This article is dedicated to our summer interns at iREIT on Alpha, who are all college students and eager to learn about dividend investing.

As you may know, I teach frequently at many colleges and universities, lecturing on the topic of Real Estate Investment Trusts (‘REITs’) as I really enjoy teaching students the benefits of owning real estate in a securities wrapper.

So far this year I’ve lectured at Penn State, University of North Carolina, NYU, and Clemson University, and I look forward to launching my very own REIT Masterclass this summer when my new REITs For Dummies book is published.

As I’m sure you know, teaching and investing go hand in hand, as I often remind readers here on Seeking Alpha, investing boils down to four words: learning from your mistakes.

I’ll be the first to admit, I’ve learned a lot over my 30+ year investing career, and I can assure you that learning curve is still growing. This is one such example of the so-called “learning curve”.

source: bumpy-learning-curve

I think about my very first job of being a newspaper delivery boy (I was 15) in which I was responsible for dropping off around 50 newspapers each day. As the learning curve illustrates (above), it started out easy and then once I received a few complaints from customers (for being late or the paper was wet) it got harder.

But I kept pedaling and just when I thought I had things under control, I found out “I don’t know s***” (as per the above chart). I had to learn how to collect money and make sure that customers were paying me. I became confident and after a few months, I was at the point where I had figured it all out.

It took a few speed bumps and a breaking point, but I was able to overcome rather than giving up and retreating to my comfort zone. That in itself, is what investing is all about.

It takes discipline, hard work, and near failure.

Oftentimes the rate of progression is slow at the beginning and then rises over time until full proficiency is obtained, but of course when it comes to investing, I’m not certain that anyone can claim they know it all, even Warren Buffett.

“You have to keep learning if you want to become a great investor. When the world changes, you must change.”

My Big Pivot

As I informed our new interns on their first day, I was a real estate developer for over 20 years in which I learned the concept of value creation literally “from the ground up”.

My formal introduction to the world of brick-and-mortar was hiring architects, engineers, and contractors to construct and lease out buildings to national chains such as Walmart, Walgreens, Advance Auto Parts, and countless others.

I learned the benefits in owning private real estate and the wealth that can be created by use of leverage, local market expertise, and shrewd negotiations. I built a considerable net worth utilizing the same learning curve displayed above.

Just about the time I thought I had figured it all out… and shouted “I did it”…

…something wicked appeared that I had never seen before…

…and it forced me back down the learning curve in which I said to myself, “I don’t know s***.”

You guessed it…the Great Recession.

So, I landed on Seeking Alpha (13 years ago) and during this time I’ve become one of the most-followed writers (I just passed 110,000 followers) with over 3,600 articles to my credit.

The learning curve did not start from scratch though, I was able to utilize all of the lessons learned from decades of real estate experience and channel them into the REIT sector… and this includes the lessons learned during the Great Recession.

So, as I pointed out, this article is dedicated to our interns (that includes my son) and all of those in their 20s. However, you don’t have to stop reading here because I think most anyone can benefit from the picks in this article.

Alexandria Real Estate (ARE)

Alexandria is a real estate investment trust (“REIT”) that specializes in life science office properties. Unlike the rest of the office sector, ARE does not face the same challenges from the work from home movement since they lease space to pharmaceutical companies, biotechnology companies, academic research, medical research institutions, and government research agencies.

Their tenants use their facilities to conduct research in labs which cannot be done from home. ARE’s properties are located in Boston, San Francisco, New York City, Seattle, San Diego, and Maryland. They have around 1,000 tenants and their total real estate portfolio covers 74.6 million square feet.

