(Note: This article was in the newsletter on May 4, 2023 and has been updated as needed.)

Ring Energy (NYSE:REI) reported profit progress despite a commodity price drop. This is something that I have seen in the commodity business for a very long time. Yet the stock price declined. The reason appears to be that the stock market values the company based upon the prices received, without hedging. So, when commodity prices drop, then the stock price follows regardless of the hedging results.

But there is also some investor confusion that if the company reported a certain level of profits when commodity prices were great, then surely the company should be reporting losses in the first quarter. Yet this is exactly what the hedging program is designed to prevent. Those who think that hedges matter to the market only need to look at the latest stock price action to realize that the market does not value the hedging program at all.

Instead, the hedging program is there to justify capital expenditures and to assure lenders of a cash flow should a downturn last. In the latest case, it would appear that oil demand and commodity price actions are going in opposite directions. That will nearly always correct one way or the other. But in the meantime, the company can demonstrate reasonable profits from capital expenditures because the cash flow in the future has been set by the hedging program.

The wells have a relatively long production life. So, profits remain uncertain throughout the life of the well. But as long as an acceptable minimal return is achieved, then the primary future risk is usually seen as more or less profits over that minimum amount.

The latest technology has a lot of wells, whether conventional or not, declining overall at rates that almost “guarantee” a quick adjustment to overproduction during times of weak commodity prices. That is a big change from 50 years ago, when the largely conventional industry took more time to adjust to periods of oversupply.

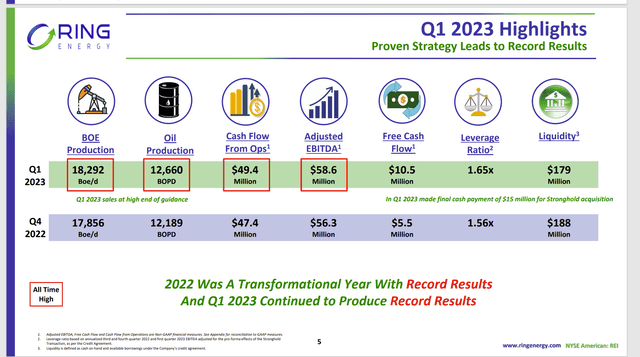

Ring Energy Comparison of Fourth Quarter 2022, And First Quarter 2023 (Ring Energy First Quarter 2023, Earnings Conference Call Slides)

This management did exactly what shareholders would expect management to do when faced with a declining commodity price. Management made an accretive acquisition that blunted the effect of lower commodity prices. In absolute terms, the company set a few records as noted above.

But what is important to shareholders is that the company made per share earnings progress when compared to the first quarter of fiscal year 2022.

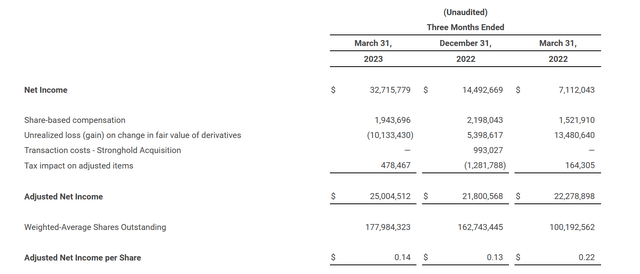

Ring Energy Calculation Of Adjusted Earnings Per Share (Ring Energy First Quarter 2023, Earnings Press Release)

Adjusted Earnings is an attempt to take out the effects of the hedging program when reporting results. In this case, shareholders can see the progress made from the fourth quarter to the first quarter. That was largely due to the acquisition made recently.

The other major effect is that if commodity prices remain at decent levels, then the hedging program allows for steadily better-realized prices net of hedging. Management did report in the presentation that the margin has improved. This is largely due to overall better realized prices.

The hedging program is there to smooth out the commodity price gyrations. This should make it easier for shareholders to see the benefits of the capital program (and really management decisions in general). A consistent hedging program is generally viewed as a zero-sum game by the market. Hence, a lot of prices are declining in the industry despite steady profit progress. That means that those with a hedging program are valued similarly to those without a hedging program because big chunks of the market ignore the hedging results.

