, they partially make up for it with sales growth. The top ten stocks in the fund have median sales growth of ~20% YoY, which is about twice as high as most in the S&P 500. Such high sales growth rates are undoubtedly strong indicators of future earnings potential. However, without a clear path to profitability, high growth rates are not necessarily beneficial and could be problematic should margins fail to improve.

Indeed, many of these companies operate at chronic losses, so the more sales they earn, the more cash they lose. Those with declining gross margins, such as DraftKings (DKNG), are extreme examples of this, as falling gross margins imply they’re only growing because they’re losing increasing amounts of money on new customers. Typically, as a firm grows, its operating expense-to-sales decline (as operating sales are more often “fixed-costs”). At the same time, gross margins improve as firms slowly increase prices as customer retention develops. In my view, besides Tesla, no clear firms show a clear trend toward consistent profitability, as seen through those measures.

The Bottom Line

In the “excess free capital” paradigm that persisted through most of the ten years before 2021, many companies formed that relied on unproven and precarious business models, offset losses with cheap debt, or, more often, immense equity investment flows. ARKK still operates under this paradigm, owning many large firms that do not have a path to profitability laid out. With interest rates much higher and the liquidity excess becoming a shortage (see banking issues), investors have more significant reason to heavily penalize firms that consistently dilute shareholders without improving profitability metrics. Should the valuations of these firms’ prices fall sufficiently (as we’ve seen), they may be unable to sell sufficient equity to offset negative cash flows, giving them significant bankruptcy risk.

Most of the companies in ARKK, including the top ten and bottom ~20, sell trendy products to customers. However, looking at the margins of these firms, many would need to raise product prices by 2-3X to achieve profitability. If so, most would likely lose much of their customer base. In my opinion, most of the stocks in ARKK may be better characterized as “charitable institutions” which provide goods and services without focusing on cash flows. Indeed, their intellectual property may have some value. Still, I do not believe that value equates to their current market capitalizations, as the underlying stability of the business models remains highly questionable.

Compared to before the lockdown boom-and-bust cycle, ARKK is trading at a very similar valuation and price level. However, the financing market environment is much tighter today than then, and the US economy is tightening, forcing many companies and households to reduce excess spending. In my view, this will likely cause underperformance in the growth rate of these firms and a dramatic decrease in their financing capabilities and costs. Eventually, I believe these trends will force these companies to either become profitable (or at least show a clear path toward profitability) or go out of business. From my standpoint, most companies in ARKK have no clear path to profitability, so they may not survive a prolonged negative shift in capital market liquidity. Those who will likely survive, such as Tesla, trade at significant valuation premiums to their industry group, making them seemingly overvalued today.

Overall, I remain pretty bearish on ARKK today from a long-term standpoint. Further, the current economic and monetary environment should create sufficient negative headwinds for ARKK’s holdings over the coming months to push ARKK lower. That said, I do not believe ARKK is a clear short-sale opportunity today because its valuation, although very high, is in the range it was before its 2020-2022 boom-and-bust cycle. Further, the potential downside in ARKK appears quite significant due to the questionable long-term survivability of most, or many, of its holdings.

Investors interested in growth stocks may find better results by looking at innovative high-sales growth firms, filtering out those with negative YoY gross margin changes or positive YoY OpEx-to-sales changes. Further, it may be wise to filter out those with over ~20% increases in price-to-sales ratios YoY to avoid overvalued stocks. I believe that approach would allow investors to buy innovative stocks trending toward profitability instead of those relying on excessively low prices to retain customers (such as most in ARKK today).

Read the full article here