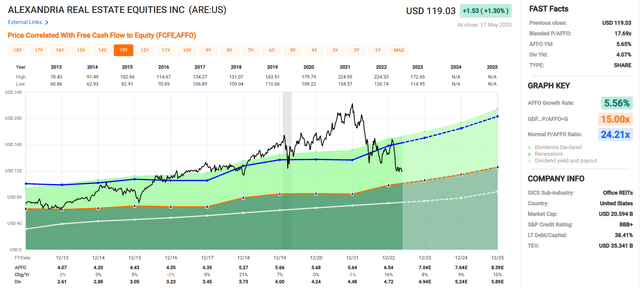

ARE has an average AFFO growth rate of 5.56% over the past 10 years. They pay a 4.07% dividend yield that is well covered with an AFFO payout ratio of 72.17% and have increased the dividend by 8.62% on average since 2013. ARE is currently trading at a P/AFFO of 17.69x which is a significant discount to their normal AFFO multiple of 24.21x. At iREIT we rate ARE a STRONG BUY.

FAST Graphs

Mid-America Apartment Communities (MAA)

MAA is an internally managed REIT that specializes in multifamily communities. They have properties in 16 states and the district of Columbia and have a strong focus on the sunbelt region with their top 5 markets located in Atlanta, Dallas, Tampa, Orlando, and Austin.

Their multifamily properties contain 102,000 apartment units that have an occupancy rate of 95.7% as of year-end 2022. MAA has an A- credit rating from S&P Global and excellent debt metrics with a net debt to adjusted EBITDAre of 3.5x and a long-term debt to capital ratio of 38.34%.

Additionally, their debt is 100% fixed rate and has a weighted average interest rate of 3.4%.

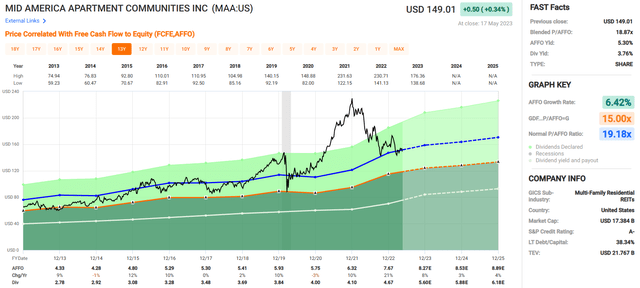

Since 2013 MAA has had an average AFFO growth rate of 6.42% and analysts expect that to continue with projected AFFO growth estimated to be 8% in 2023. MAA pays a 3.76% dividend yield that is very secure with an AFFO payout ratio of 60.95%.

Additionally, MAA has an average dividend growth rate of 5.92% over the last 10 years. Currently MAA is trading at a P/AFFO of 18.87x which is slightly below their normal AFFO multiple of 19.18x. At iREIT we rate MAA a BUY.

FAST Graphs

Realty Income (O)

Realty Income is REIT that specializes in acquiring retail properties that are primarily single-tenant and leased on a triple-net basis. Their portfolio includes 12,237 properties that are in all 50 states, Spain, Italy and the United Kingdom.

Their properties encompass 236.8 million square feet and have an occupancy rate of 99.0% with a weighted average remaining lease term of 9.5 years. Realty Income pays monthly dividends and has increased the dividend for 29 consecutive years making them one of the few REITs that are a Dividend Aristocrat.

They have an A- credit rating and strong debt metrics including a net debt to pro forma adjusted EBITDAre of 5.4x and a 4.6x fixed charge coverage ratio. Their debt is 90% fixed rate and has a weighted average term to maturity of 5.9 years.

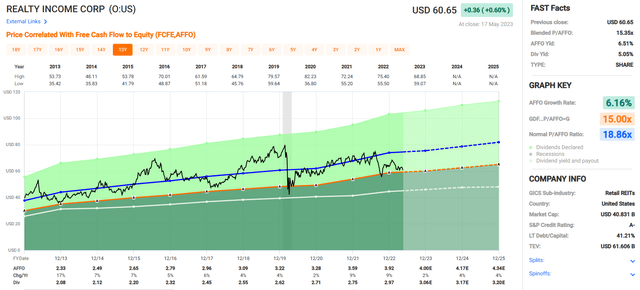

Realty Income pays a 5.05% dividend yield and that is well covered with an AFFO payout ratio of 75.69%. Since 2013 Realty Income has had an average AFFO growth rate of 6.16% and an average dividend growth rate of 5.76% and are presently trading well below their normal AFFO multiple.