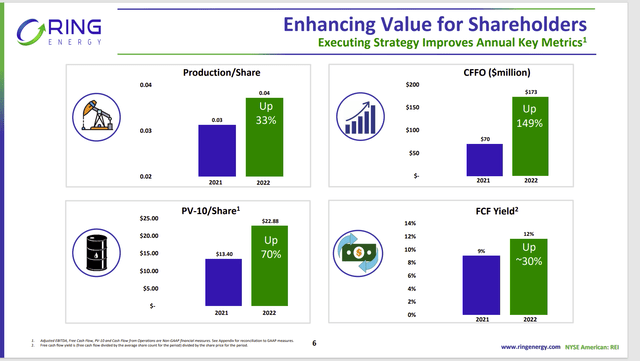

Ring Energy Profitability Progress Through Fiscal Year 2022 (Ring Energy First Quarter 2022, Earnings Conference Call Slides)

The key idea here is that management is trying to communicate that corporate profitability is improving. The market worries about price declines ending up with the company reporting losses (even company destroying losses). However, some costs like administrative are now spread over more production and so will be less per barrel.

It also seems unlikely that something like 2020 will repeat. In that year, management shut down production completely for a while to wait for a commodity price recovery and lived off the hedging program. Even though that strategy was wildly successful, the market worried about sustained low prices due to a depression. That depressed the stock price to an extremely low level.

Now the market is going to watch that free cash flow progress to make sure the debt can be repaid in a reasonable amount of time. Management “took a step backward” to use the credit line (which increased debt) to pay a deferred payment and other adjustments. Sometimes the market really does not count free cash flow as calculated when that happens.

Nonetheless, from here on in, the acquisition expenses are over and free cash flow will not be encumbered by other obligations other than to repay debt.

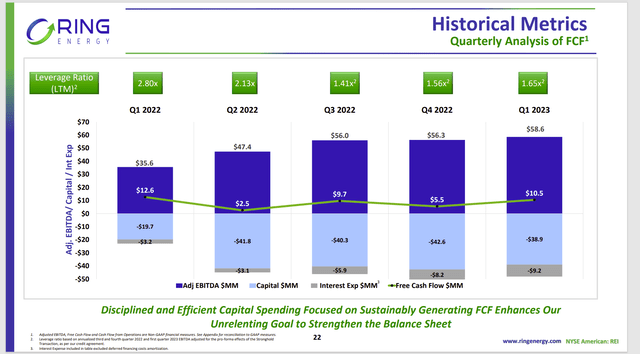

Ring Energy Free Cash Flow Trend (Ring Energy First Quarter 2023, Earnings Conference Call Slides)

Now, free cash flow improvement is likely to come as management finishes assimilating and optimizing the acquisition. Keep in mind that the acquisition is relatively large compared to the company production before the acquisition. Therefore, this could take a couple of quarters. Mr. Market often frets about the possibility of failure during the whole time as well, even though management knows this area pretty well and has built companies before.

The largest consideration is that the debt ratio has come down considerably. Now it has to be lower, assuming considerably lower commodity prices to reassure both lenders and the market. Already, the new loan has considerably relaxed constraints that were not available in the old loan.

Management has mentioned that there are a lot of cheap rework possibilities with very fast paybacks that could lead to material cash flow growth. Management will likely drill new wells also. Production overall is projected to remain level as management ascertains the new acquisition. But the overall profitability of the company appears to have materially improved as a result of the acquisition.

Now that commodity prices have pulled back. This management and a few other companies I follow could well make some more accretive acquisitions. It is a fast way out of the debt situation this company and a few others found itself in. Even if that does not happen, these wells are profitable enough for the company to drill its way to better results.

This management is doing what it needs to do once the coronavirus challenges changed the debt market considerations virtually overnight. The challenges since the big oil price decline appear to have led to a valuation collapse throughout the industry. That will slowly fix itself.

The company is valued dirt cheap despite the progress made since, fiscal year 2020. For that reason, the stock ranks as a strong buy consideration. The biggest risk here is a sustained oil price decline before management can fully take advantage of the acquisition. That is highly unlikely.

This company was an asset story, as are many beginning oil and gas companies. Fiscal year 2020 interrupted the conversion to a regular production company and changed the lending rules overnight. Management is doing well dealing with “the hand they were dealt”. Now all management needs is time and a lack of future challenges. This appears to be very likely.

Read the full article here