Overview

Clearwater Analytics (NYSE:CWAN) offers Investment Accounting-as-a-Service (IAaaS) through cloud-based software aimed at helping firms to simplify their investment accounting, compliance, and risk reporting while automating and hence reducing the workload (refer to my initiation post for more background). I continue to recommend a buy rating for CWAN after its strong revenue performance in 1Q23. Importantly, management remarked that demand is in line with projections. With a major customer win recently, as well as a strong pipeline for the rest of the year, I believe CWAN has shown that it can continue to shine despite a weak economic climate. This shows that CWAN offerings are resonating with market participants, and it is able to consolidate market share during this downcycle, which reinforces its market position in the next upcycle. As such, I continue to be bullish on CWAN. I expect the business to continue growing like how it has been doing so far, with potential upside as it implements its pricing strategies.

Strong performance

Despite the gloomy economic climate, CWAN has managed to execute and consolidate its market share by attracting notable new clients such as Bank of America Private Bank and Merrill Lynch. To reiterate CWAN targeted customer groups, they are insurers, asset managers (AM), and corporates. Among the mega-cap insurers, management has noted that CWAN is experiencing greater than anticipated growth. They also made significant headway in Europe, where they inked a seven-figure deal, and signed 2 large AM in 1Q23. And so, I think the bears are focusing on the wrong metric when they focus on the gap between ARR growth and revenue growth. CWAN’s continued success in securing high-profile clients and building market share suggests to me that the company has a lengthy growth runway, given that deals with major corporations typically take years to finalize. This means it could be years before the full benefit of the contract is reflected in the P&L after it has been won. Not only that, but it’s important to know that the new “base plus” pricing model is being used for all newly signed contracts. The new pricing structure features a base fee for the book of business already in place, a natural fee increase proportional to the growth of AUM, a yearly reset of the base fee by 3-5%, and a la carte pricing for the various modules available on the platform. This new pricing model will also take time to flow through the entire customer base. As a result of the lag time associated with large deals and the pricing model, CWAN business’s true potential is not yet reflected in the P&L in my view.

Forward growth strategy

I believe there are possible strategic levers that it can pull to drive more growth and revenue streams. Management at CWAN boasted about the company’s extensive data and access to clients’ entire books at J.P. Morgan’s 51st annual global TMC conference. This is possible because of the comprehensive nature of their accounting and regulatory audits. This means that CWAN has complete and accurate accounting information on all of their customers, allowing them to conduct in-depth analyses and offer more insightful recommendations. One example that I can think of is similar to what Xero has done in Australia – Xero Small Business Insights. CWAN could possibly offer the same thing by gathering all the data, segmenting it into relevant verticals, and providing a “benchmark index”. Assuming they achieve widespread adoption as a benchmarking standard, CWAN will be in a strong position to counsel asset managers on how they are faring in comparison to the firms that use CWAN’s services. Taking this service a step further, CWAN could use the aggregated, anonymous data to provide guidance to its customers on how to enhance their own performance in relation to the industry as a whole.

Adopting AI

The rise in AI adoption may disrupt CWAN business, but I don’t think it’s as bad as people think. To begin, 90% of the CWAN solution to clients is automated, with only 10% requiring manual reconciliation. The remaining 10% is handled by in-house machine learning and AI solutions. This means that CWAN has significantly surpassed the norm in terms of AI adoption. I anticipate CWAN making full use of this advancement in reducing the 10% of manual reconciliation that it currently requires due to the growth of generative AI.

Valuation

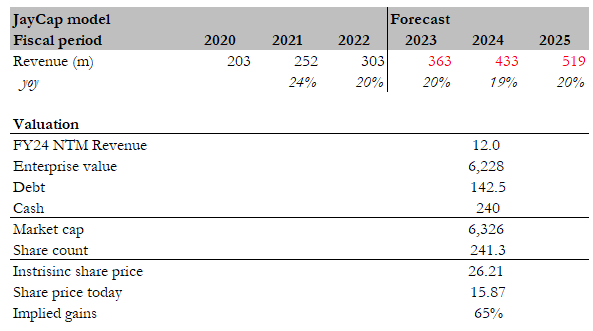

My assessment of CWAN’s upside potential has not changed. In fact, I believe the stock is now much more appealing than it was previously. For whatever reason, CWAN stock has remained at its current valuation of 9.5x forward revenue. I anticipate that valuation will eventually return to its historical average of 12x as CWAN’s performance convinces the market that its market position remains intact, with constant 20% growth. I’d also like to point out that CWAN profit (EBITDA) will likely begin to inflect in the next 1 to 2 years, which should support valuation as well.

Author’s model

Conclusion

I maintain a bullish outlook on CWAN. Despite the challenging economic climate, CWAN has demonstrated strong revenue performance and the ability to attract major clients, solidifying its market position. The gap between ARR growth and revenue growth should not overshadow CWAN’s success in securing high-profile deals, as large contracts typically take time to fully materialize and contribute to the bottom line. Furthermore, the implementation of a new pricing model and access to comprehensive data provide strategic opportunities for additional growth and revenue streams. From a valuation perspective, CWAN’s current stock price appears appealing, and I anticipate a potential increase as the market recognizes the company’s strong market position, steady growth, and the potential for positive EBITDA in the near future.

Read the full article here