Currently Realty Income trades at a P/AFFO of 15.35x which is well below their normal P/AFFO multiple of 18.86x. At iREIT we rate Realty Income a BUY.

FAST Graphs

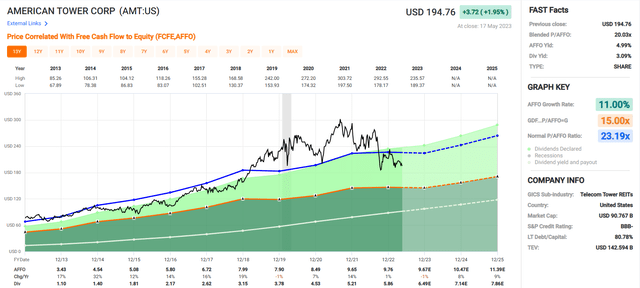

American Tower (AMT)

AMT is one of the larger REITs with a market capitalization of approximately $89 billion. They specialize in multitenant cell towers and other wireless communication infrastructure. AMT has around 226,000 global sites located on 6 continents and in 26 countries.

Their portfolio consists of approximately 43,000 cell towers in the U.S. and Canada and more than 181,000 international towers. Additionally, AMT has 1,700 Distributed Antenna Systems and 28 data centers. Cell towers are part of the “e-commerce trifecta” (along with logistic warehouses and data centers) as they are a necessary component for online retail.

AMT has an average AFFO growth rate of 11% and an average dividend growth rate of 20.70% over the last ten years. They pay a 3.09% dividend yield that is well covered with an AFFO payout ratio of just 60.04%. Currently AMT is trading at a P/AFFO of 20.03x which is a discount to their normal AFFO multiple of 23.19x. At iREIT we rate AMT a BUY.

FAST Graphs

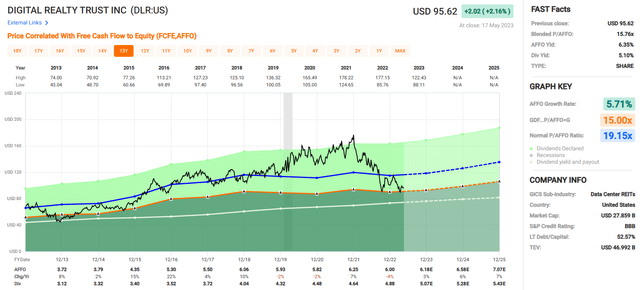

Digital Realty Trust (DLR)

Digital Realty Trust is a data center REIT that owns or has an ownership interest in 316 data centers located in 28 countries and on 6 continents. DLR has a global footprint with properties in the U.S., Europe, Latin America, Africa, Asia, Australia and Canada.

Data centers are where the cloud lives. They store servers that are used for digital communication and processing transactions and are another part of the “e-commerce trifecta”.

Essentially, once an order is placed online, the signal is sent to a cell tower which then routes it to a data center where the information is gathered and organized. As of December 31, 2022, DLR’s portfolio of data centers was approximately 84.7% leased.

Since 2013 DLR has had an average AFFO growth rate of 5.71%. Analysts expect AFFO growth of 3% in 2023 and then 6% and 7% in the years 2024 & 2025 respectively. DLR pays a 5.10% dividend yield that is well covered with an AFFO payout ratio of 81.33%.

Additionally, DLR has an average dividend growth rate of 5.29% over the last 10 years. Currently DLR is trading at a P/AFFO of 15.76x which is well below their normal P/AFFO multiple of 19.15x At iREIT we rate DLR a STRONG BUY.

FAST Graphs

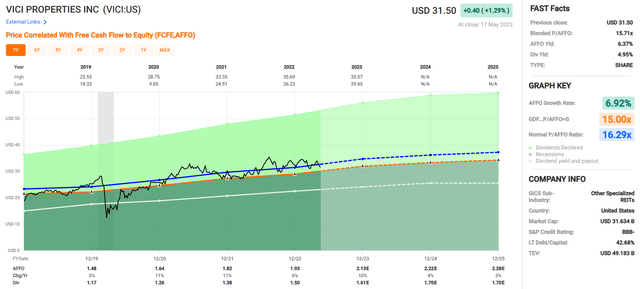

VICI Properties (VICI)

VICI is a REIT in the gaming sector that acquires gaming properties, namely casinos, and other hospitality and entertainment destinations through sale-leasebacks that are structured on a triple-net lease basis. Their portfolio includes trophy properties such as Caesars Palace, the Venetia Resort, and MGM Grand in Las Vegas.

In total VICI has 50 gaming properties spread across 15 states and Canada that covers around 124 million square feet and features around 60,100 hotel rooms and roughly 450 restaurants, nightclubs and bars.

VICI pays a 4.95% dividend yield and that is well covered with an AFFO payout ratio of 77.72%. Since 2019 VICI has had an average AFFO growth rate of 6.92% and an average dividend growth rate of 10.80%. Currently VICI trades at a P/AFFO of 15.71x which compares favorably to their normal P/AFFO multiple of 16.29x. At iREIT we rate VICI a BUY.

FAST Graphs

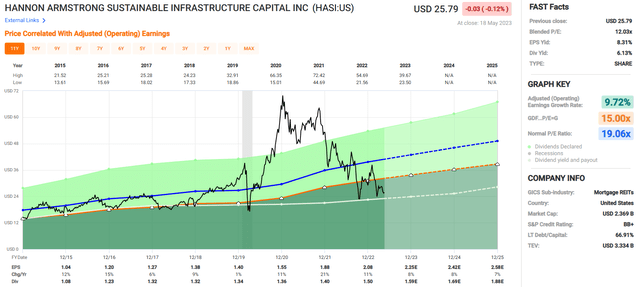

Hannon Armstrong Sustainable (HASI)

Hannon Armstrong is an internally managed Mortgage real estate investment trust (“mREIT”) that invests in climate solutions including renewable energy, energy efficiency and other environmentally sustainable infrastructure projects.

They provide capital to companies for green energy projects such as solar power generation, solar power storage, on shore wind, and energy efficiency improvements. They primarily provide capital and earn the majority of their revenue from interest income, but they also own properties for which they receive rental income.

HASI’s emphasis on clean energy is centric to their investment strategy, so much so that a prerequisite for them to provide capital is that the project has to reduce carbon emissions, or be carbon neutral, or provide some other environmental benefit such as reducing water consumption.

HASI has an average adjusted operating earnings growth rate of 9.72% and an average dividend growth rate of 6.46% over the last eight years. They pay a 6.13% dividend yield that is well covered with a payout ratio of 72.12% when based on adjusted operating earnings.

Currently HASI is trading at a P/E of 12.03x which is a significant discount to their normal P/E ratio of 19.06x. At iREIT we rate HASI a STRONG BUY.

FAST Graphs

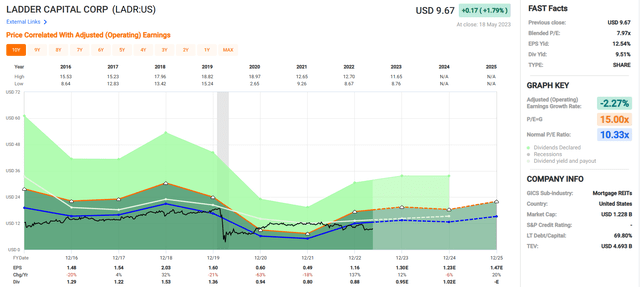

Ladder Capital (LADR)

Ladder Capital is an internally managed mortgage REIT that specializes in commercial real estate lending. LADR originates senior first mortgage loans and variable rate loans that are collateralized by commercial real estate as well as conduit loans on stabilized properties that are securitized and sold as commercial mortgage-backed securities.

In addition to loan origination, LADR invests in securities that are secured by commercial real estate and owns commercial real estate that they receive rental income from.

LADR has an average adjusted operating earnings growth rate of -2.27% since 2016, however, analysts expect earnings to grow by 12% in 2023. They pay a 9.51% dividend yield that is well covered with an adjusted operating earnings payout ratio of 75.86%.

Their average dividend growth rate is -9.79% since 2016, but they did increase the dividend by 10% in 2022. LADR is currently trading at a P/E of 7.97x which is a well below their normal P/E multiple of 10.33x. At iREIT we rate LADR a BUY.

FAST Graphs

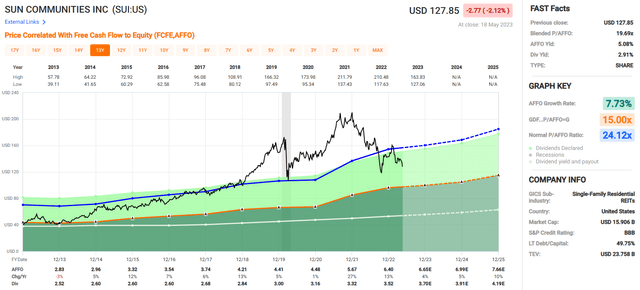

Sun Communities (SUI)

Sun Communities is a REIT that specializes in manufacturing housing (“MH”), recreational vehicle (“RV”) parks, and marinas. They have properties in the U.S., the United Kingdom, and Canada and have been acquiring, developing and operating MH and RV parks since 1975, and more recently marinas in 2020.

Their portfolio consists of 669 properties that include 353 MH communities, 134 marinas, and 182 RV parks. Their MH communities contain a total of 118,204 developed sites, Their RV parks contain 61,514 developed sites (both annual and transient), and their marinas contain 47,823 wet slips and storage spaces.

SUI has an average AFFO growth rate of 7.73% and an average dividend growth rate of 3.43% over the last ten years. They pay a 2.91% dividend yield that is very secure with an AFFO payout ratio of just 55.0%.

Currently SUI is trading at a P/AFFO of 19.69x which is a discount to their normal AFFO multiple of 24.12x. At iREIT we rate SUI a BUY.

FAST Graphs

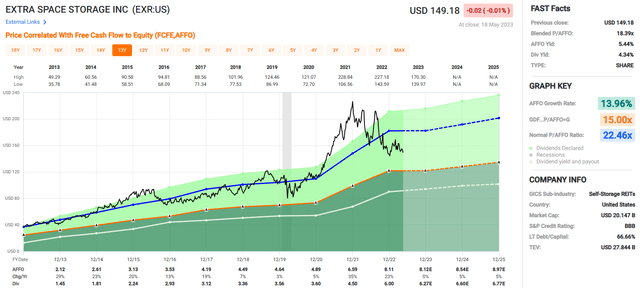

Extra Space Storage (EXR)

Extra Space Storage is a REIT that operates and owns self-storage properties. Their portfolio includes wholly owned self-storage properties, storage properties that they have an ownership interest in, and storage properties that they manage.

As of year-end 2022, EXR owned or operated 2,338 self-storage properties that contain around 1.6 million units that are located in 41 states and cover approximately 176.1 million square feet.

In addition to their rental income, EXR generates revenues through management fees on the facilities they manage for third party owners and revenues from their reinsurance program that insures against the loss of goods in their facilities.

EXR has an average AFFO growth rate of 13.96% and an average dividend growth rate of 22.96% over the last ten years. They pay a 4.34% dividend yield that is well covered with an AFFO payout ratio of 73.98%. Currently EXR is trading at a P/AFFO of 18.39x which compares favorably to their normal P/AFFO multiple of 22.46x. At iREIT we rate EXR a BUY.

FAST Graphs

In Closing…

As you know, it’s almost impossible to eliminate all investment risk, but you can reduce it by filtering out the disadvantageously positioned stocks from the outset.

By using fundamental analysis, our team has been able to generate solid total returns across our various portfolios. One of the most important lessons learned for me is to not put all your eggs in one basket.

After all, it takes only a few large losses to decimate overall investment performance, even if many other investments prove successful.

Stay tuned for more “lessons learned” articles.

Happy SWAN Investing!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here